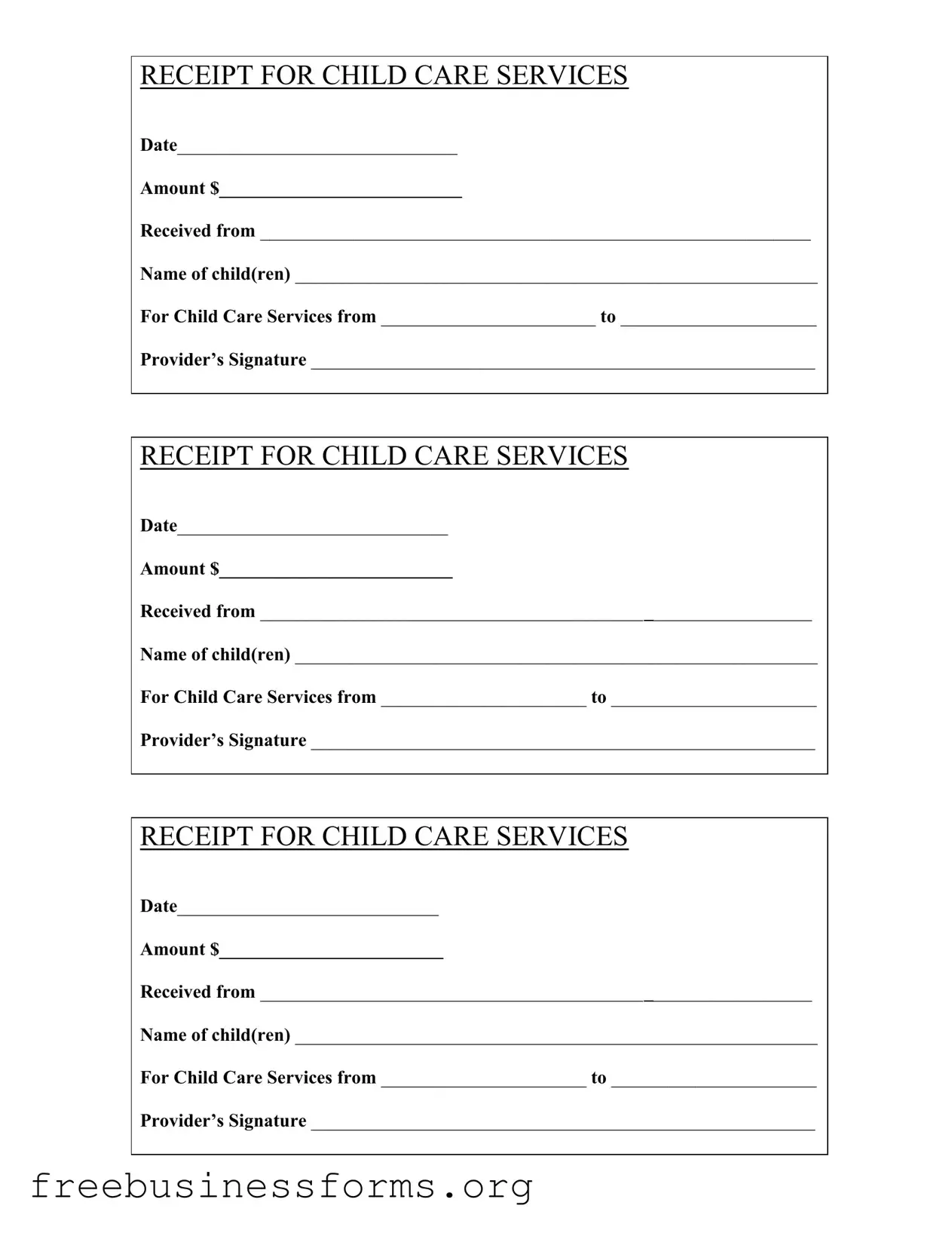

Official Childcare Receipt Form in PDF

The Childcare Receipt form serves as a crucial document for parents and guardians, providing a record of payment for child care services. This form typically includes essential details such as the date, amount paid, and the names of the children receiving care. It ensures transparency and can be important for tax purposes or reimbursement requests.

