|

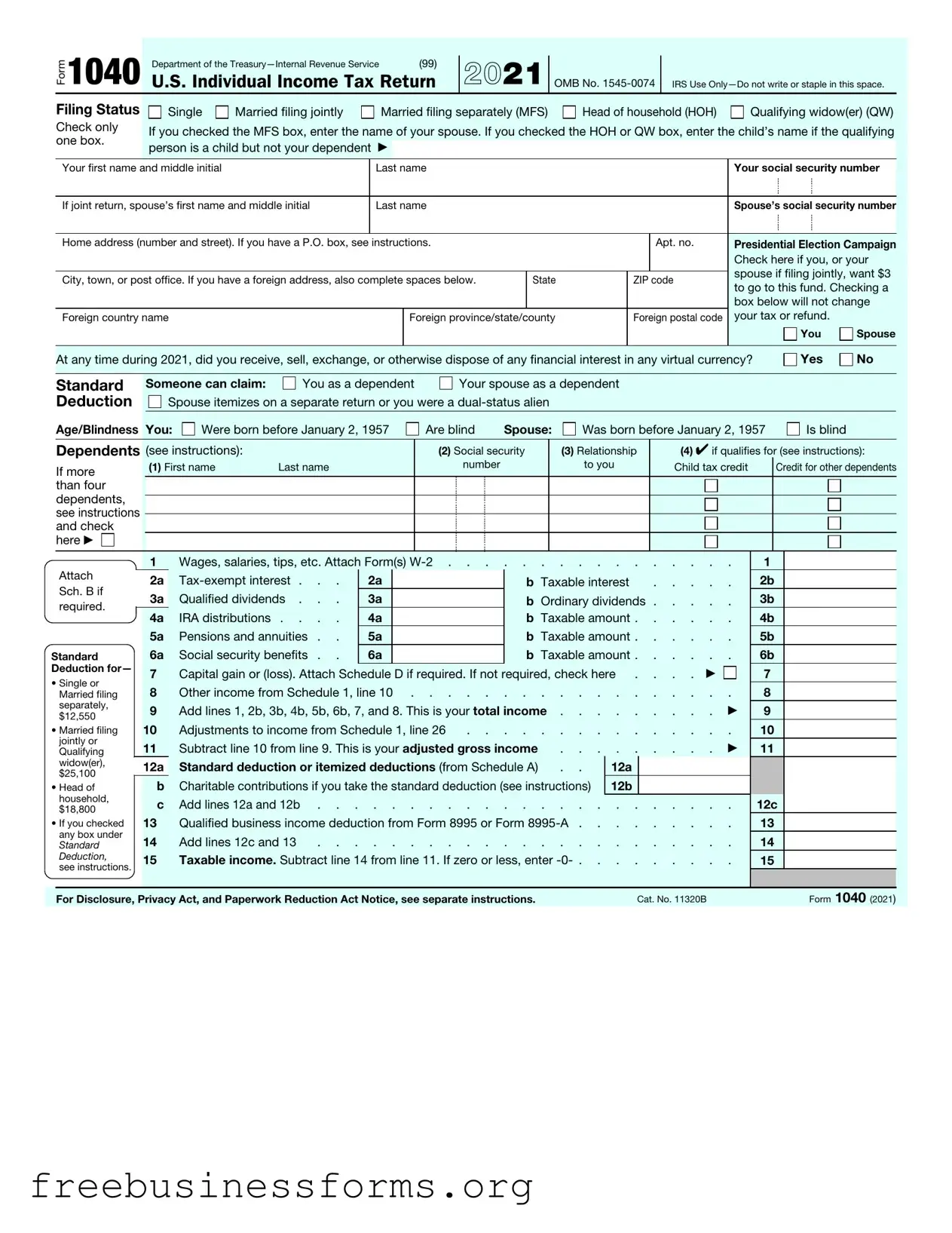

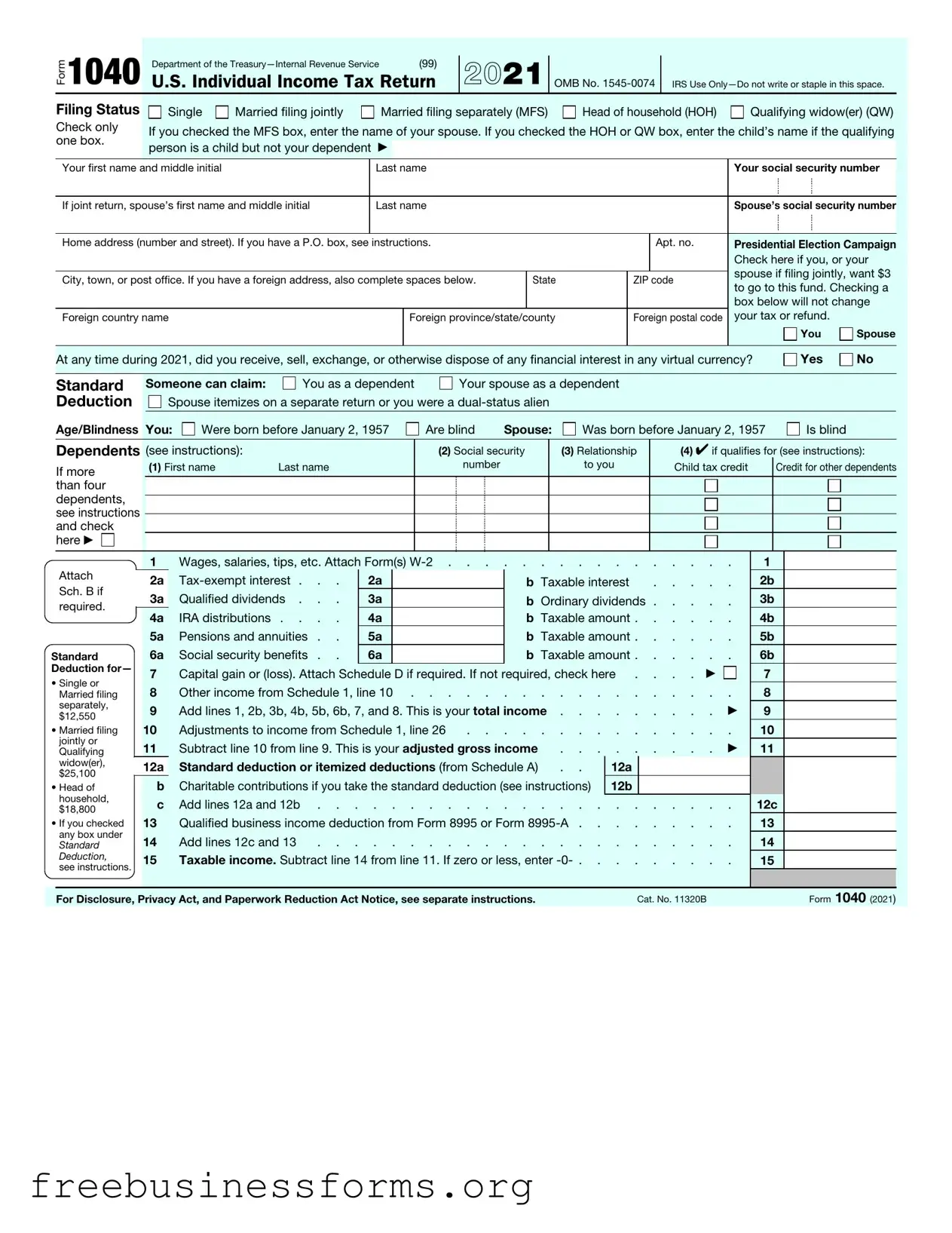

Your first name and middle initial |

|

|

|

|

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

Your social security number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If joint return, spouse’s first name and middle initial |

