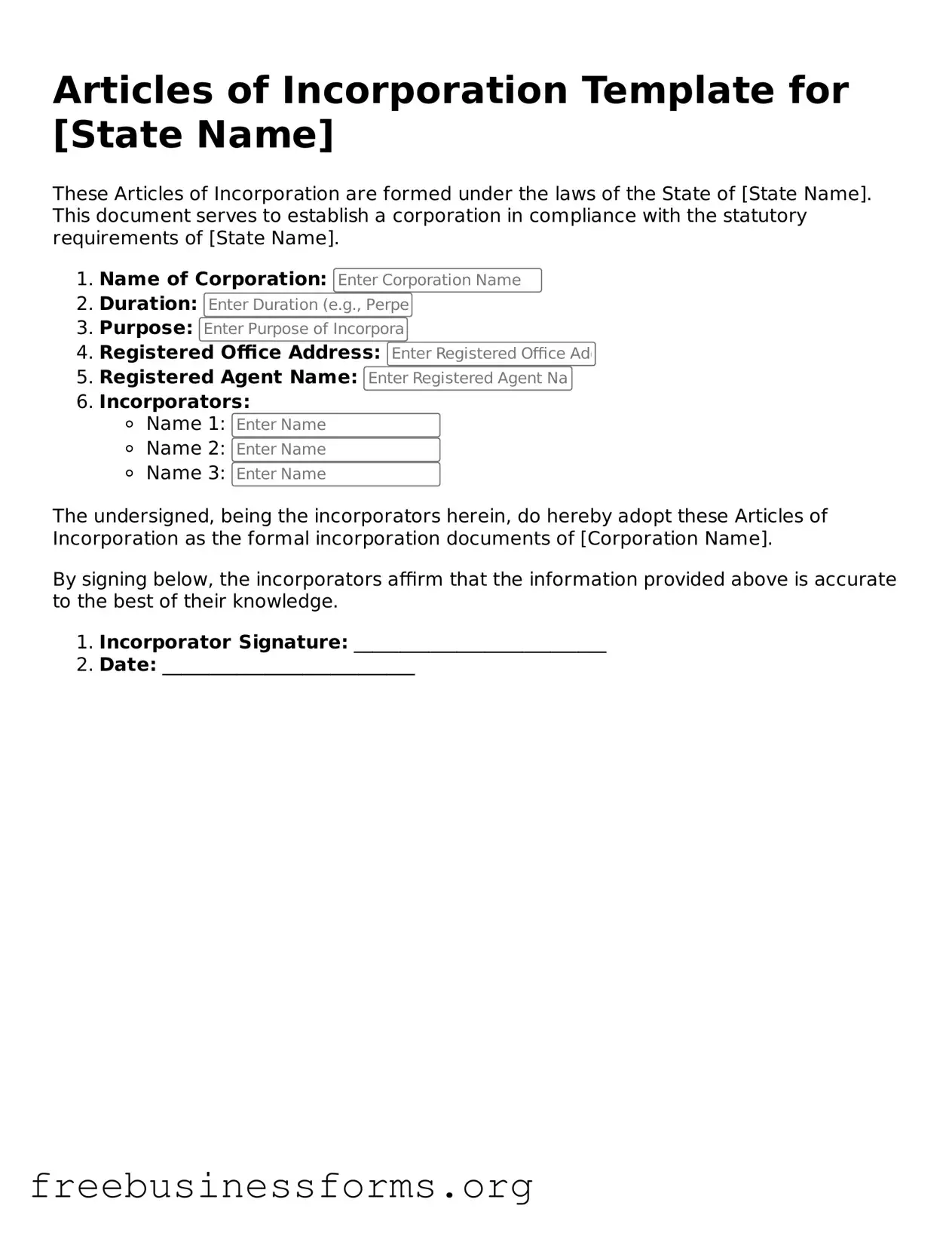

Official Articles of Incorporation Form

The Articles of Incorporation form is a crucial document that establishes a corporation's existence in the eyes of the law. It outlines essential information about the business, such as its name, purpose, and structure. Completing this form is the first step toward creating a legal entity that can operate independently and protect its owners from personal liability.