Open Form Here

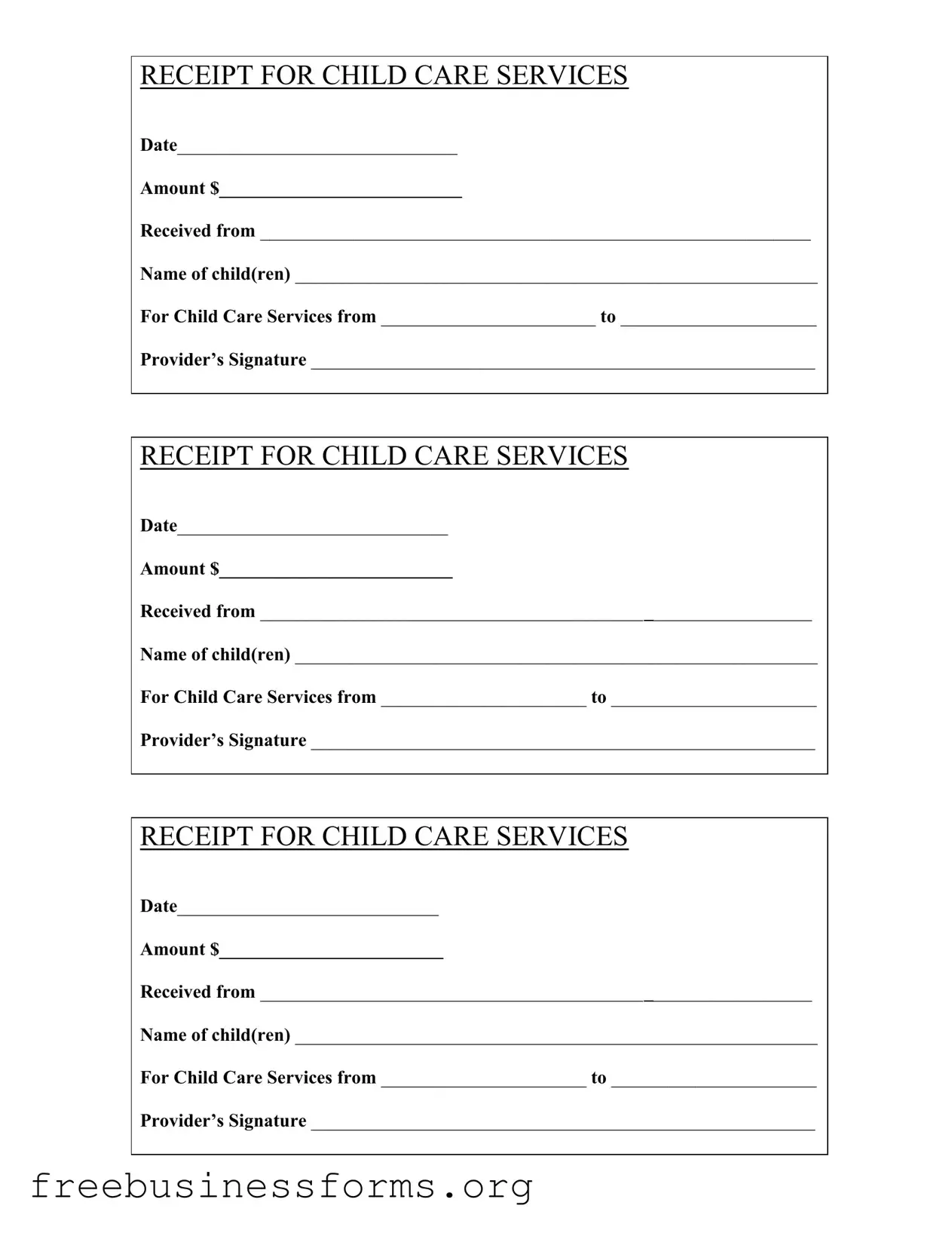

Official Childcare Receipt Form in PDF

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Childcare Receipt online quickly — edit, save, download.