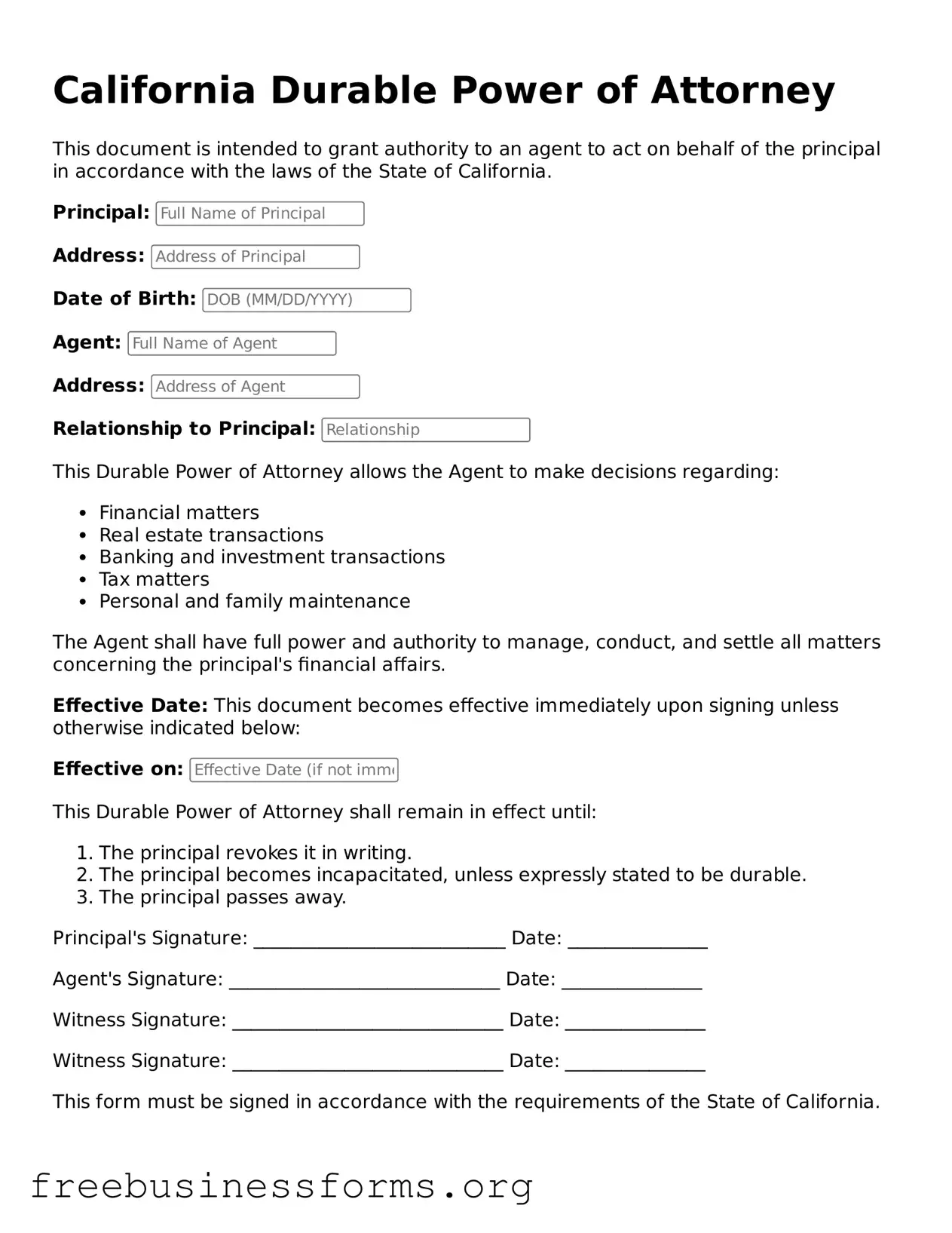

Blank Durable Power of Attorney Template for California

A California Durable Power of Attorney form is a legal document that allows an individual to appoint someone else to manage their financial and legal affairs if they become incapacitated. This form ensures that your wishes are respected and that your affairs are handled by someone you trust. Understanding its importance can help you make informed decisions about your future.

