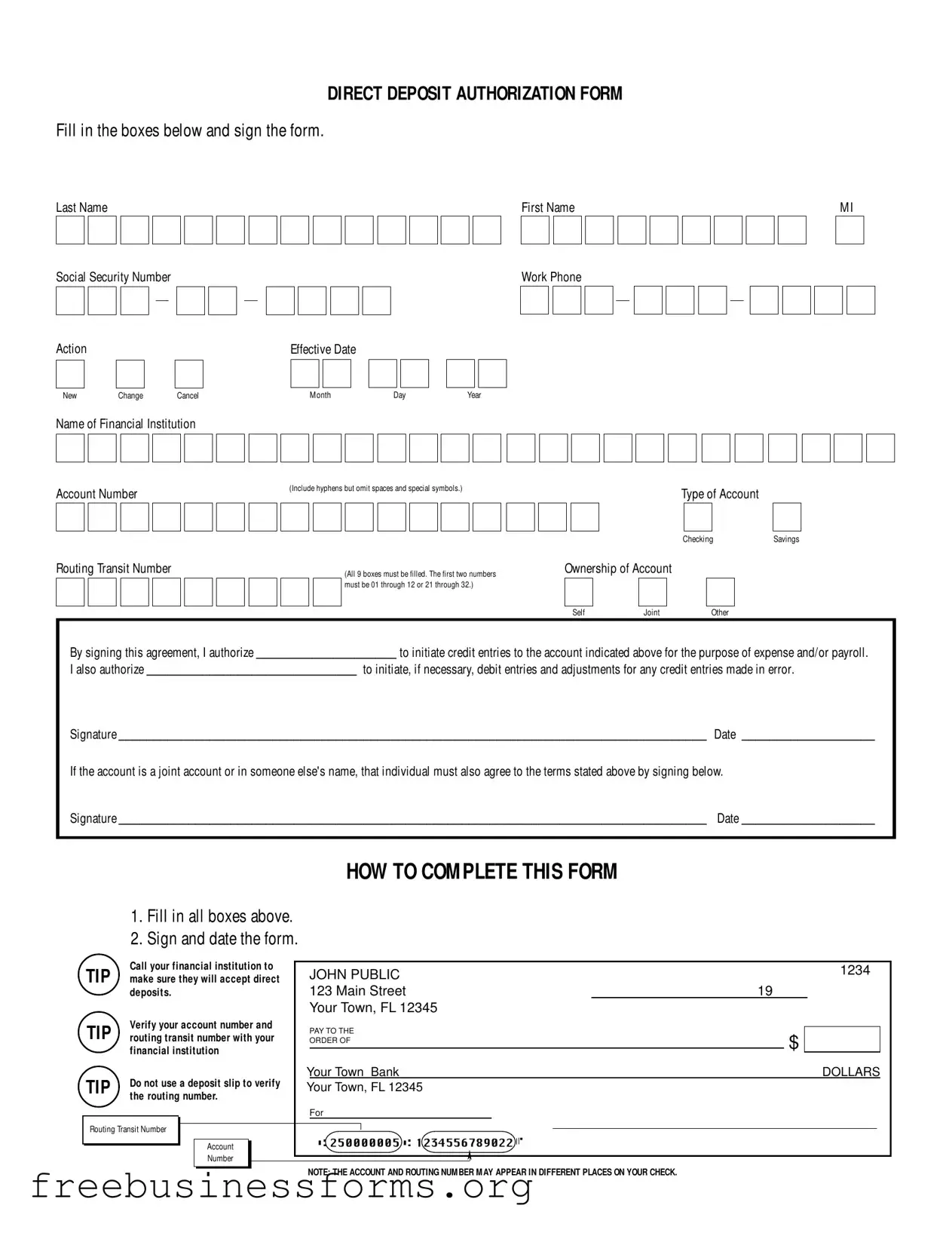

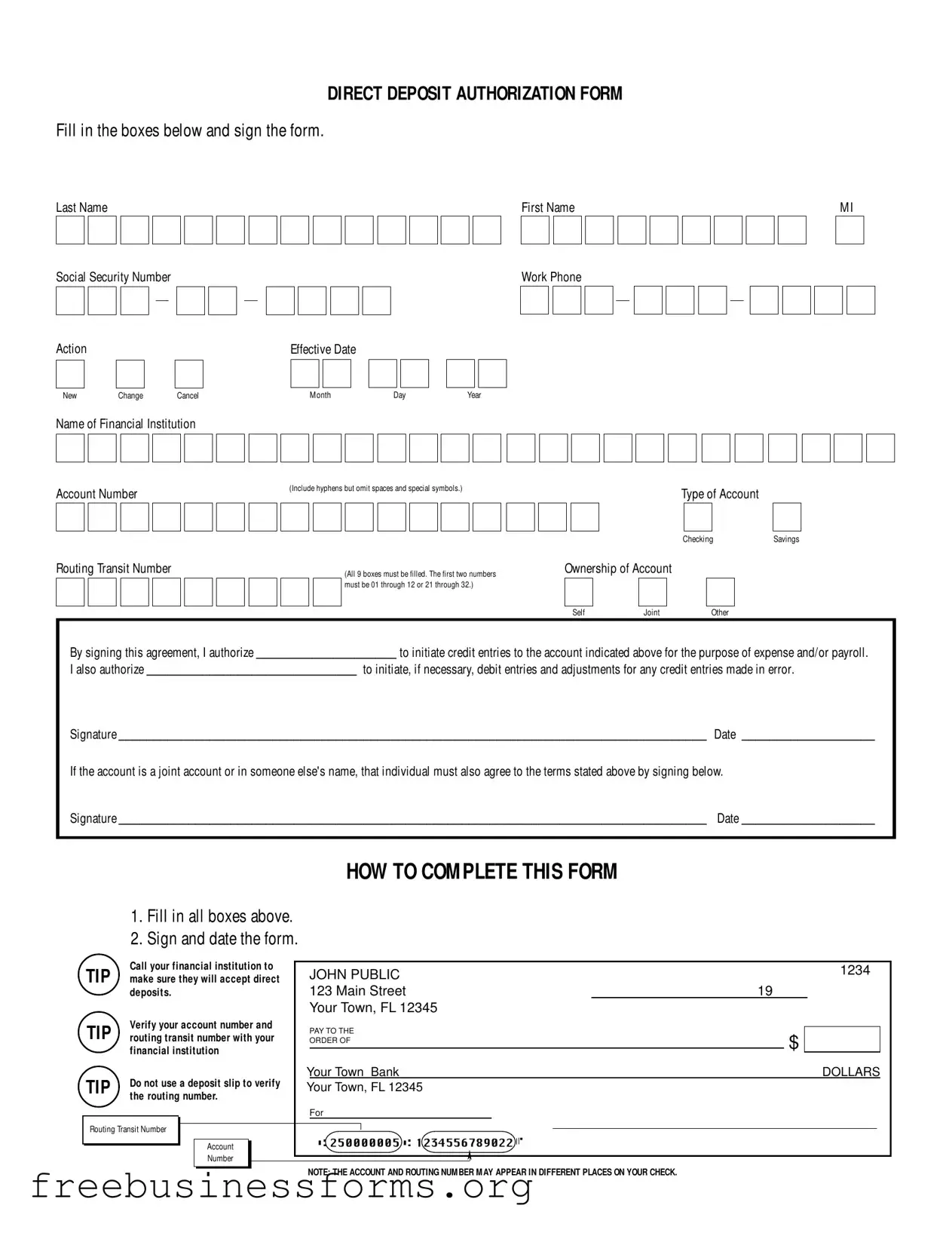

Official Generic Direct Deposit Form in PDF

The Generic Direct Deposit Authorization Form is a document that allows individuals to authorize the electronic transfer of funds directly into their bank accounts. This form is essential for setting up payroll deposits or other types of payments, ensuring that funds are deposited securely and efficiently. Proper completion of the form is crucial to avoid any delays or errors in receiving payments.

Open Form Here

Official Generic Direct Deposit Form in PDF

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Generic Direct Deposit online quickly — edit, save, download.

□

□