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s social security number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (number and street). If you have a P.O. box, see instructions. |

|

|

|

|

|

|

|

|

|

Apt. no. |

Presidential Election Campaign |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here if you, or your |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

spouse if filing jointly, want $3 |

|

City, town, or post office. If you have a foreign address, also complete spaces below. |

|

State |

|

|

|

|

ZIP code |

|

|

|

|

|

|

to go to this fund. Checking a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

box below will not change |

|

Foreign country name |

|

|

|

|

|

|

|

|

|

|

Foreign province/state/county |

|

|

|

|

Foreign postal code |

your tax or refund. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You |

|

|

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? |

|

|

|

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Standard |

|

Someone can claim: |

|

|

|

You as a dependent |

|

|

Your spouse as a dependent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deduction |

|

|

|

|

|

Spouse itemizes on a separate return or you were a dual-status alien |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Age/Blindness You: |

|

|

Were born before January 2, 1957 |

|

|

Are blind |

Spouse: |

|

|

Was born before January 2, 1957 |

|

|

|

|

Is blind |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dependents (see instructions): |

|

|

|

|

|

|

|

|

|

(2) Social security |

|

(3) Relationship |

(4) ✔ if qualifies for (see instructions): |

|

If more |

|

|

(1) First name |

Last name |

|

|

|

|

|

|

|

number |

|

|

|

|

|

to you |

Child tax credit |

|

|

Credit for other dependents |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

than four |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

dependents, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

see instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and check |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

here ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attach |

|

|

1 |

|

|

|

|

Wages, salaries, tips, etc. Attach Form(s) W-2 |

. |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

a |

|

|

Tax-exempt interest . . . |

2a |

|

|

|

|

|

|

|

|

b Taxable interest |

. . . . |

|

|

. |

|

|

2b |

|

|

|

|

|

|

|

|

|

|

|

Sch. B if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

a |

|

|

Qualified dividends . . . |

3a |

|

|

|

|

|

|

|

|

b Ordinary dividends . . . . |

. |

|

|

3b |

|

|

|

|

|

|

|

|

|

|

|

required. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4a |

IRA distributions . . . . |

4a |

|

|

|

|

|

|

|

|

b Taxable amount |

. |

|

|

4b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5a |

Pensions and annuities . . |

5a |

|

|

|

|

|

|

|

|

b Taxable amount |

. |

|

|

5b |

|

|

|

|

|

|

|

|

|

|

Standard |

|

|

6a |

Social security benefits . . |

6a |

|

|

|

|

|

|

|

|

b Taxable amount |

. |

|

|

6b |

|

|

|

|

|

|

|

|

|

|

Deduction for— |

7 |

|

|

|

|

Capital gain or (loss). Attach Schedule D if required. If not required, check here . |

. . . ▶ |

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• Single or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

Other income from Schedule 1, line 10 |

. |

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

Married filing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

separately, |

9 |

|

|

|

|

Add lines 1, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income |

▶ |

|

9 |

|

|

|

|

|

|

|

|

|

|

|

$12,550 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• Married filing |

10 |

|

|

|

|

Adjustments to income from Schedule 1, line 26 |

. |

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

jointly or |

11 |

|

|

|

|

Subtract line 10 from line 9. This is your adjusted gross income |

. . . . . . . . . |

|

|

▶ |

|

11 |

|

|

|

|

|

|

|

|

|

|

|

Qualifying |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

widow(er), |

|

|

|

12 |

a |

|

|

Standard deduction or itemized deductions (from Schedule A) |

. . |

12a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$25,100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b |

Charitable contributions if you take the standard deduction (see instructions) |

12b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• Head of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

household, |

|

|

|

c |

Add lines 12a and 12b |

. |

|

|

12c |

|

|

|

|

|

|

|

|

|

$18,800 |

|

|

|

|

|

|

|

|

|

|

|

• If you checked |

13 |

|

|

|

|

Qualified business income deduction from Form 8995 or Form 8995-A |

. |

|

|

13 |

|

|

|

|

|

|

|

|

|

|

|

any box under |

14 |

|

|

|

|

Add lines 12c and 13 |

. . . . . . . . . . . . . . . . . . . . . . |

|

|

. |

|

|

14 |

|

|

|

|

|

|

|

|

|

|

|

Standard |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deduction, |

15 |

|

|

|

|

Taxable income. Subtract line 14 from line 11. If zero or less, enter -0- |

. |

|

|

15 |

|

|

|

|

|

|

|

|

|

|

|

see instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. |

|

|

|

|

Cat. No. 11320B |

|

|

|

|

|

|

|

|

|

Form 1040 (2021) |