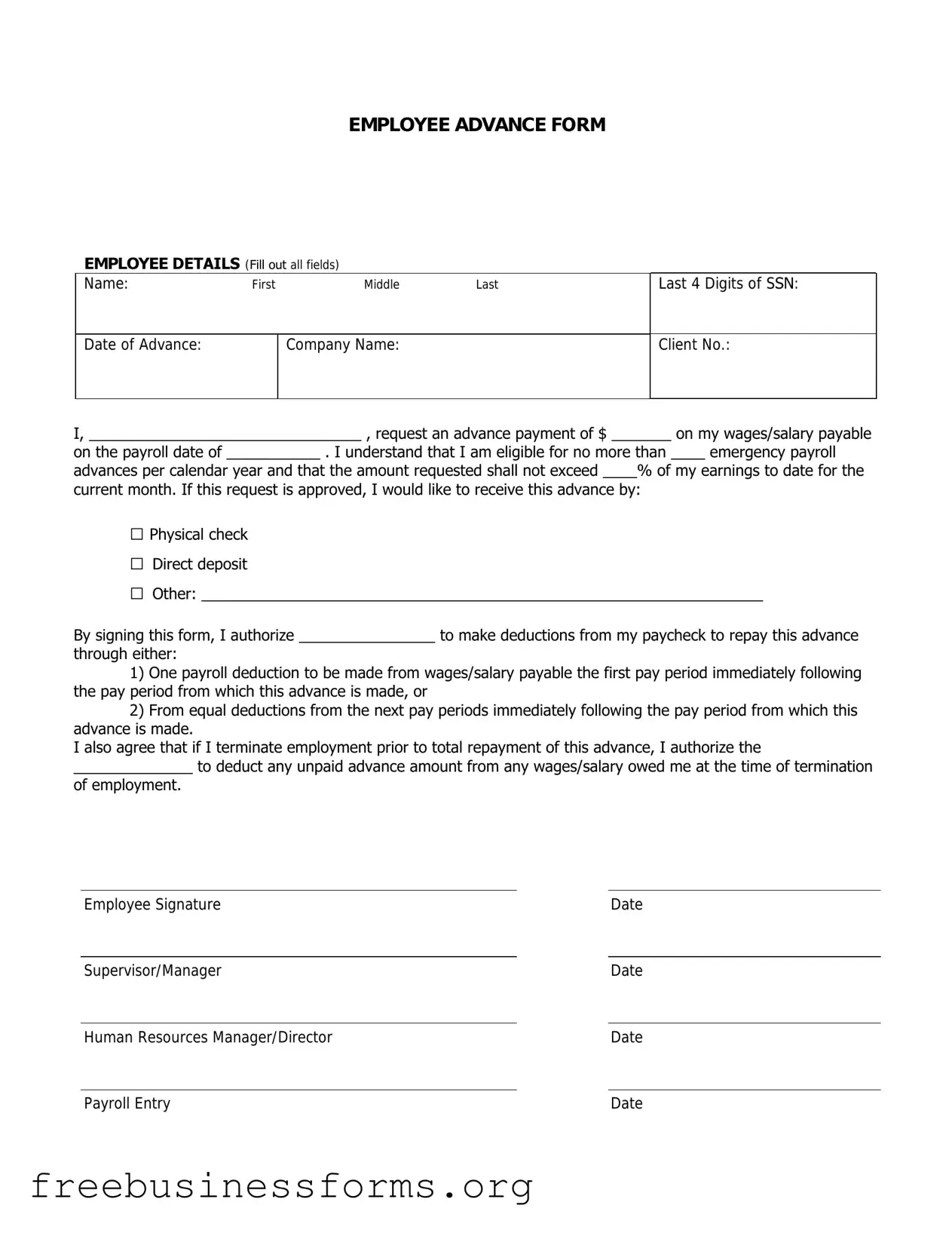

Official Employee Advance Form in PDF

The Employee Advance form is a document used by employers to request and authorize a cash advance for employees. This form outlines the amount requested, the purpose of the advance, and the repayment terms. Understanding how to properly complete and submit this form is essential for both employees and employers to ensure smooth financial transactions.

