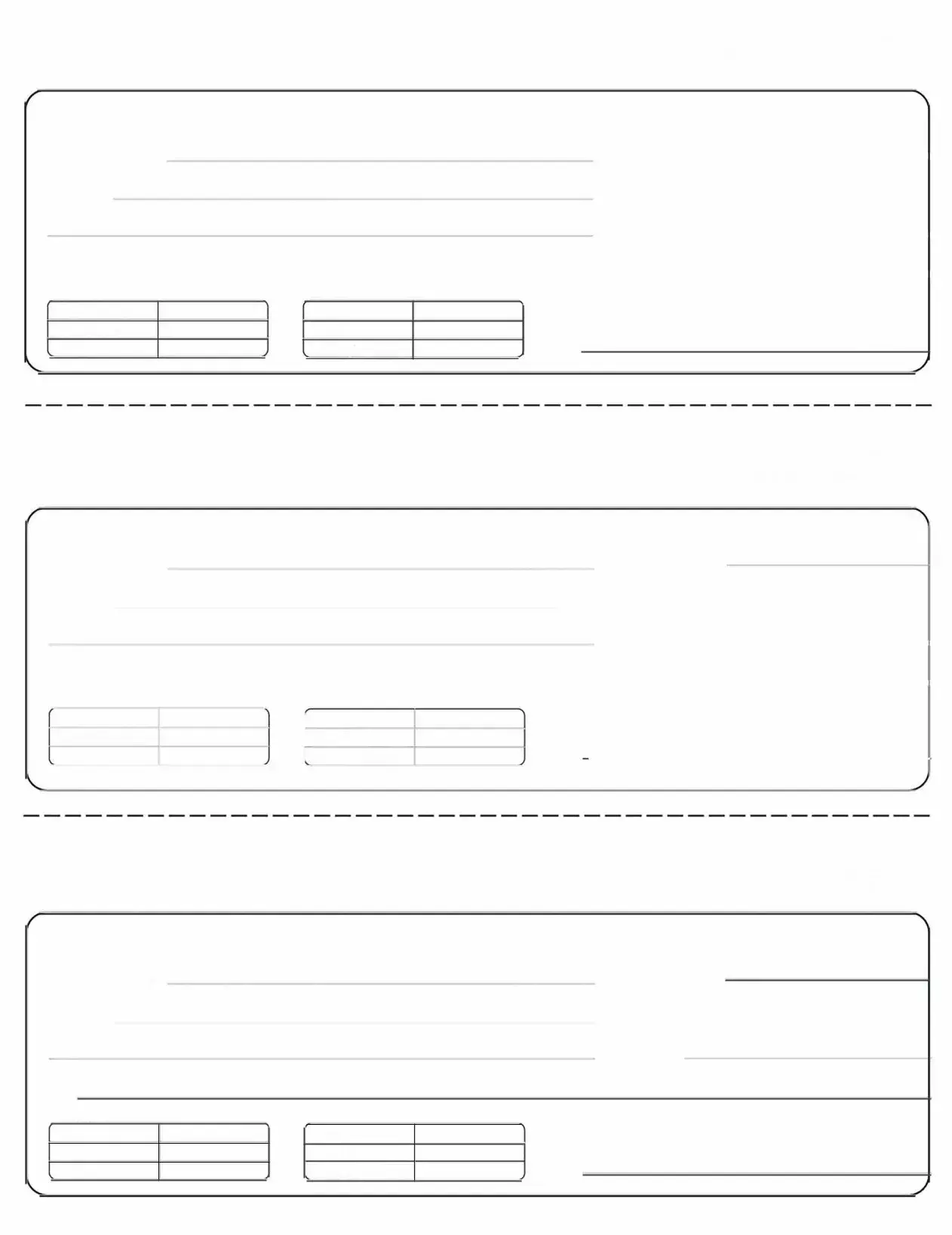

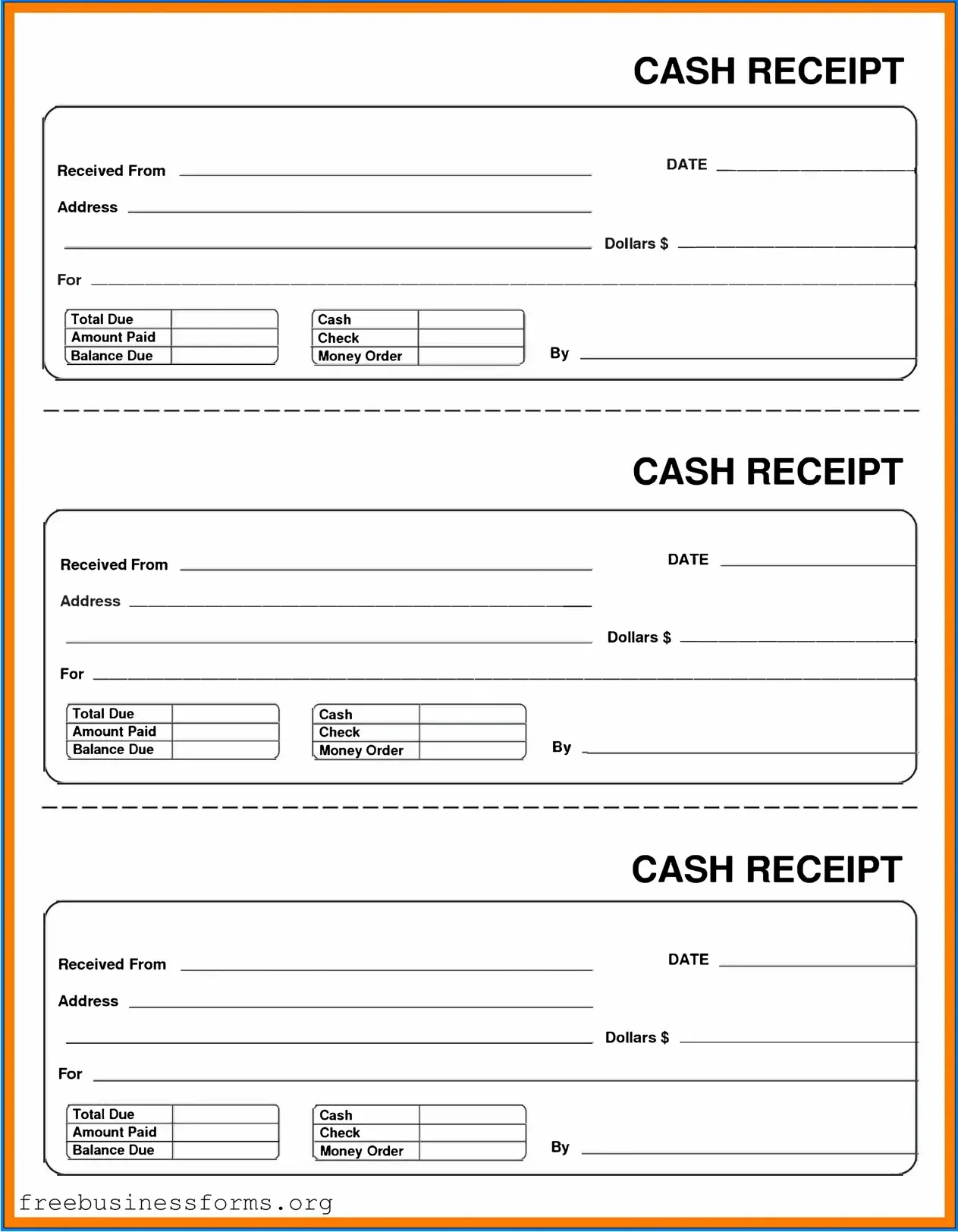

Official Cash Receipt Form in PDF

The Cash Receipt form is a crucial document used by businesses to record the receipt of cash payments. This form serves as proof of payment and helps maintain accurate financial records. Understanding its components and purpose can significantly enhance a company's financial management practices.

