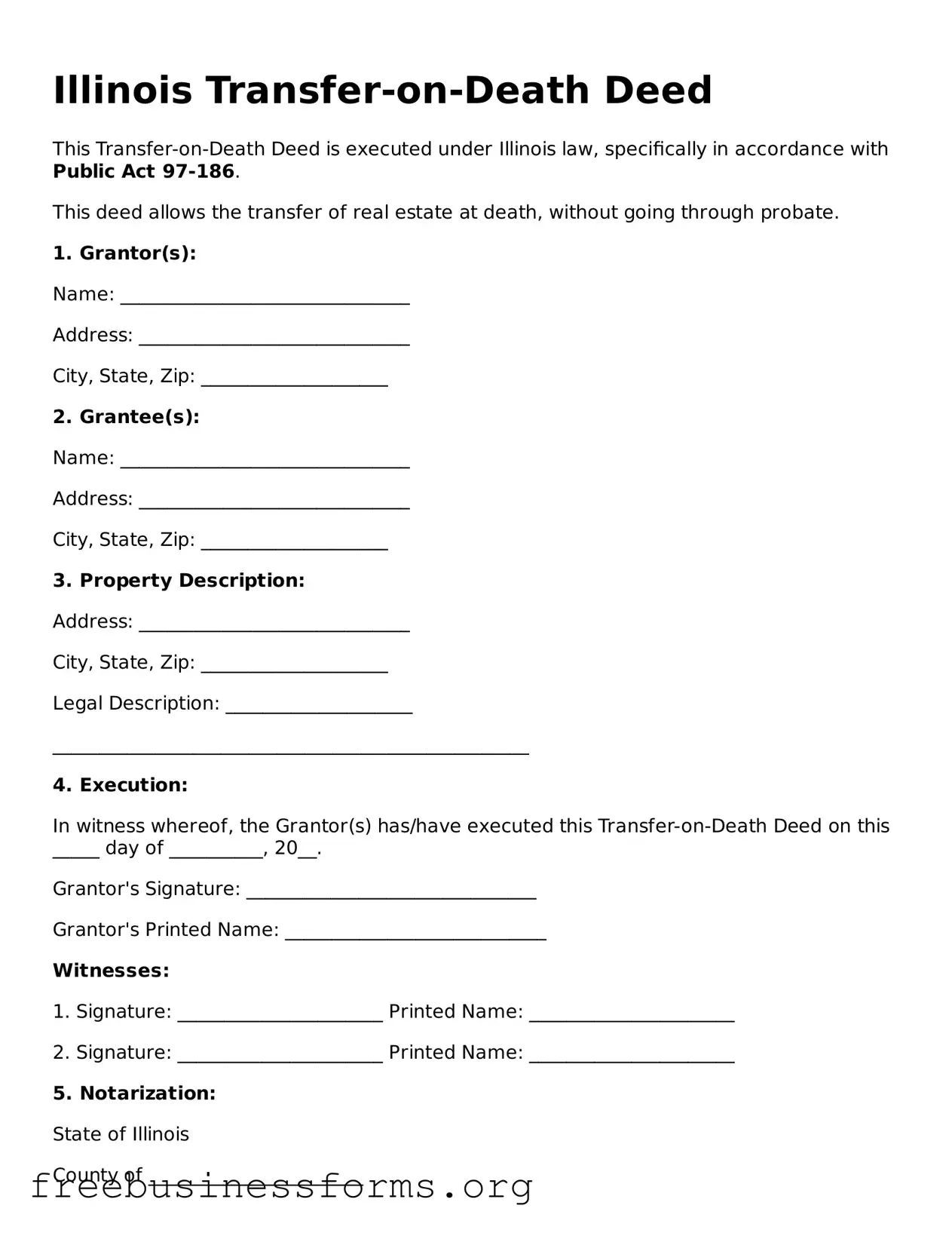

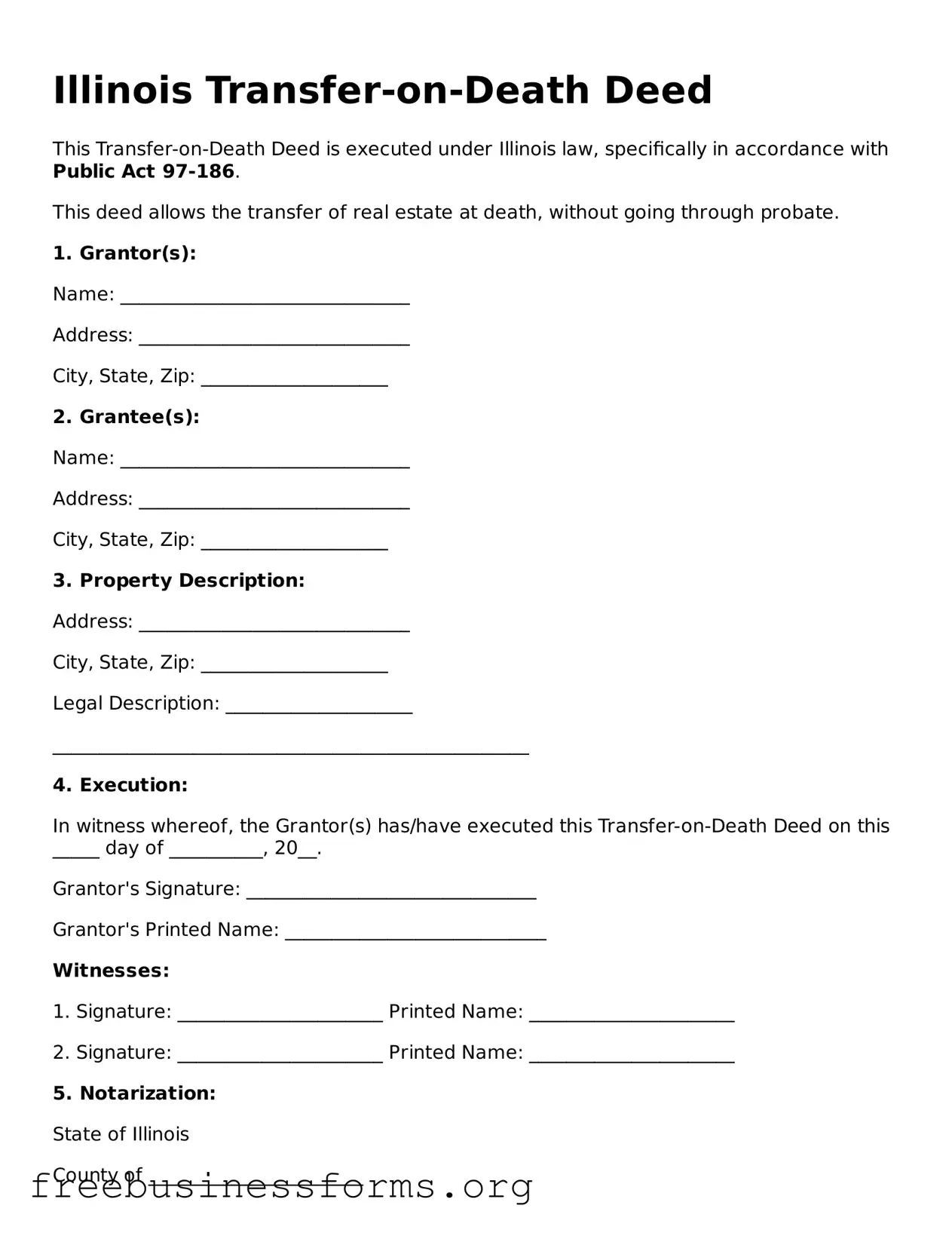

Blank Transfer-on-Death Deed Template for Illinois

The Illinois Transfer-on-Death Deed form allows property owners to designate beneficiaries who will receive their real estate upon their death, bypassing the probate process. This legal tool provides a straightforward way to transfer property, ensuring that the owner's wishes are honored without the complications of court proceedings. Understanding the form's requirements and implications is essential for effective estate planning.

Open Form Here

Blank Transfer-on-Death Deed Template for Illinois

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Transfer-on-Death Deed online quickly — edit, save, download.