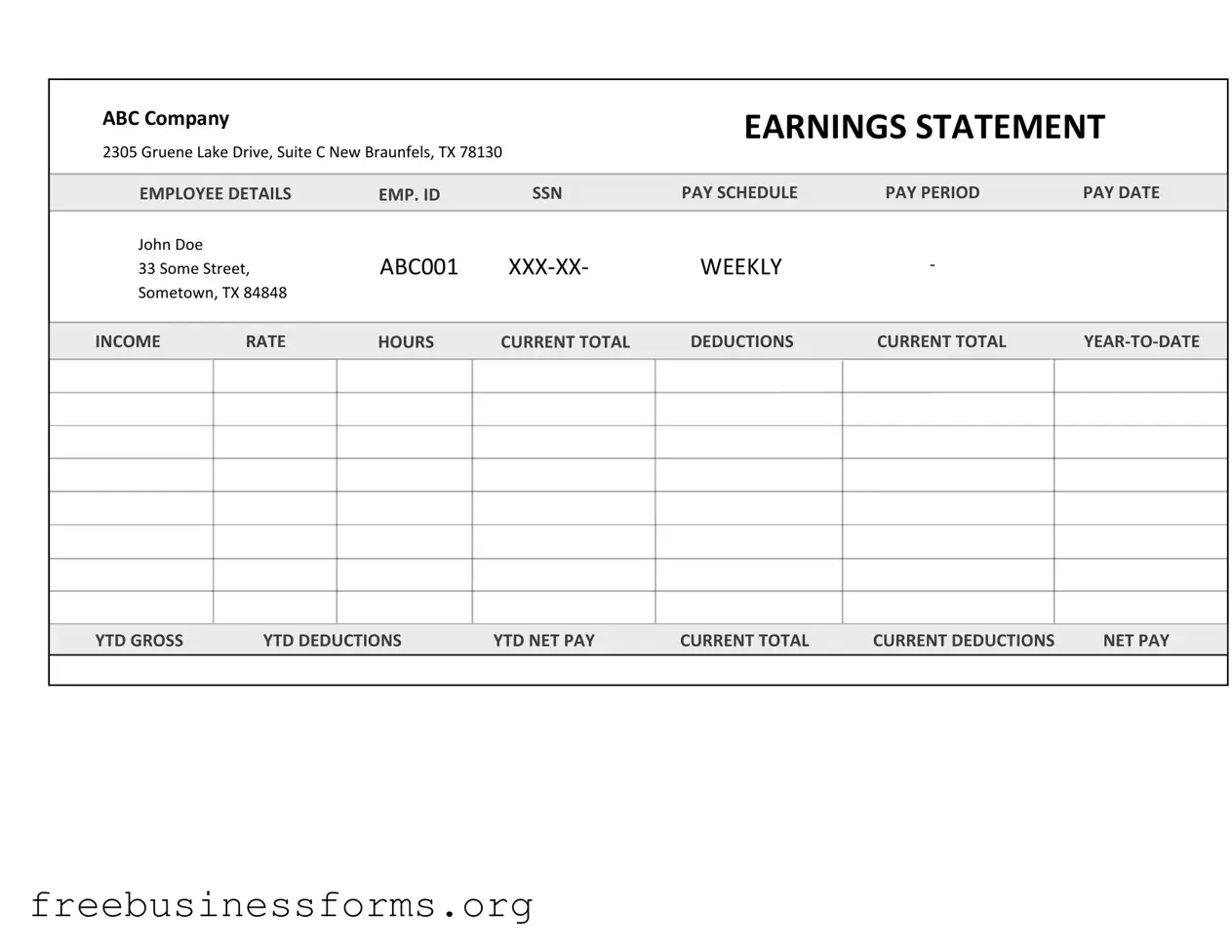

Official Independent Contractor Pay Stub Form in PDF

The Independent Contractor Pay Stub form is a document that outlines the earnings and deductions for individuals who work as independent contractors. This form serves as a vital record for both contractors and clients, ensuring transparency in payment details. Understanding its components can help contractors manage their finances and comply with tax regulations.

