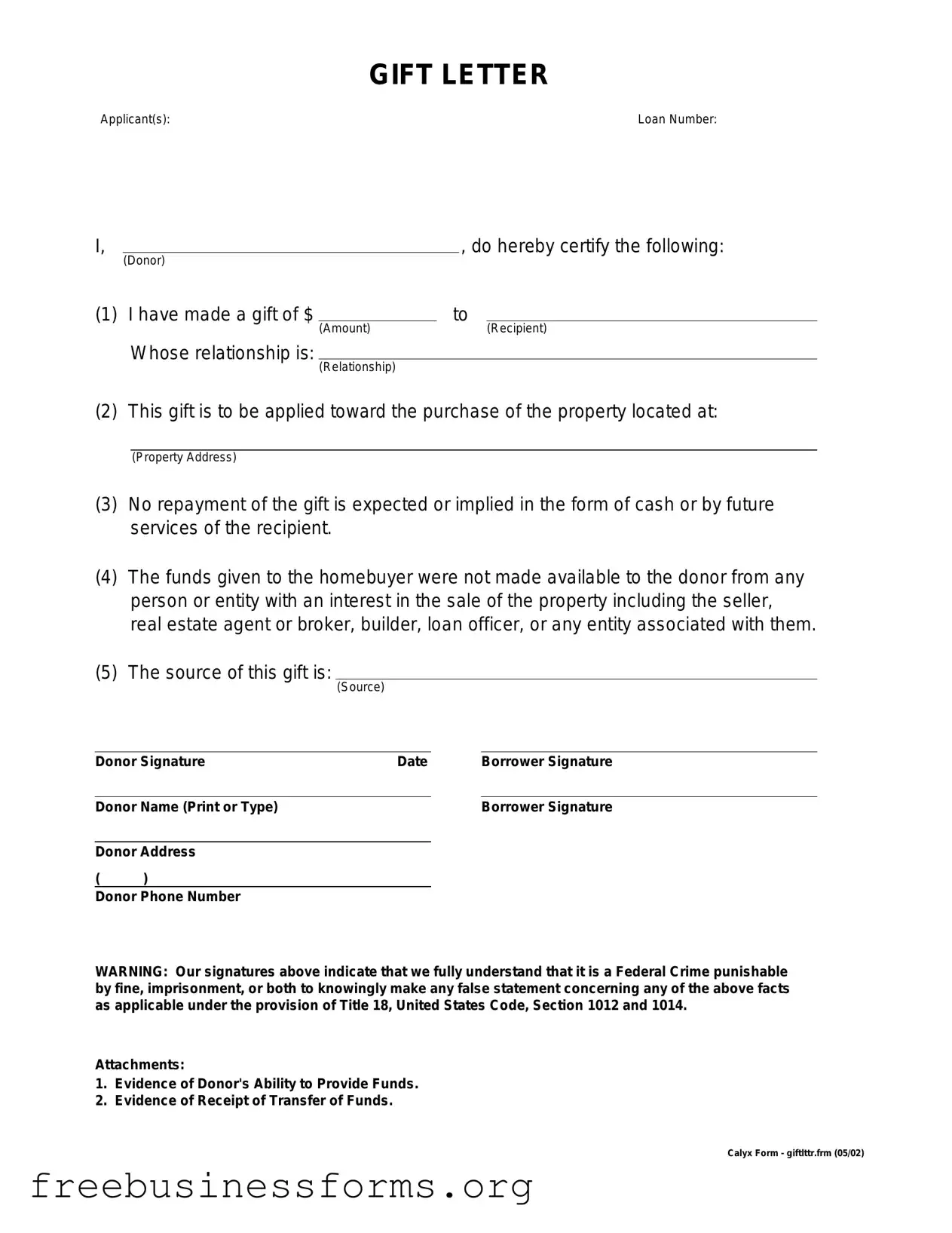

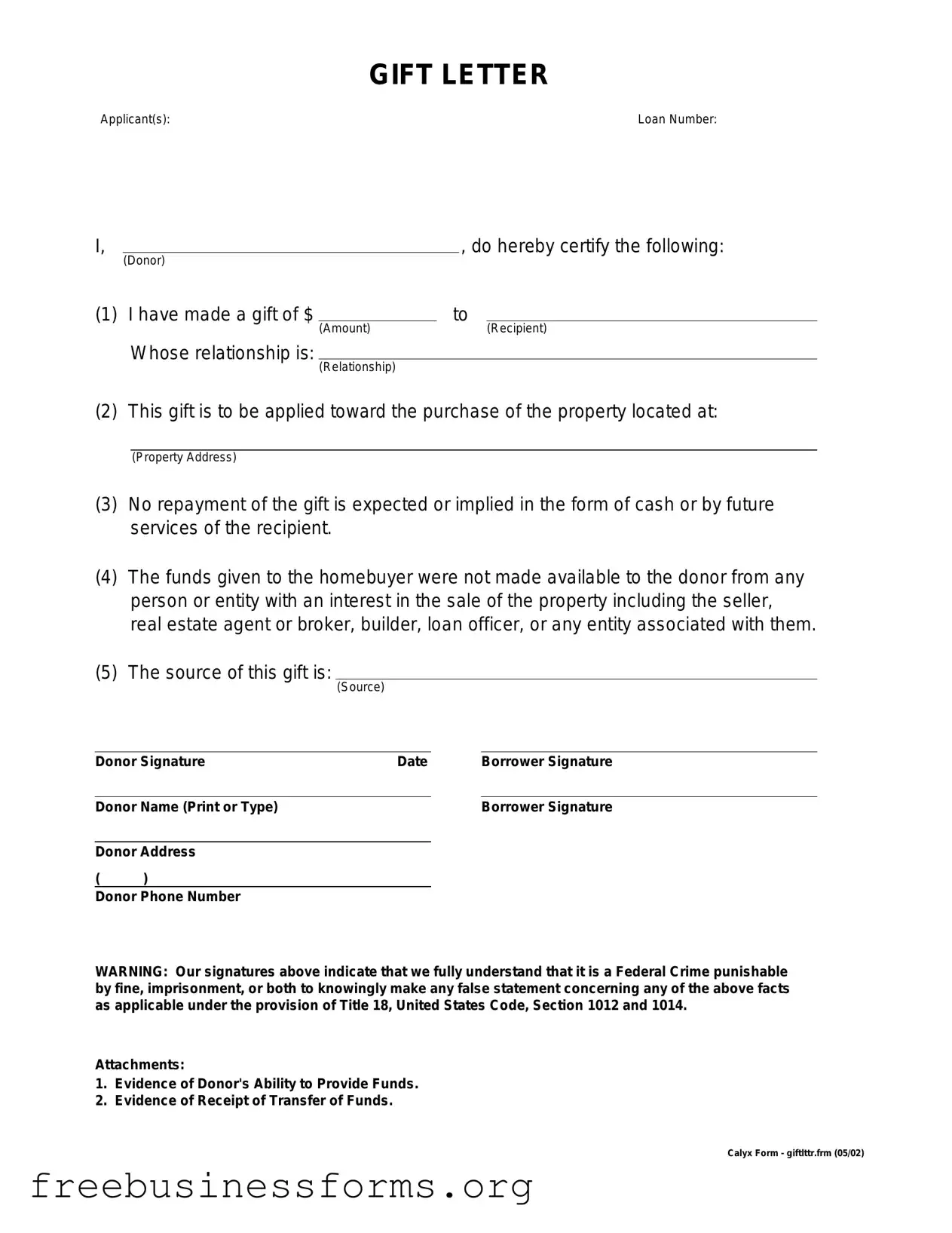

Official Gift Letter Form in PDF

The Gift Letter form is a document used to declare that a monetary gift is being given to a borrower, typically in the context of securing a mortgage. This form helps clarify that the funds are not a loan, ensuring transparency in the financial process. Proper completion of the Gift Letter form can facilitate smoother transactions and prevent potential misunderstandings between parties involved.

Open Form Here

Official Gift Letter Form in PDF

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Gift Letter online quickly — edit, save, download.