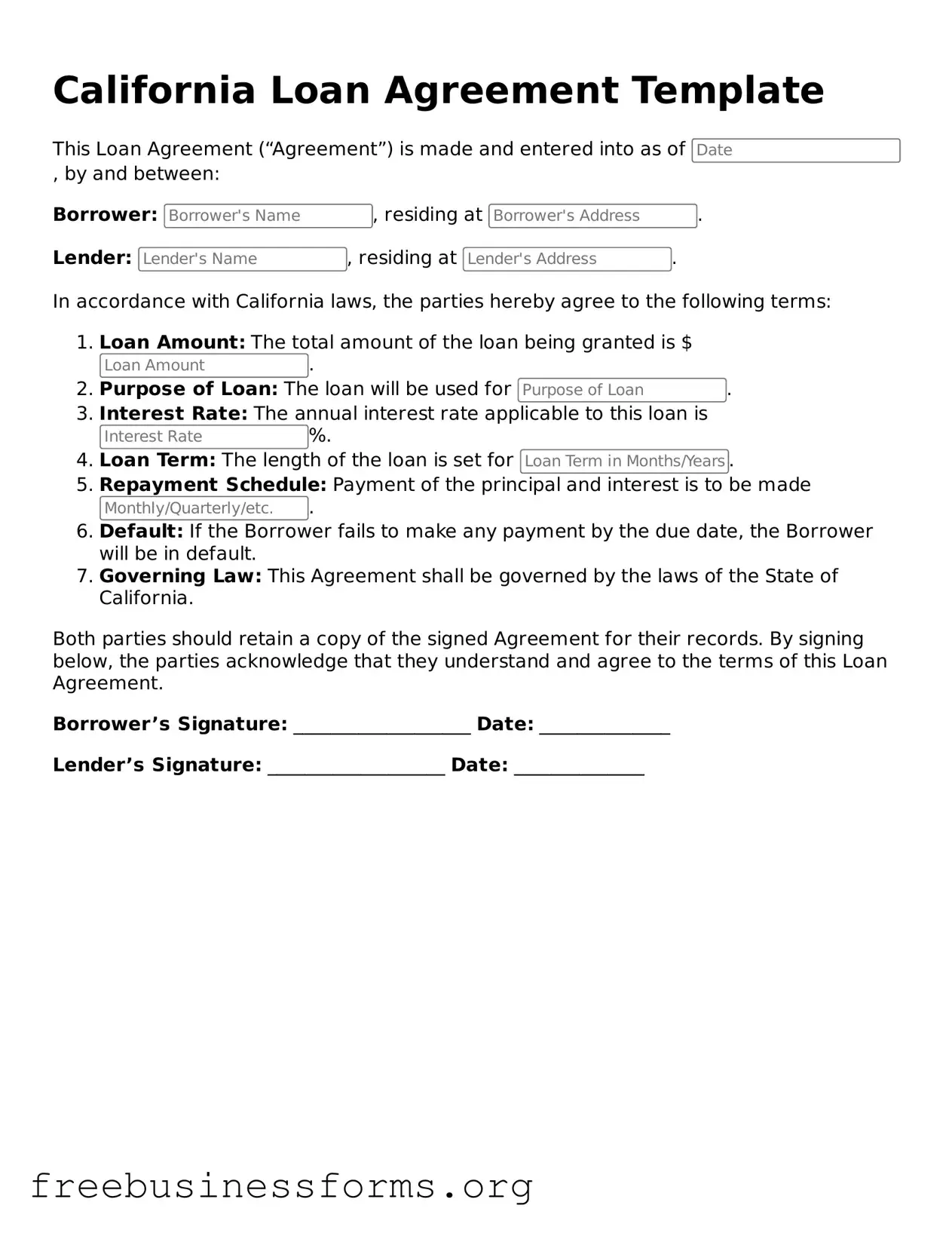

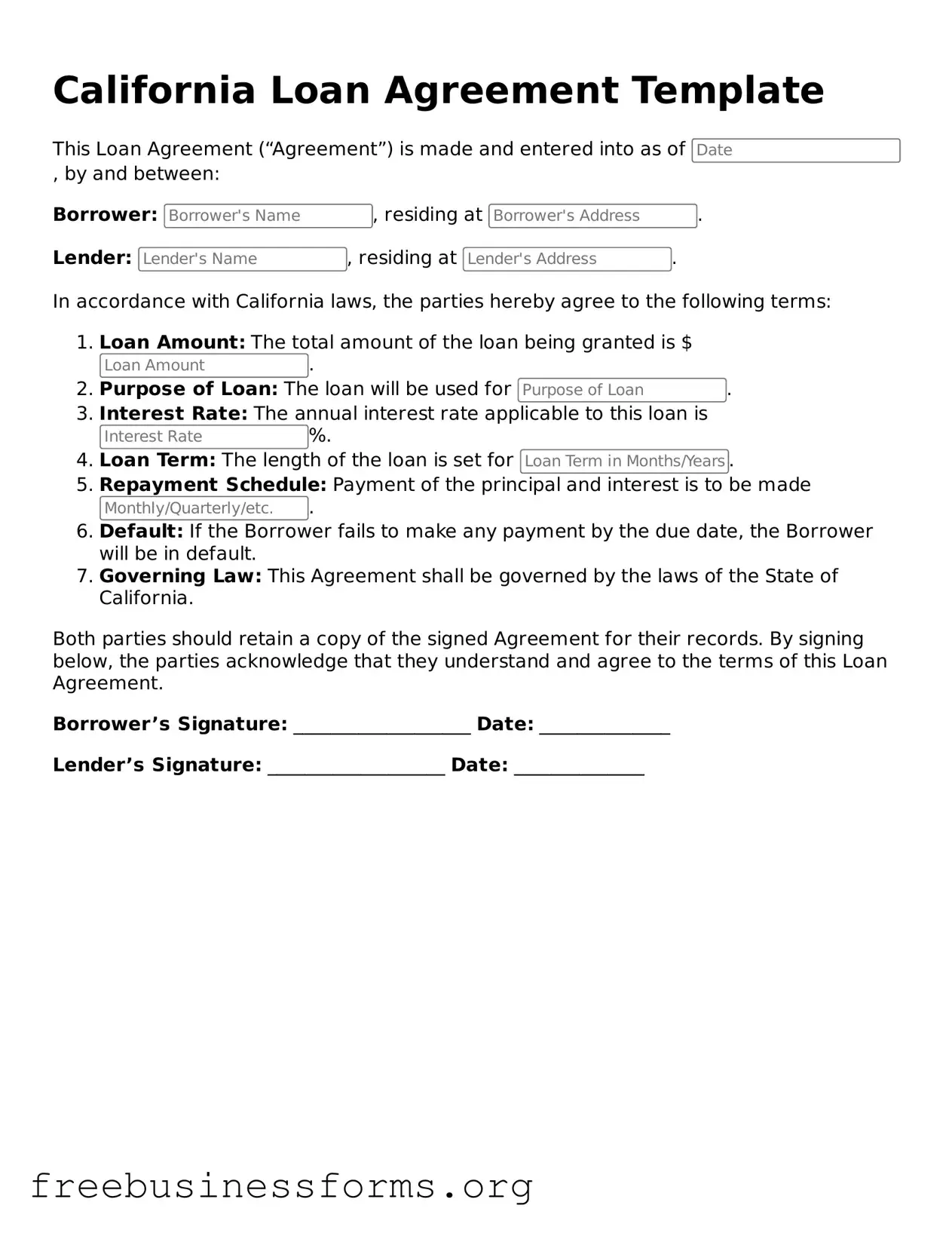

Blank Loan Agreement Template for California

A California Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. This form serves to protect both parties by clearly stating the amount borrowed, repayment schedule, and any interest rates involved. Understanding this agreement is crucial for anyone considering taking out a loan in California.

Open Form Here

Blank Loan Agreement Template for California

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Loan Agreement online quickly — edit, save, download.