Open Form Here

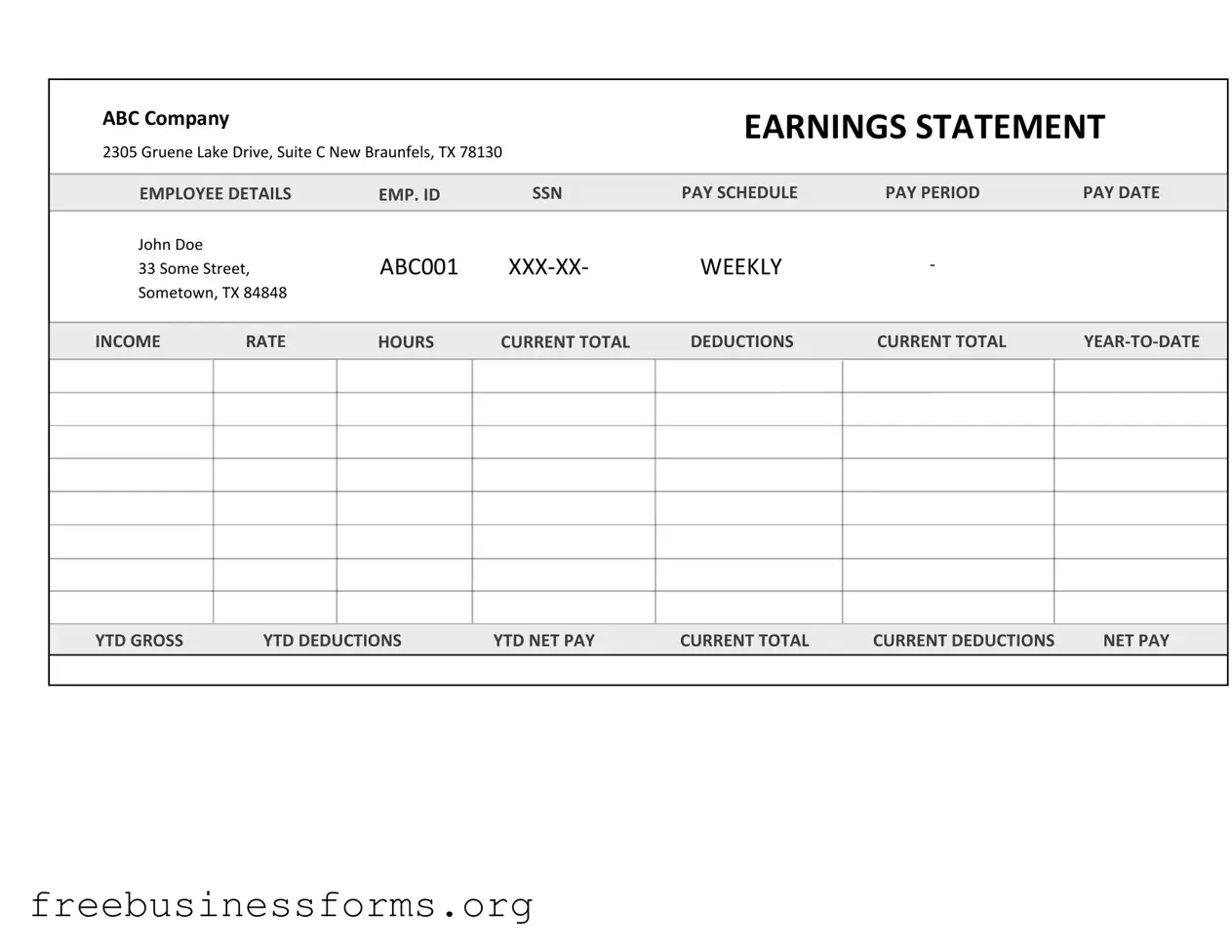

Official Independent Contractor Pay Stub Form in PDF

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Independent Contractor Pay Stub online quickly — edit, save, download.