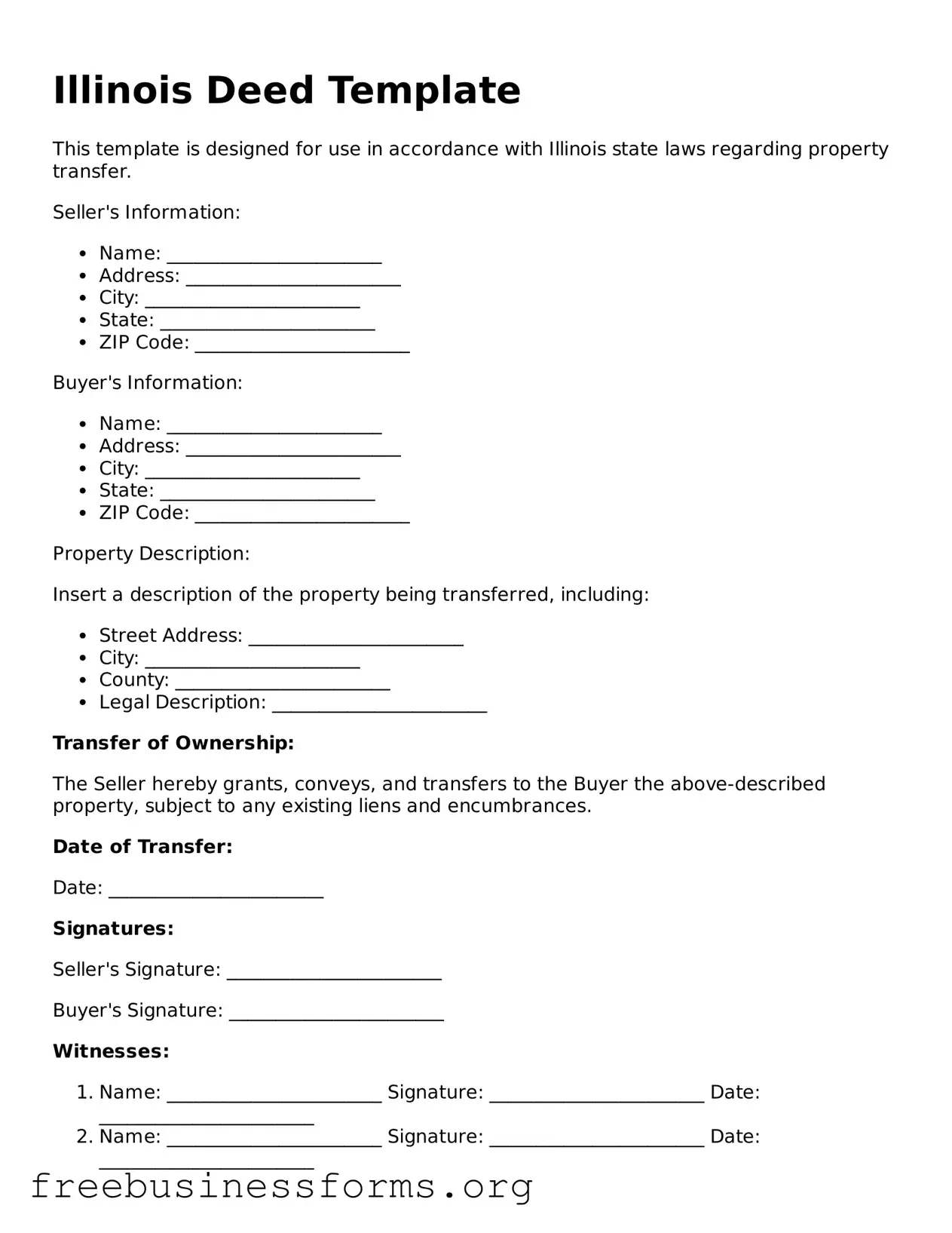

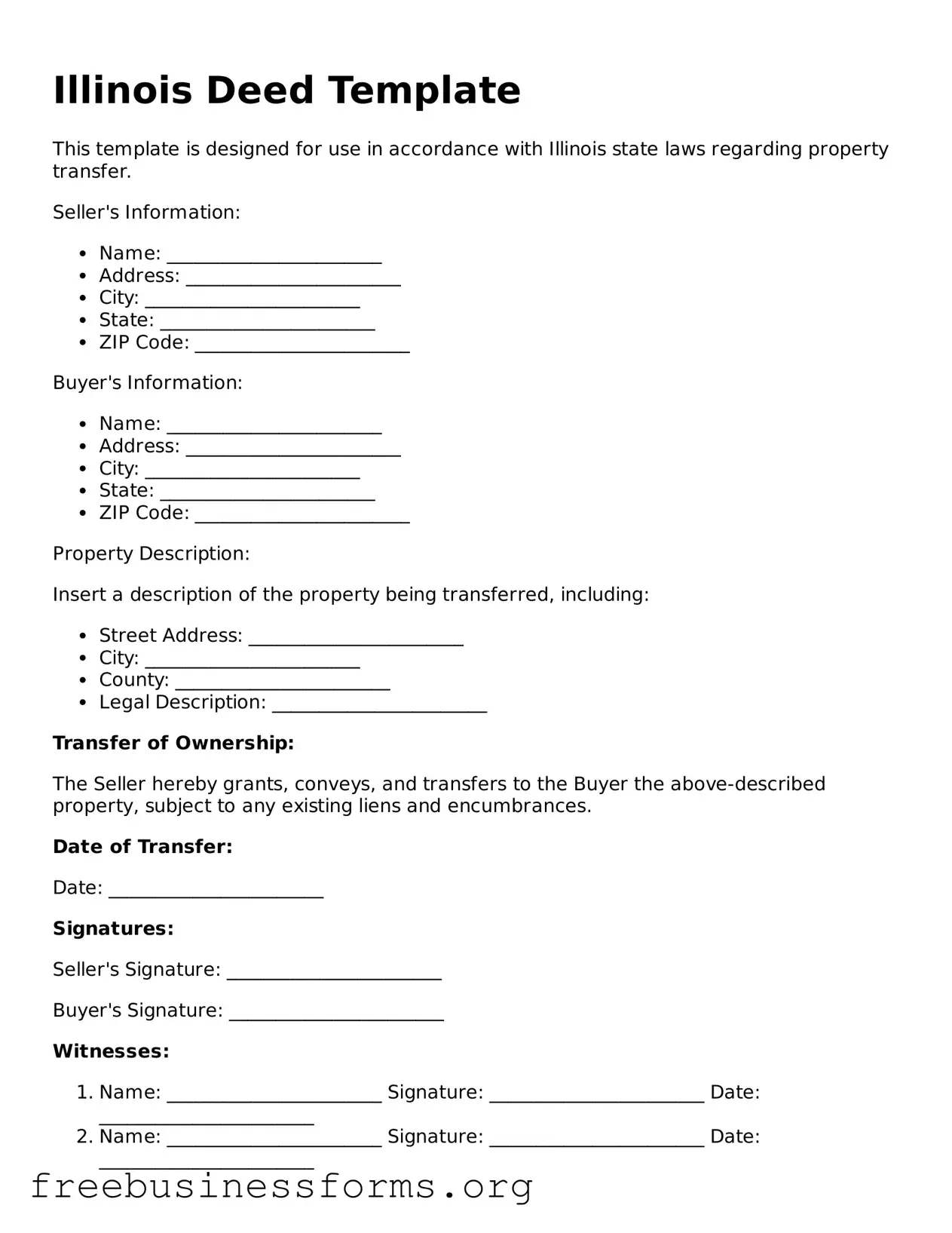

Blank Deed Template for Illinois

The Illinois Deed form is a legal document used to transfer ownership of real estate from one party to another. This form plays a crucial role in ensuring that property transactions are clear and enforceable. Understanding its components can help simplify the process of buying or selling property in Illinois.

Open Form Here

Blank Deed Template for Illinois

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Deed online quickly — edit, save, download.