Open Form Here

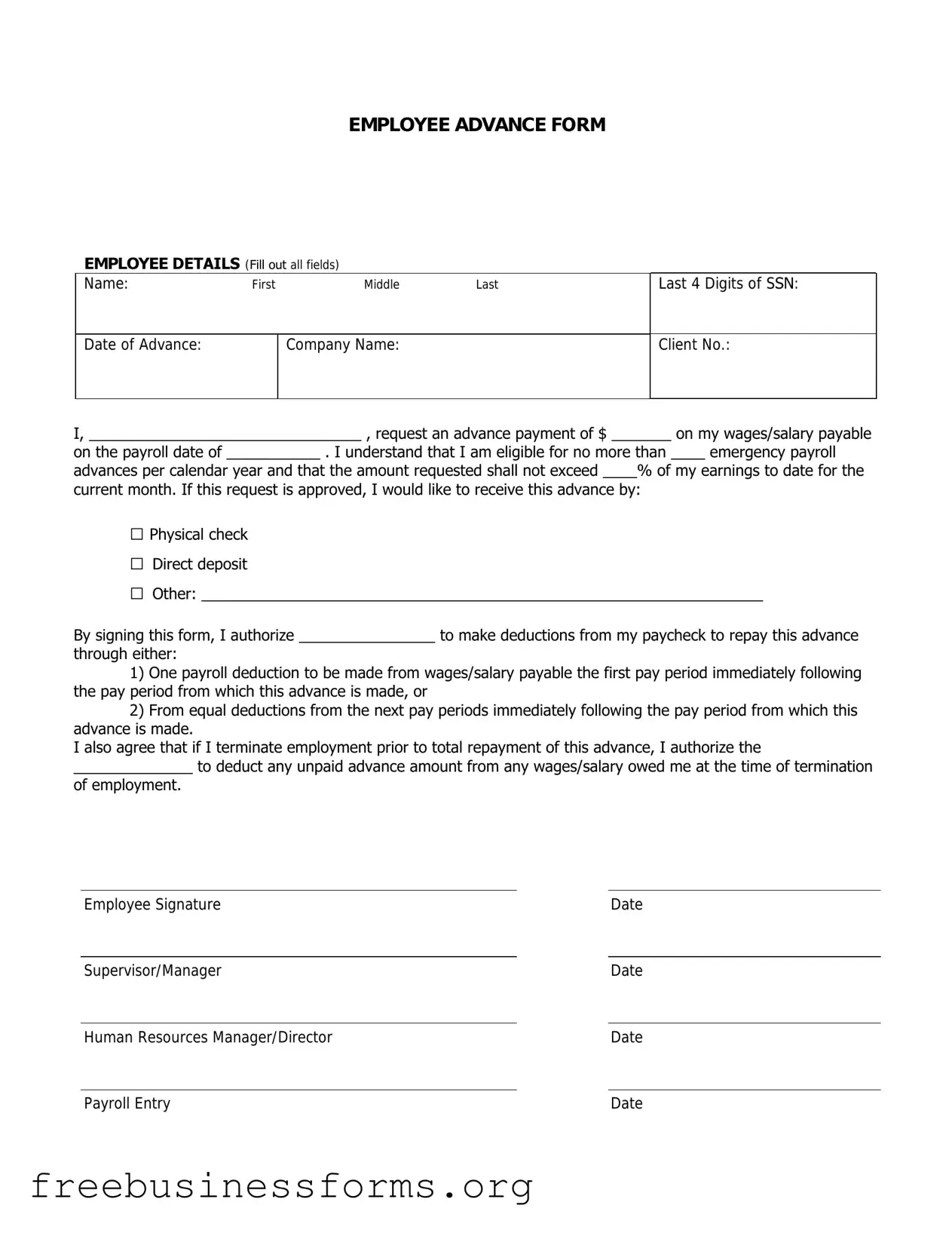

Official Employee Advance Form in PDF

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Employee Advance online quickly — edit, save, download.