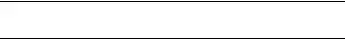

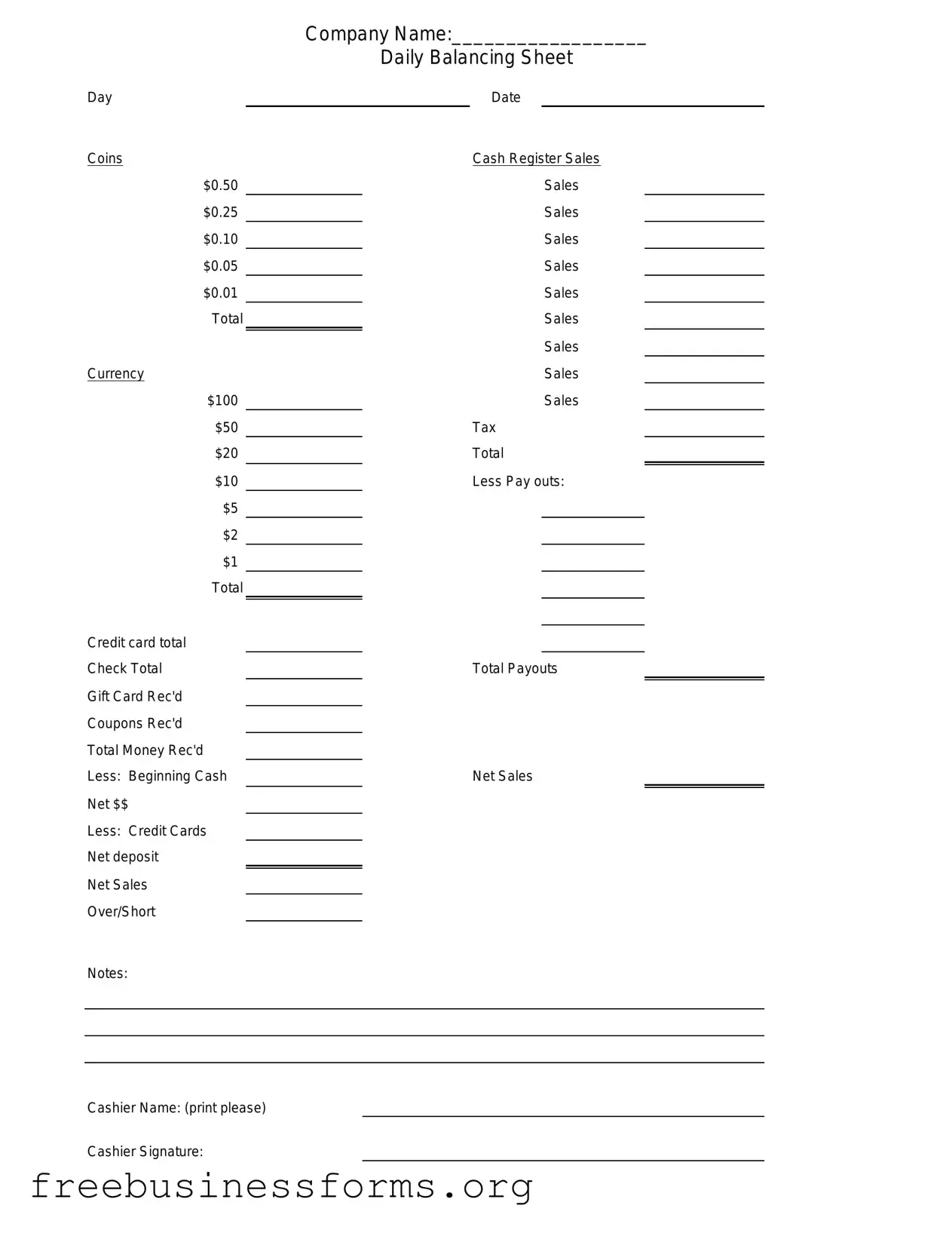

Official Cash Drawer Count Sheet Form in PDF

The Cash Drawer Count Sheet is a vital tool used by businesses to track the cash flow within their registers. This form helps ensure accuracy in cash handling by providing a structured way to document the cash on hand at the beginning and end of a shift. By using this sheet, employees can identify discrepancies and maintain financial accountability.

Open Form Here

Official Cash Drawer Count Sheet Form in PDF

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Cash Drawer Count Sheet online quickly — edit, save, download.