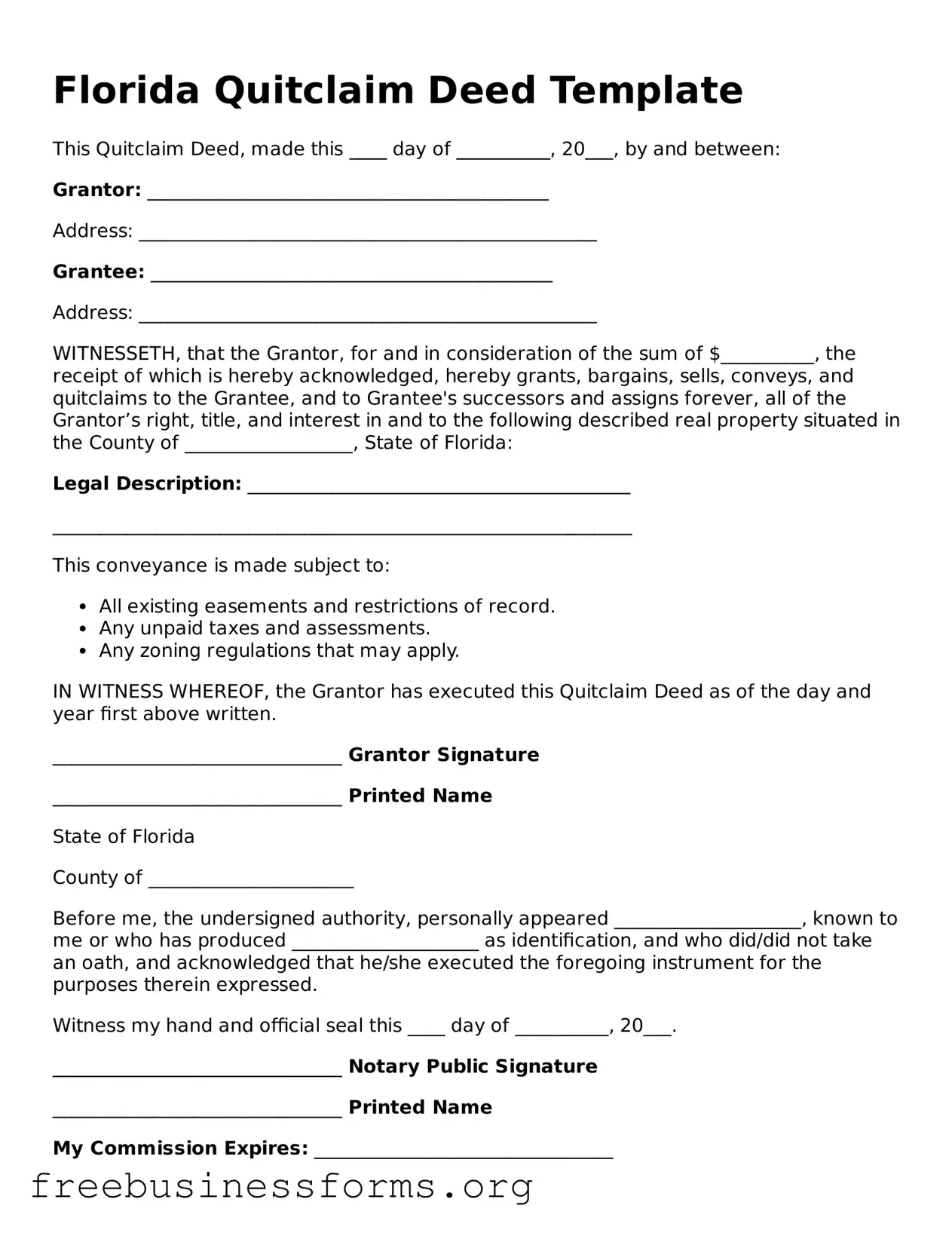

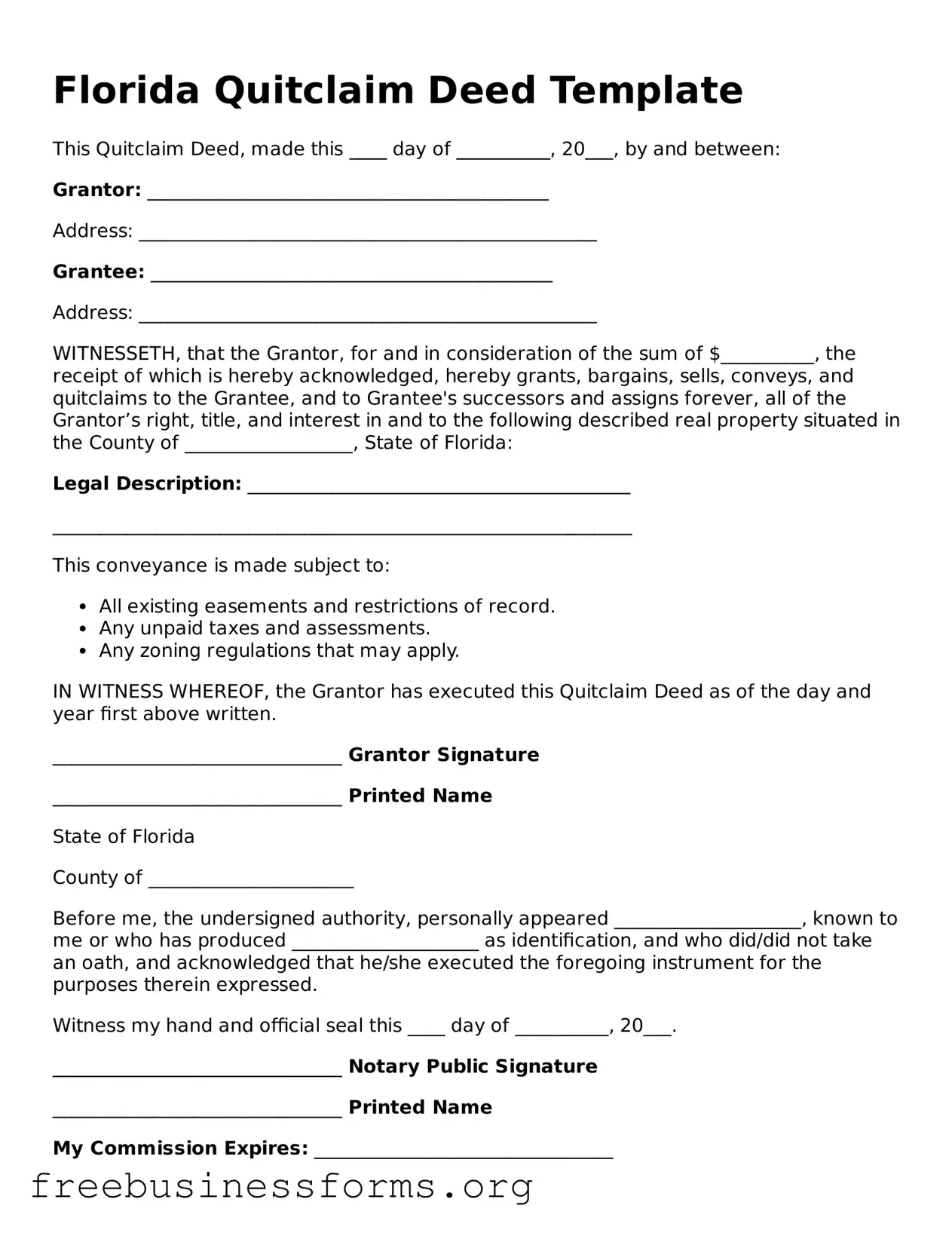

Blank Quitclaim Deed Template for Florida

A Florida Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties. This form allows the grantor to relinquish their interest in the property, making it a straightforward option for property transfers. Understanding its use and implications is essential for anyone involved in real estate transactions in Florida.

Open Form Here

Blank Quitclaim Deed Template for Florida

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Quitclaim Deed online quickly — edit, save, download.