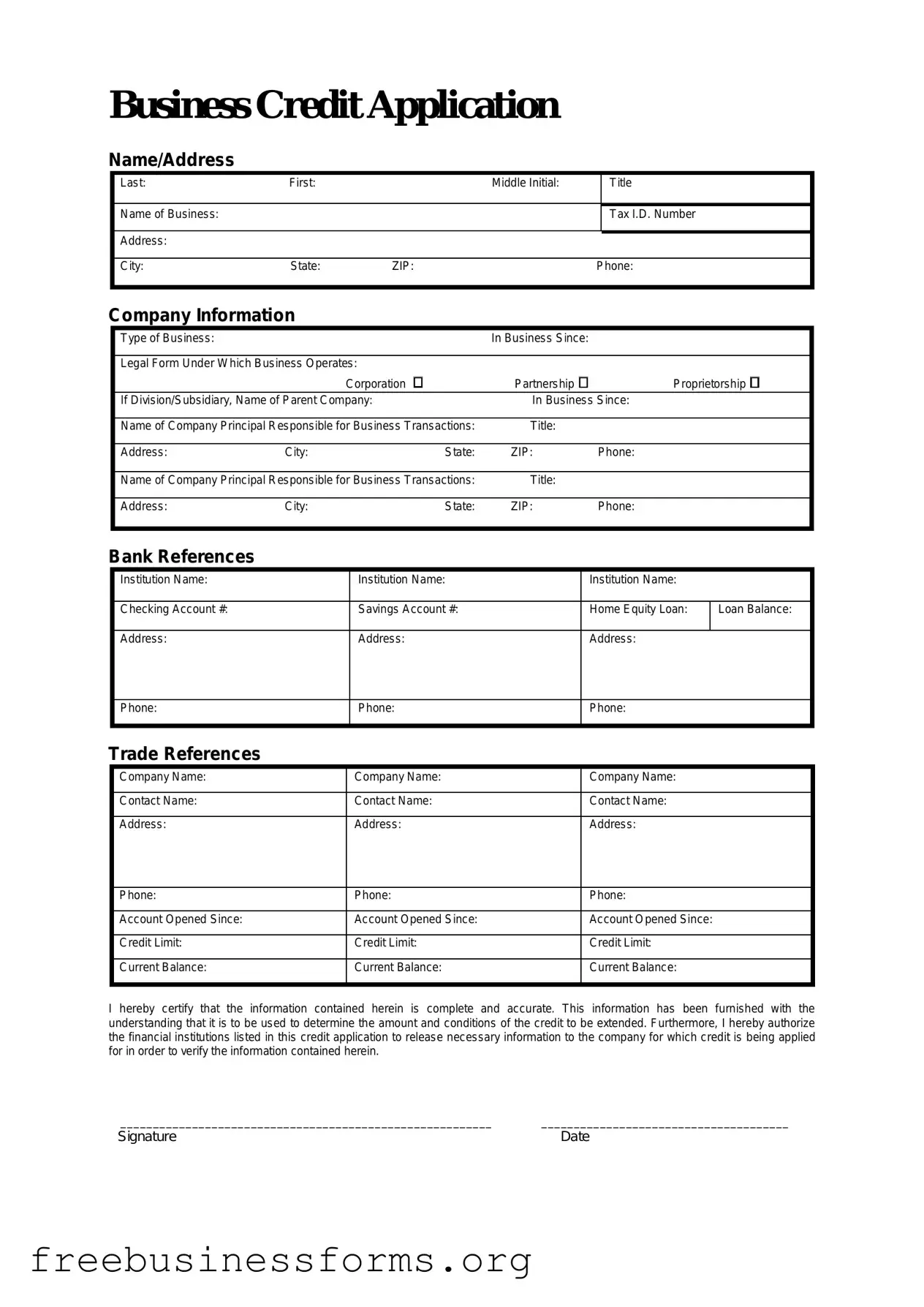

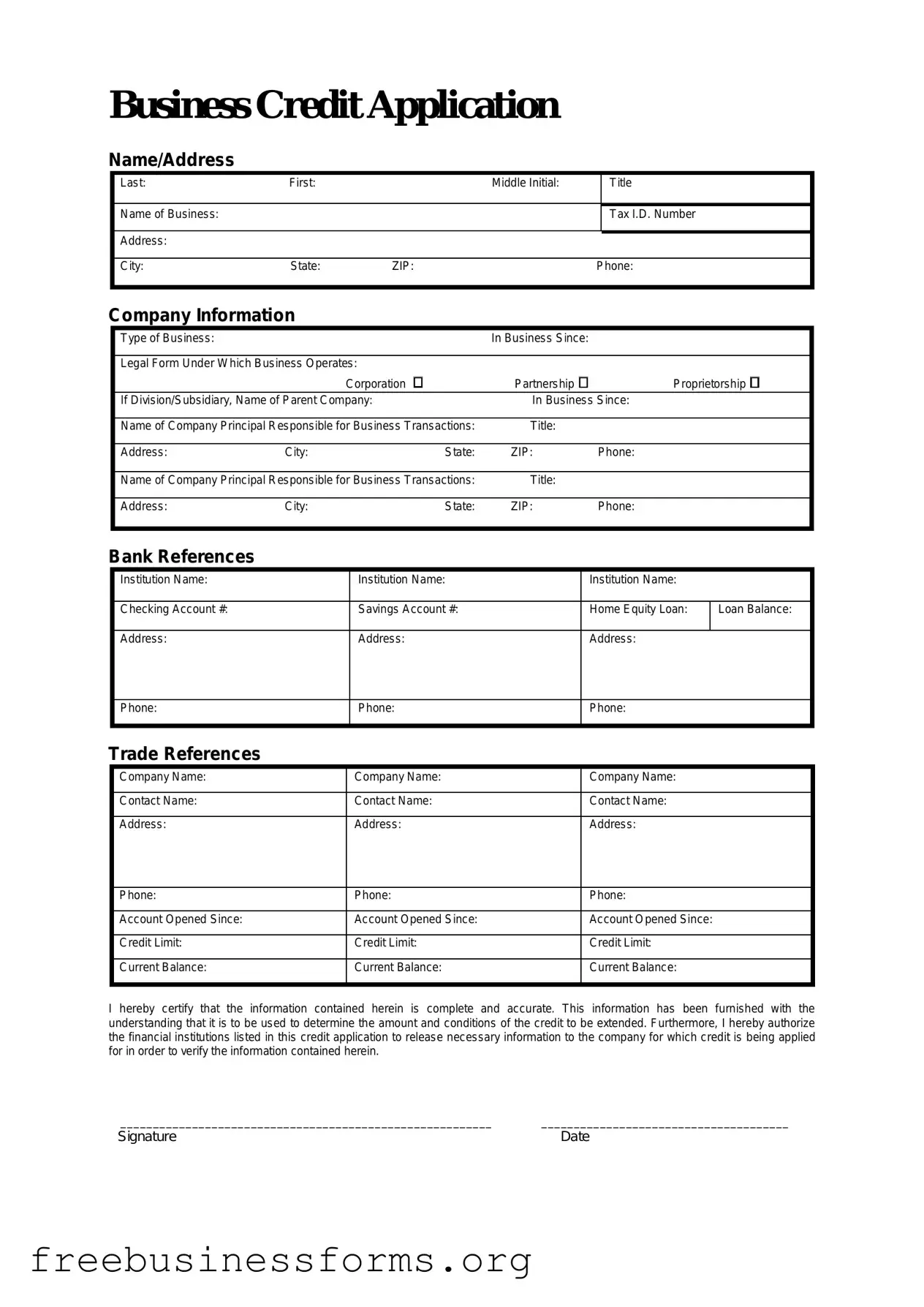

Official Business Credit Application Form in PDF

A Business Credit Application form is a document used by companies to apply for credit from suppliers or lenders. This form collects essential information about the business, including financial history and creditworthiness. Completing it accurately can help secure the necessary funds for growth and operations.

Open Form Here

Official Business Credit Application Form in PDF

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Business Credit Application online quickly — edit, save, download.