Open Form Here

Official Articles of Incorporation Form

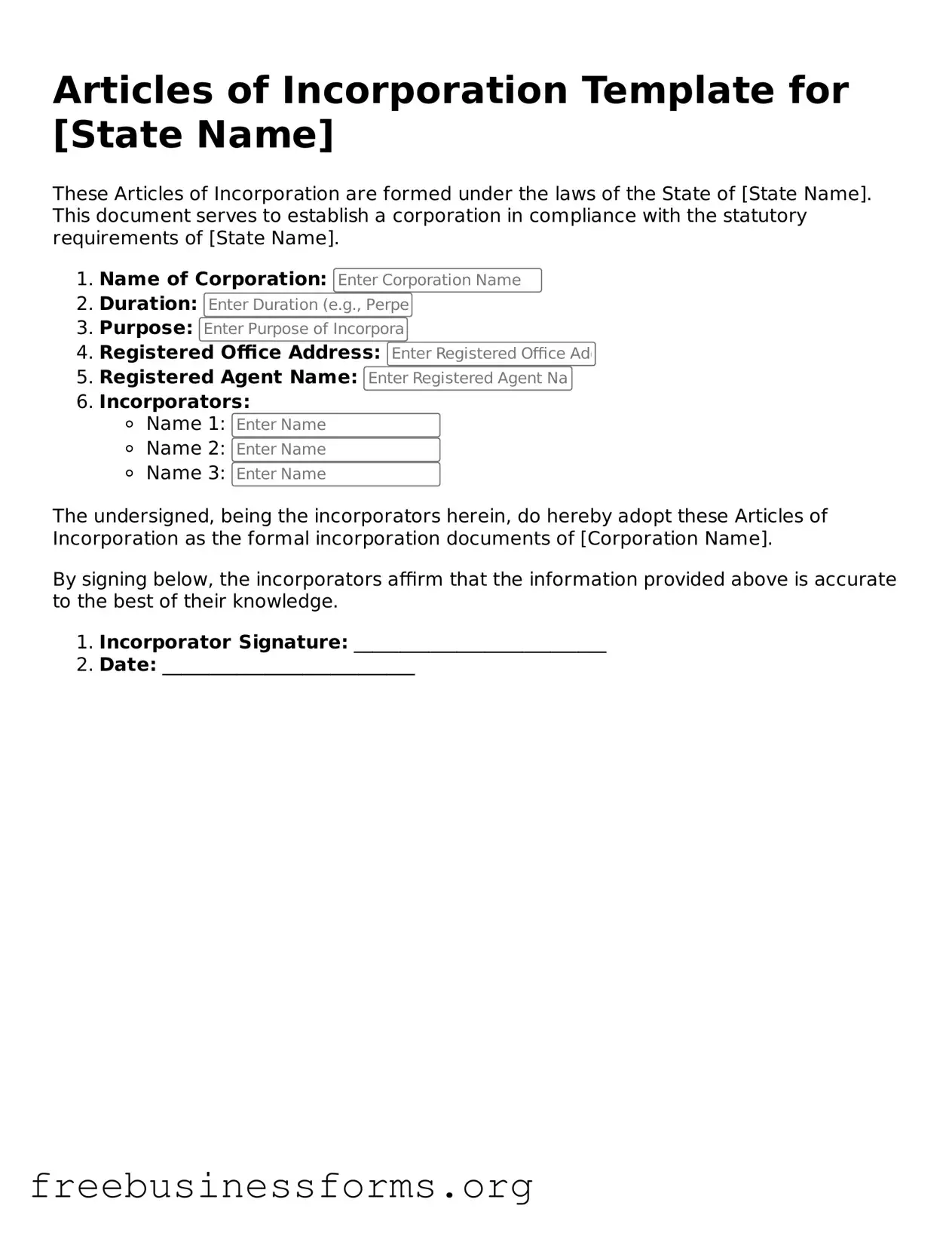

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Articles of Incorporation online quickly — edit, save, download.