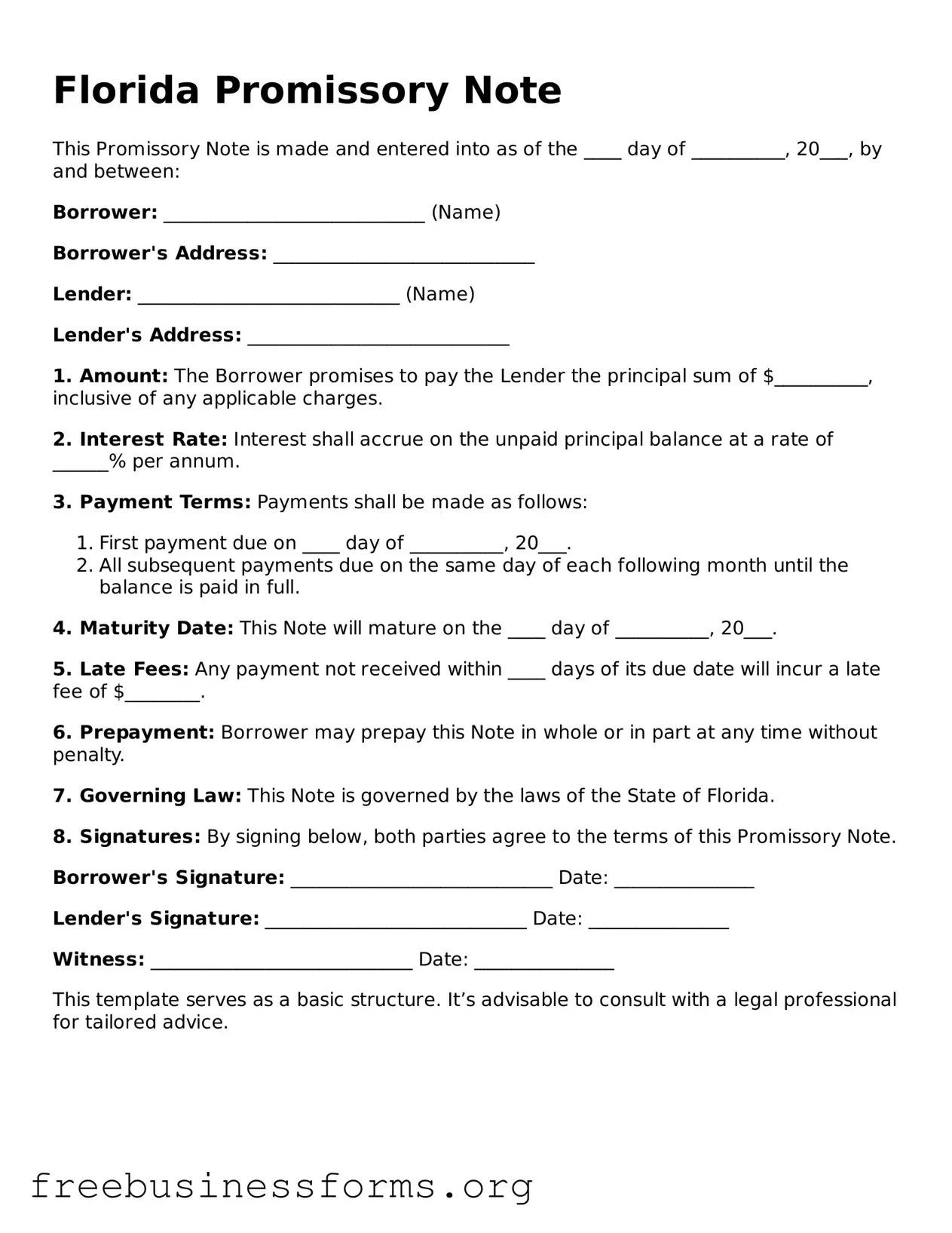

Blank Promissory Note Template for Florida

A Florida Promissory Note is a written promise to pay a specified amount of money to a designated party at a future date or on demand. This legal document outlines the terms of the loan, including the interest rate and payment schedule. Understanding this form is crucial for both lenders and borrowers to ensure clarity and enforceability in financial agreements.