Open Form Here

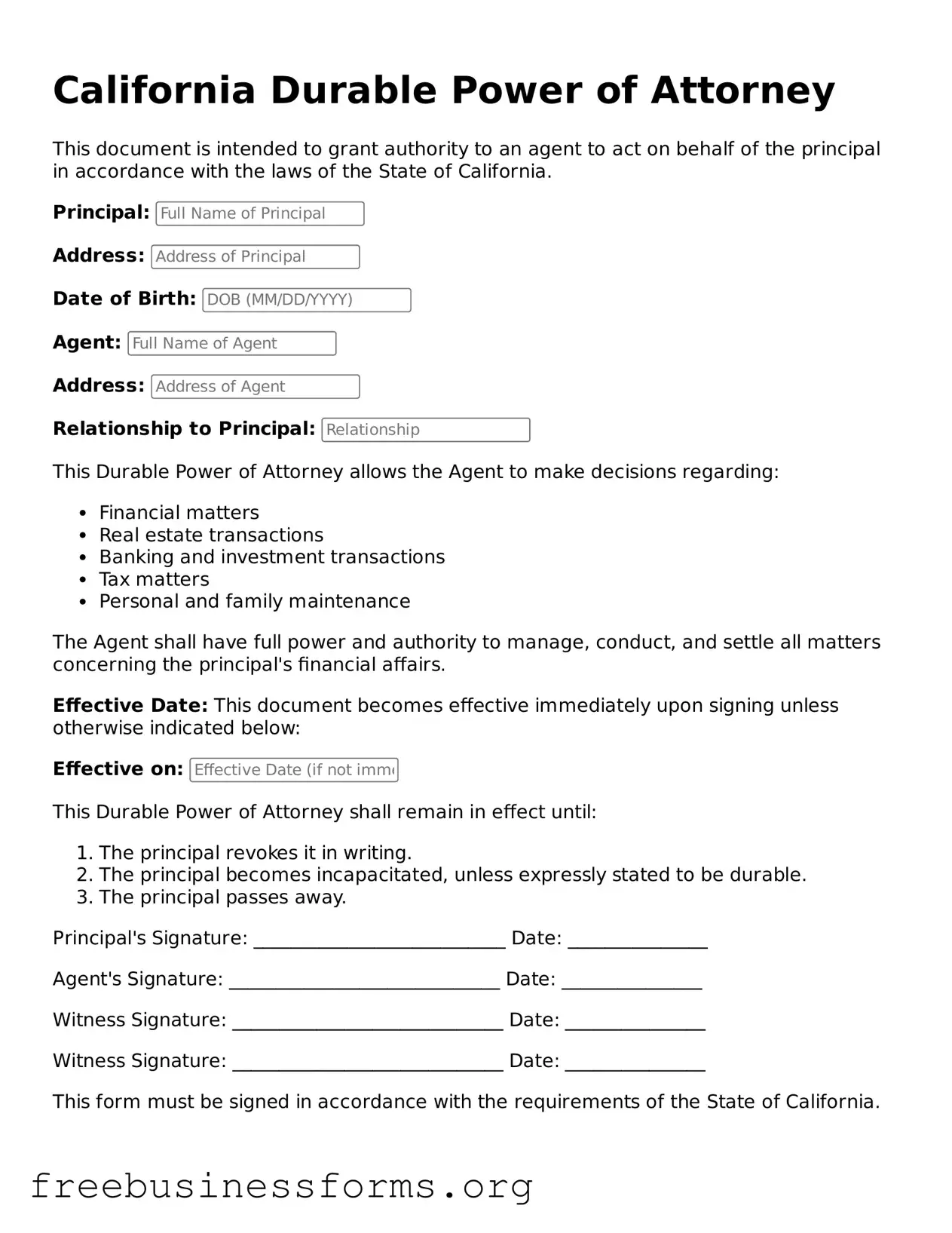

Blank Durable Power of Attorney Template for California

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Durable Power of Attorney online quickly — edit, save, download.