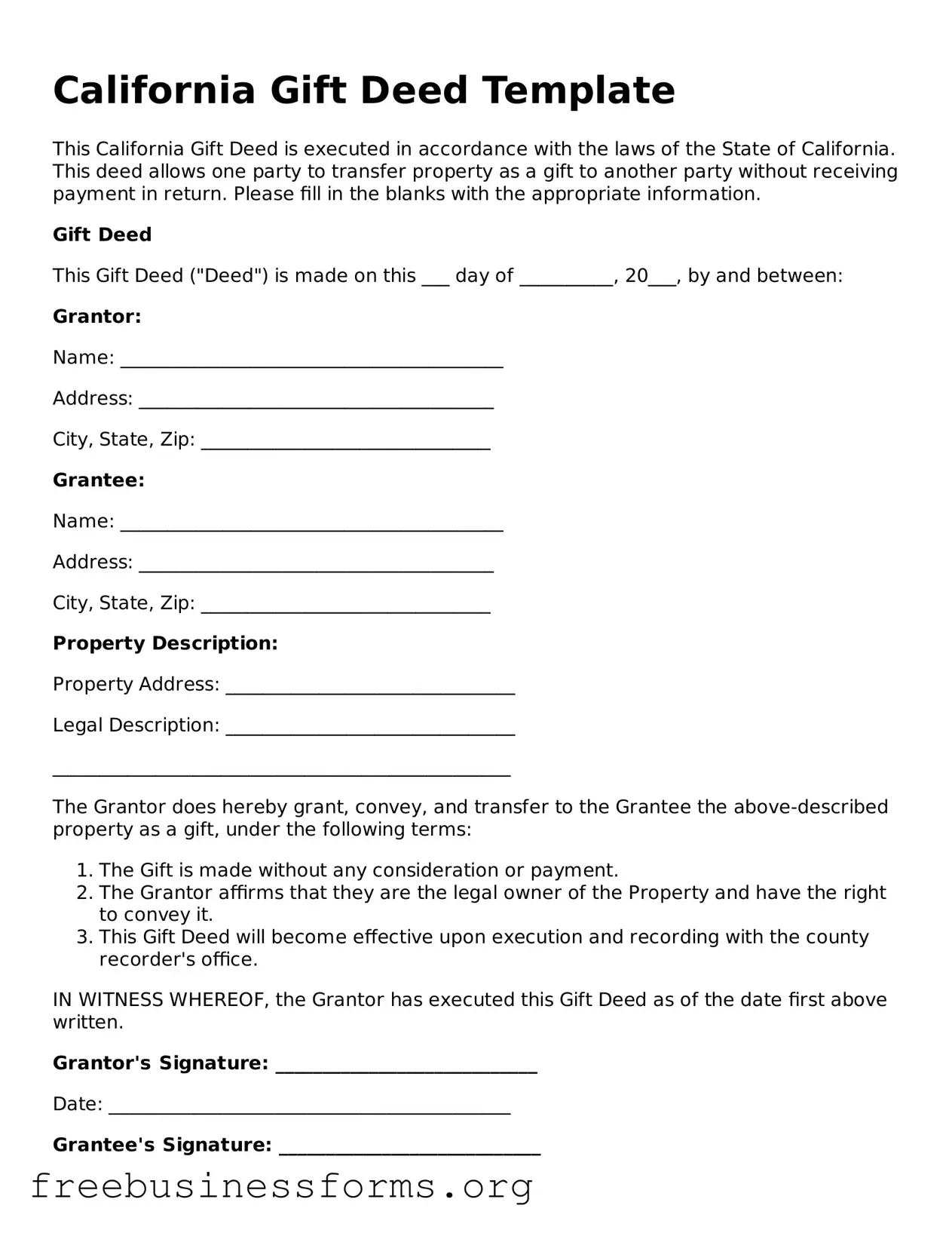

Blank Gift Deed Template for California

A California Gift Deed form is a legal document used to transfer property ownership from one individual to another without any exchange of money or compensation. This form serves as a formal declaration of a gift, ensuring that the transfer is recognized by law. Understanding the implications and requirements of a Gift Deed is essential for both donors and recipients to avoid potential disputes in the future.

Open Form Here

Blank Gift Deed Template for California

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Gift Deed online quickly — edit, save, download.