Open Form Here

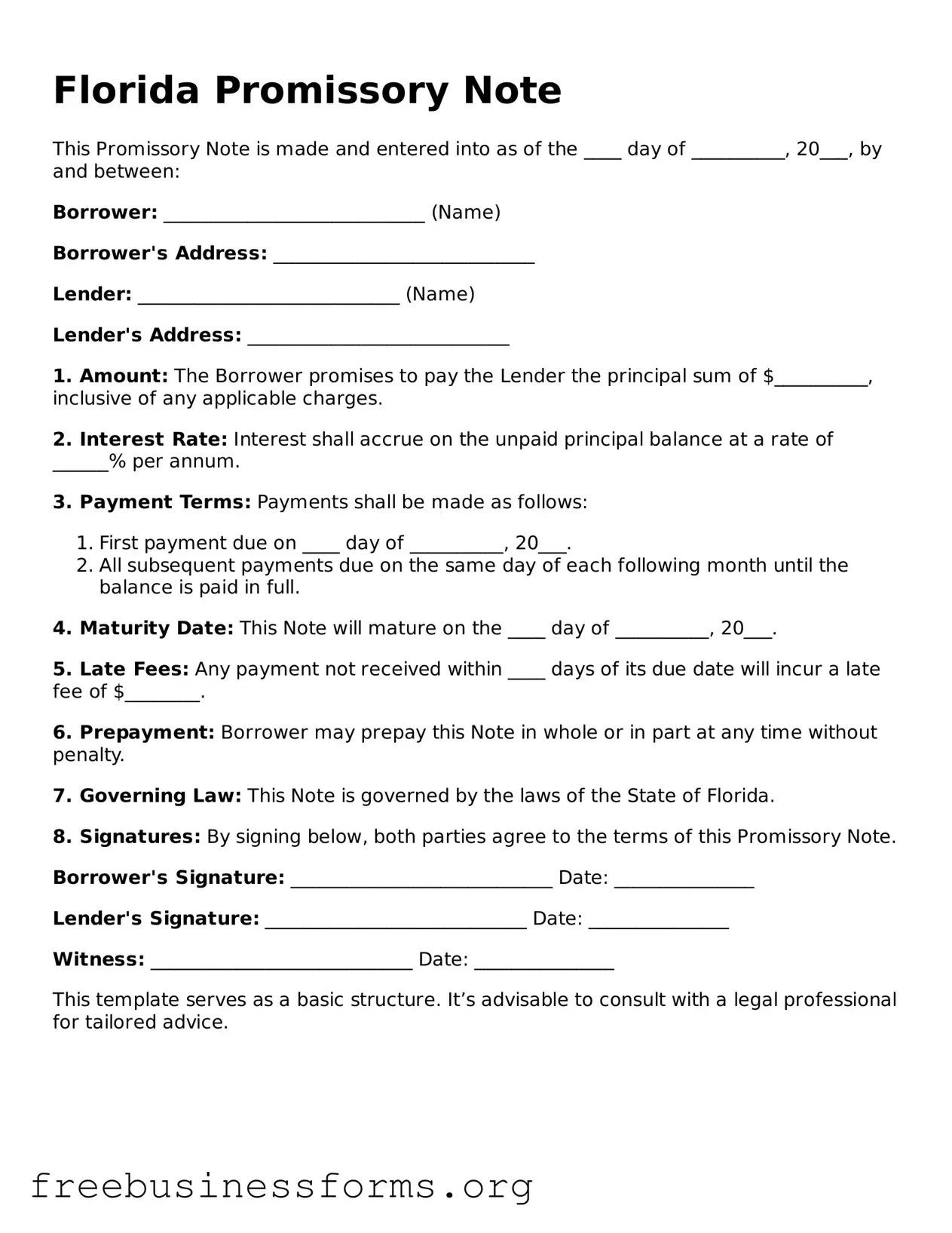

Blank Promissory Note Template for Florida

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Promissory Note online quickly — edit, save, download.