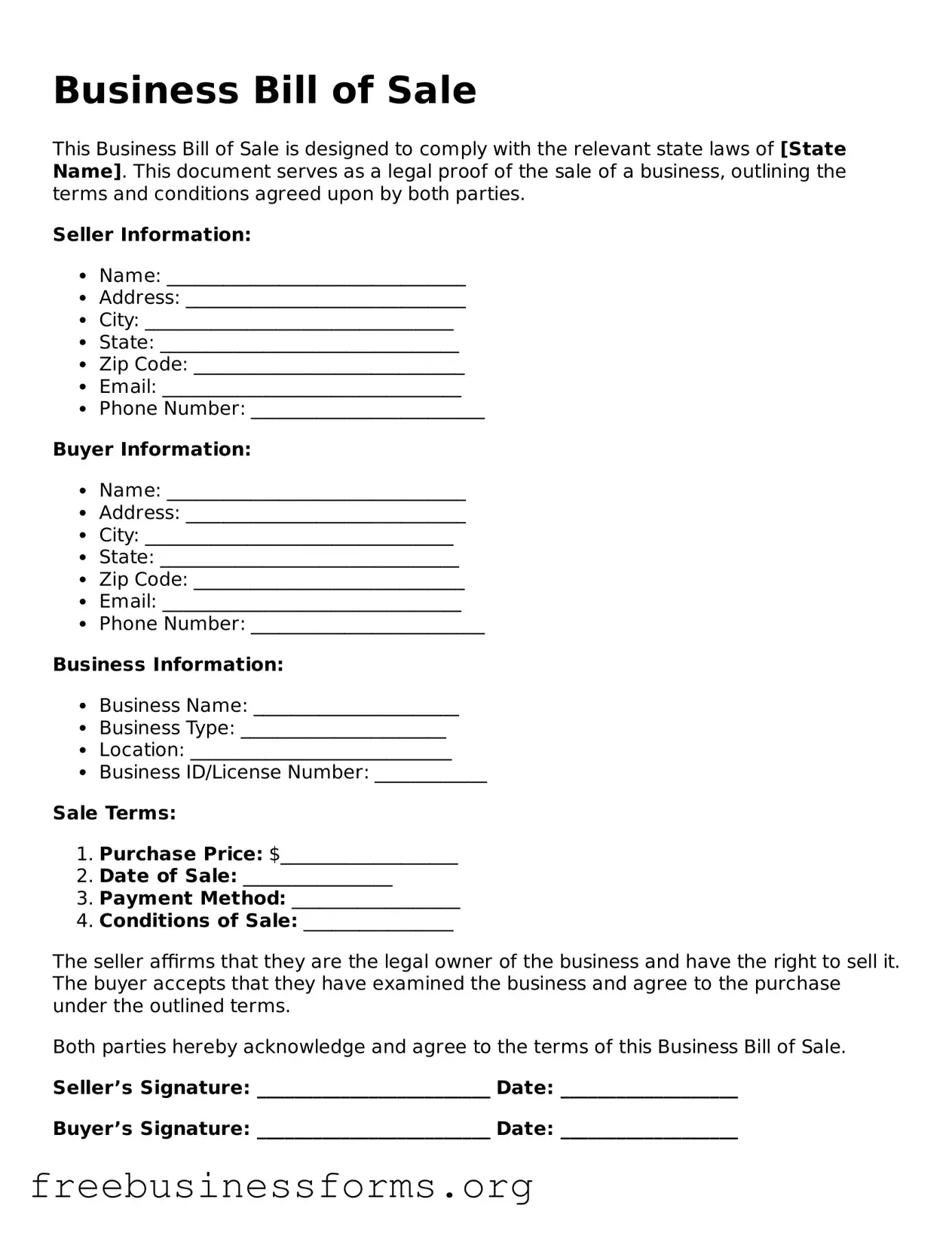

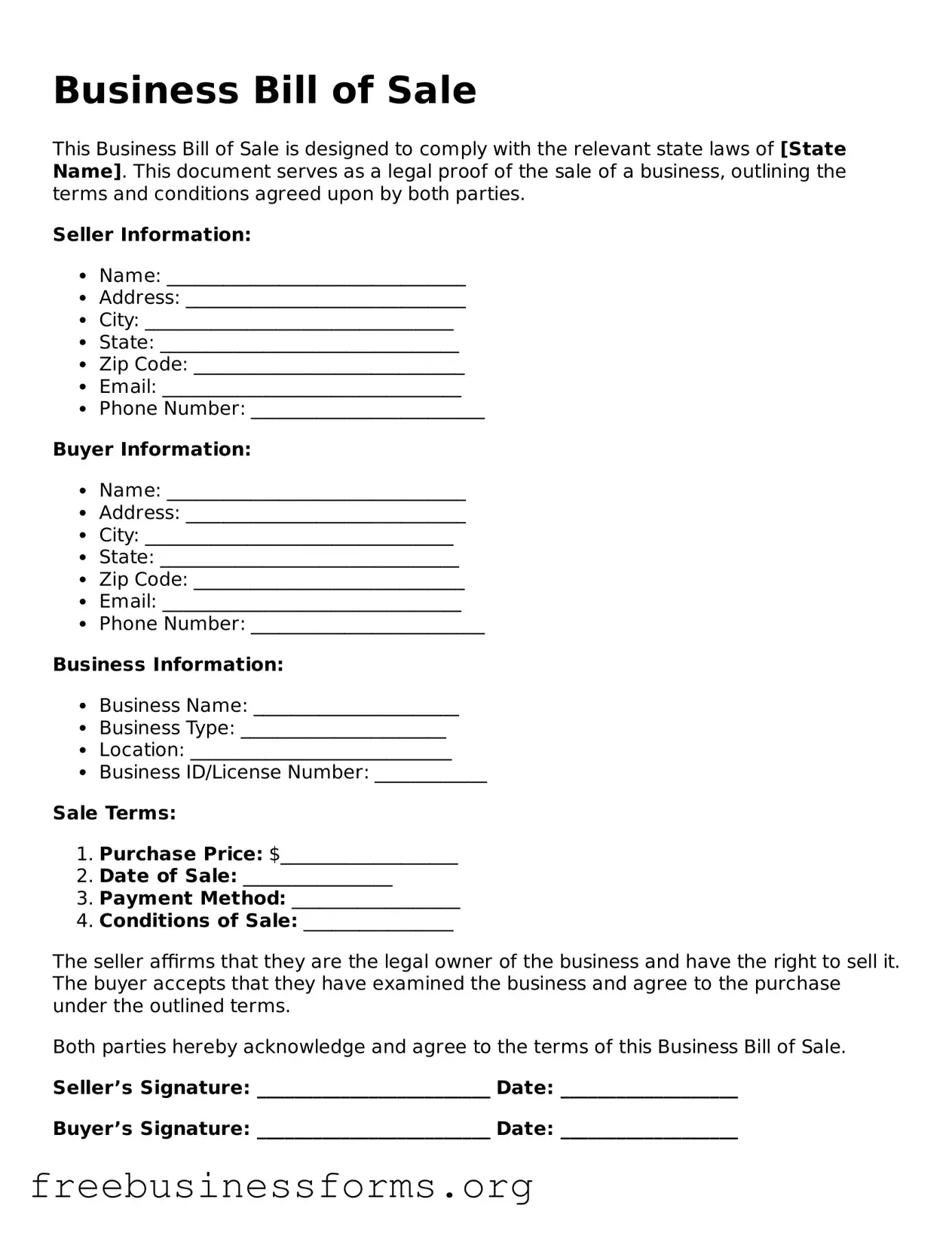

Official Business Bill of Sale Form

A Business Bill of Sale is a legal document that records the transfer of ownership of a business from one party to another. This form outlines the details of the transaction, including the assets being sold and the agreed-upon price. It serves as proof of the sale and protects both the buyer and the seller in the process.

Open Form Here

Official Business Bill of Sale Form

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Business Bill of Sale online quickly — edit, save, download.