Open Form Here

Official Cash Receipt Form in PDF

Open Form Here

Open Form Here

or

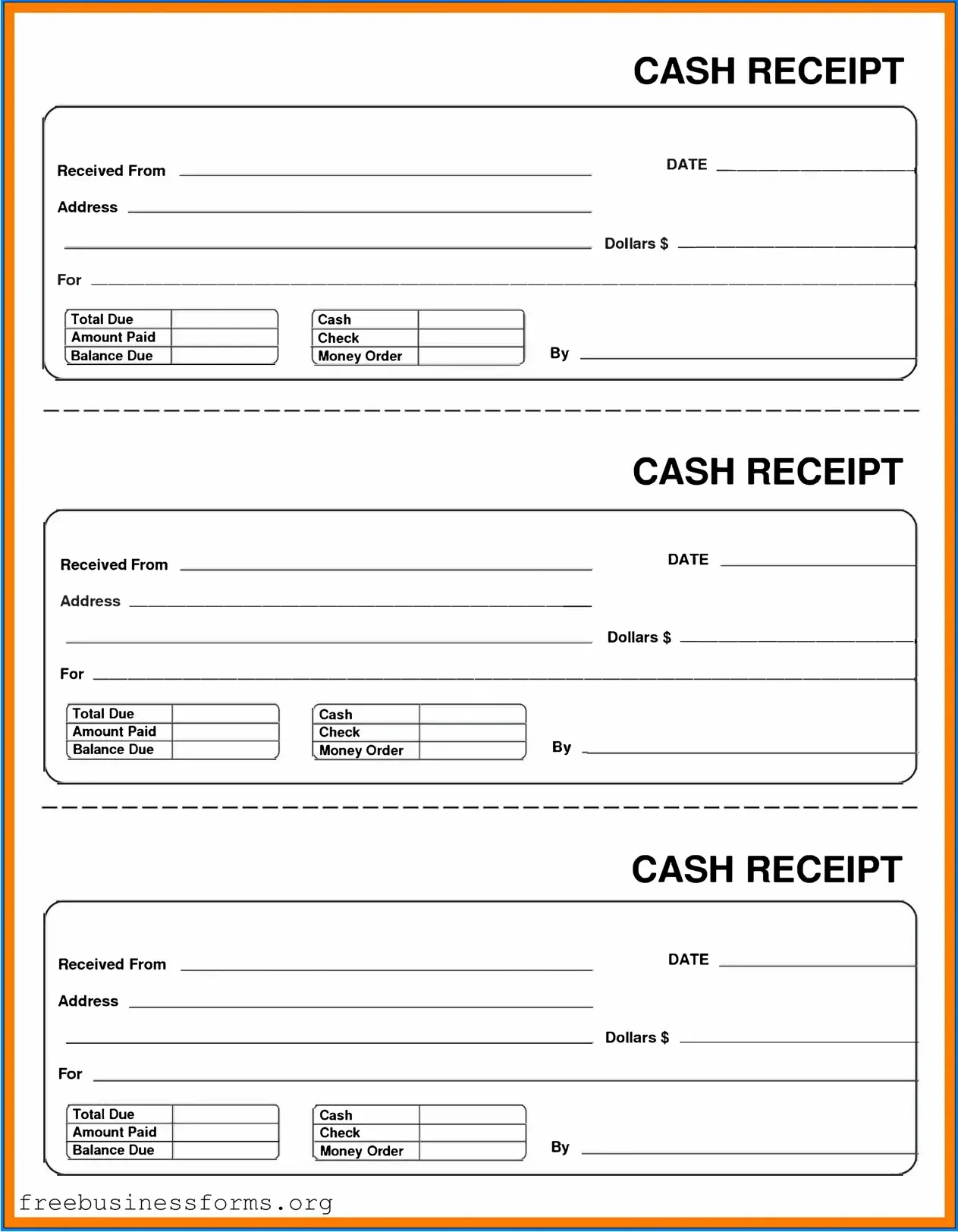

↓ PDF File

Quickly complete this form online

Complete your Cash Receipt online quickly — edit, save, download.