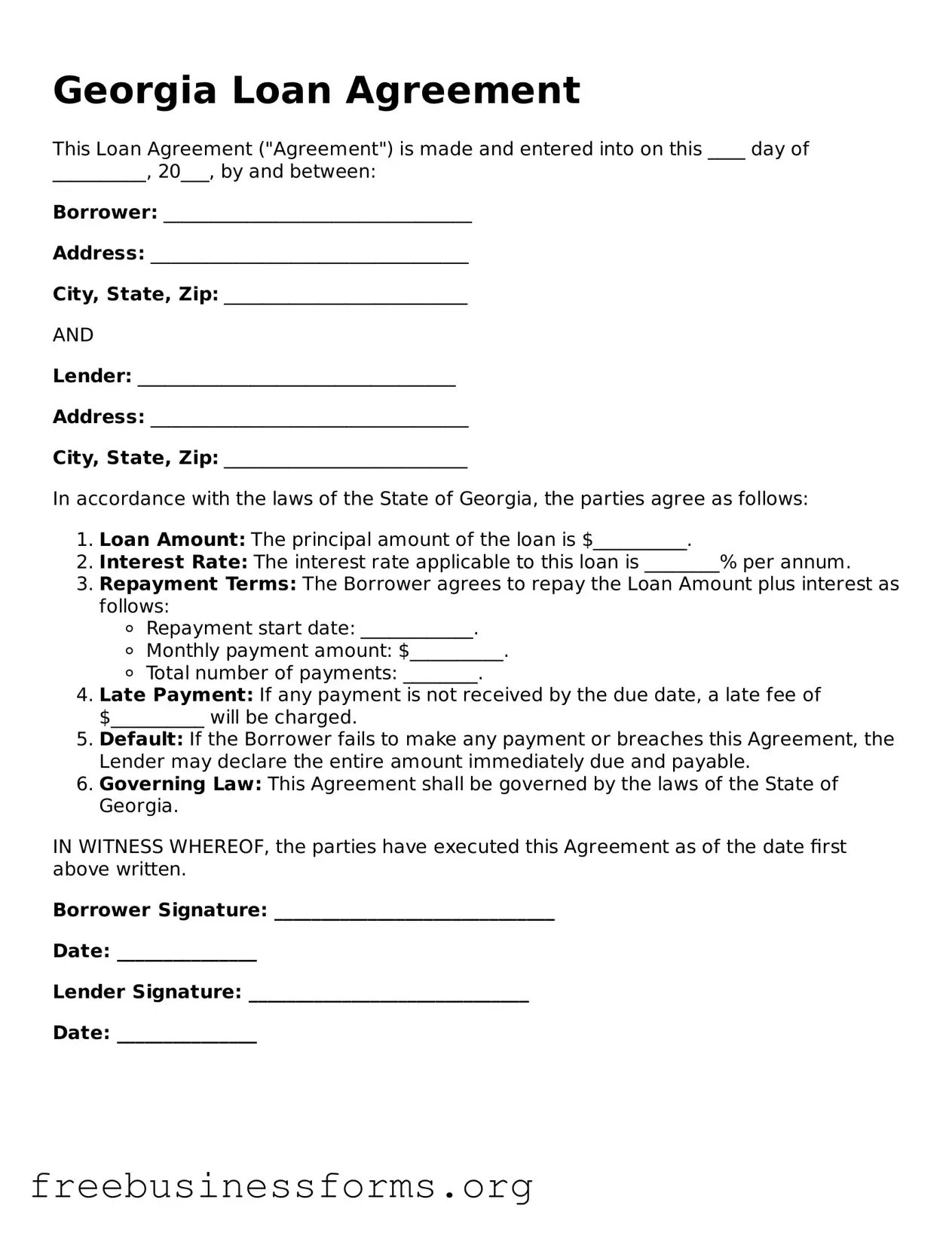

Blank Loan Agreement Template for Georgia

A Georgia Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower in the state of Georgia. This form serves to protect both parties by clearly detailing the amount borrowed, repayment schedule, and any interest rates or fees associated with the loan. Understanding this agreement is crucial for ensuring a smooth lending process and avoiding potential disputes.

Open Form Here

Blank Loan Agreement Template for Georgia

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Loan Agreement online quickly — edit, save, download.