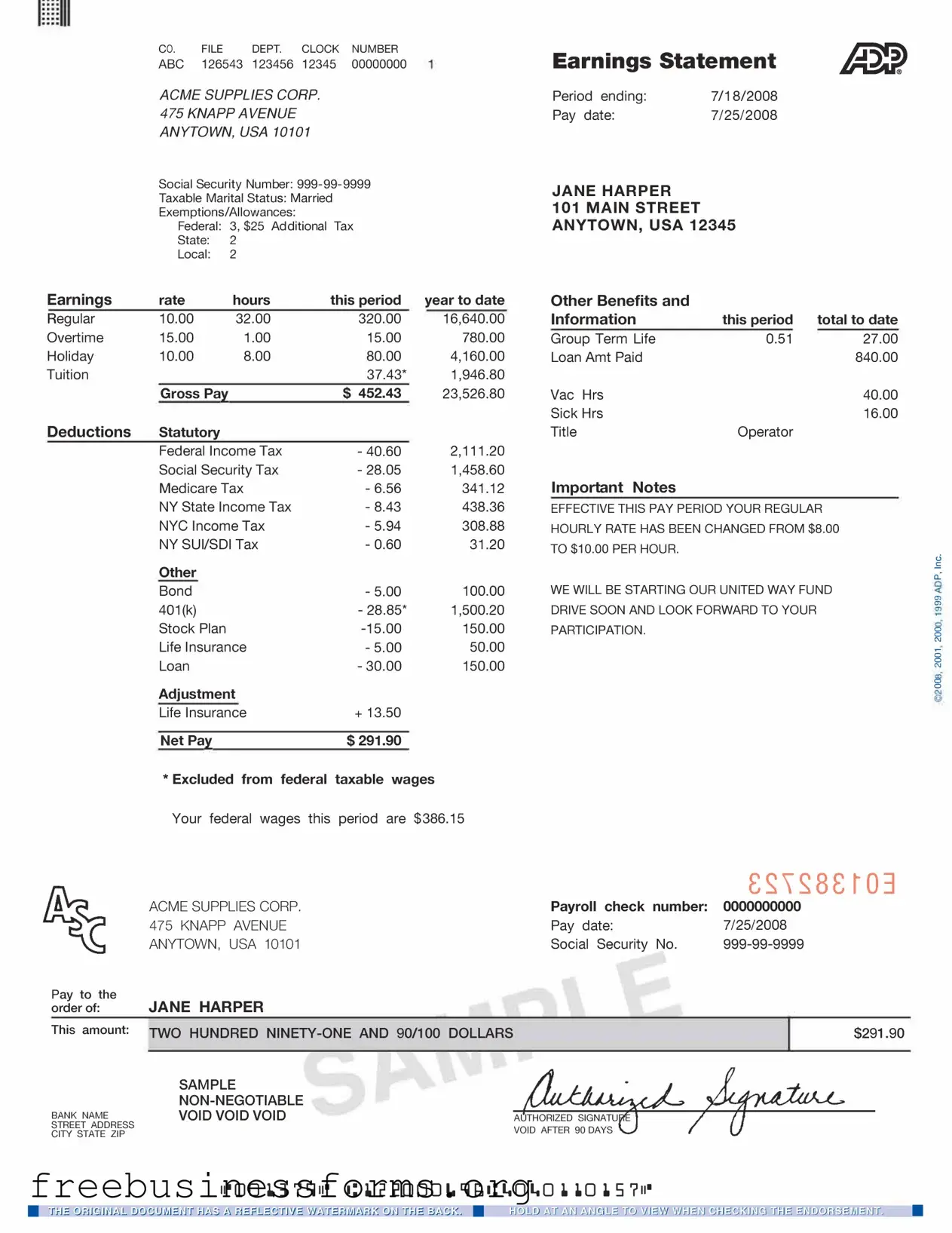

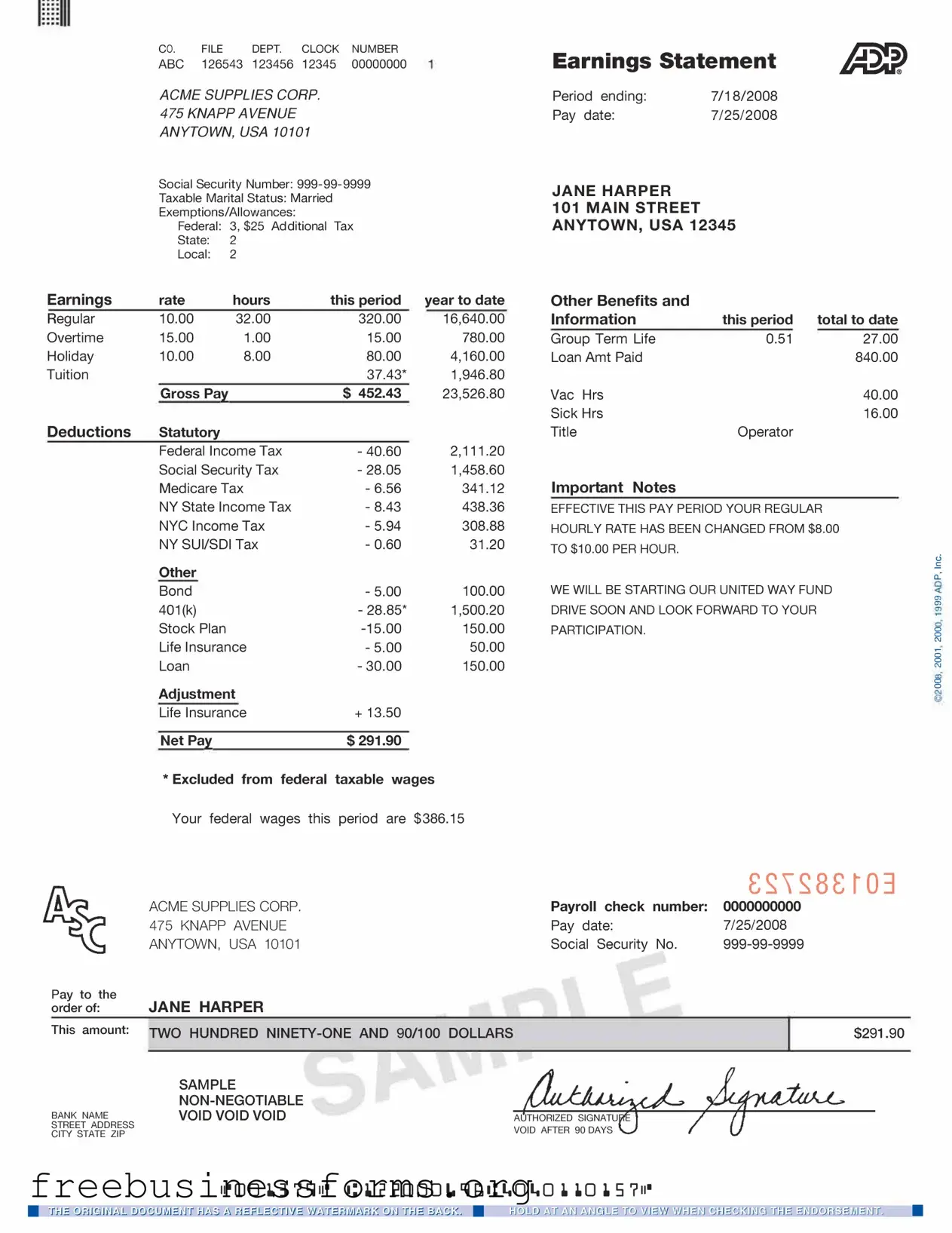

Official Adp Pay Stub Form in PDF

The ADP Pay Stub form is a document that provides employees with a detailed breakdown of their earnings and deductions for a specific pay period. It serves as an essential tool for understanding one’s compensation, tax withholdings, and benefits contributions. By reviewing this form, employees can ensure that their pay reflects their work accurately and can address any discrepancies with their employer.

Open Form Here

Official Adp Pay Stub Form in PDF

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Adp Pay Stub online quickly — edit, save, download.