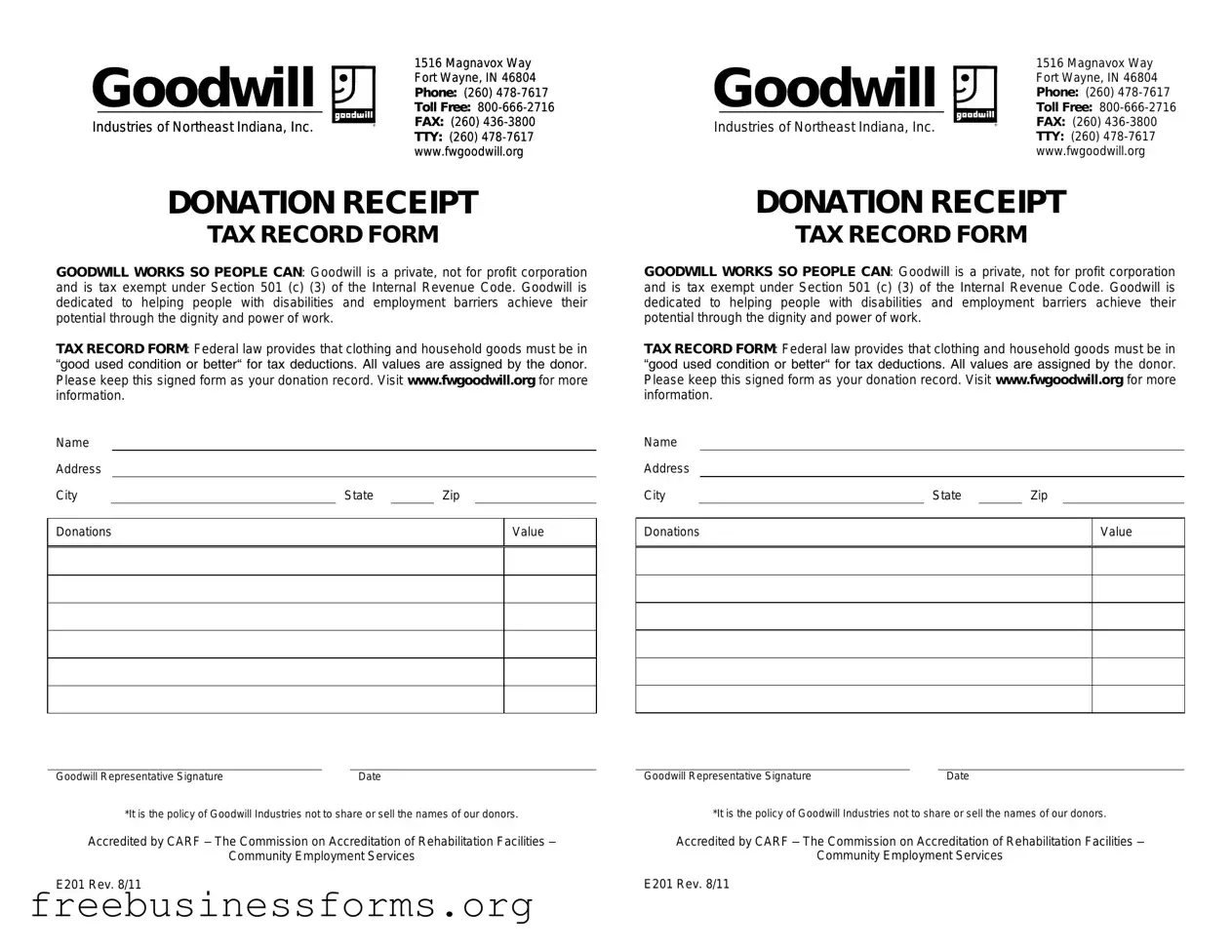

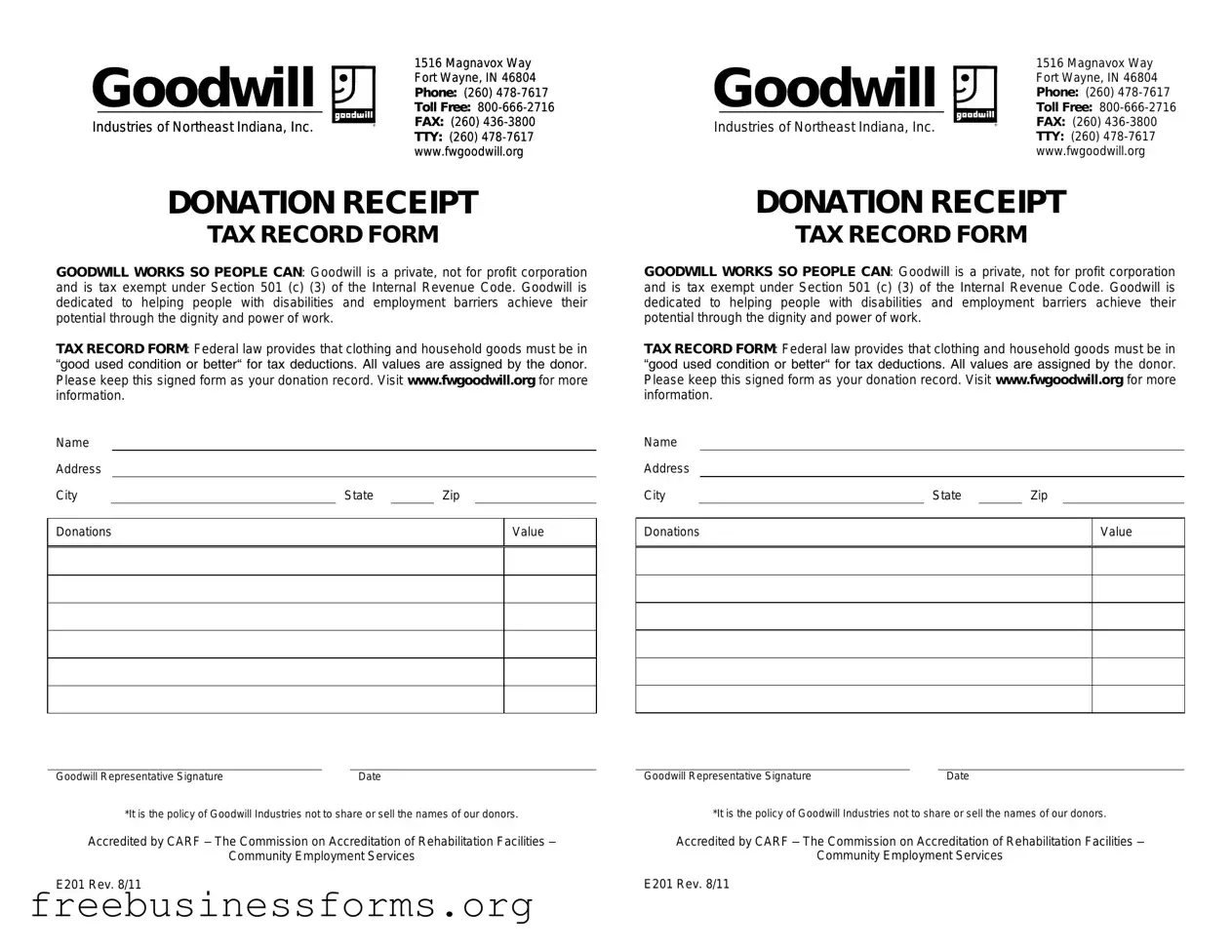

Official Goodwill donation receipt Form in PDF

The Goodwill donation receipt form serves as a record for individuals who donate items to Goodwill Industries. This form is essential for tracking donations and can be used for tax purposes, ensuring that donors receive appropriate acknowledgment for their generosity. Understanding how to properly fill out and utilize this form can enhance your charitable giving experience.

Open Form Here

Official Goodwill donation receipt Form in PDF

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Goodwill donation receipt online quickly — edit, save, download.