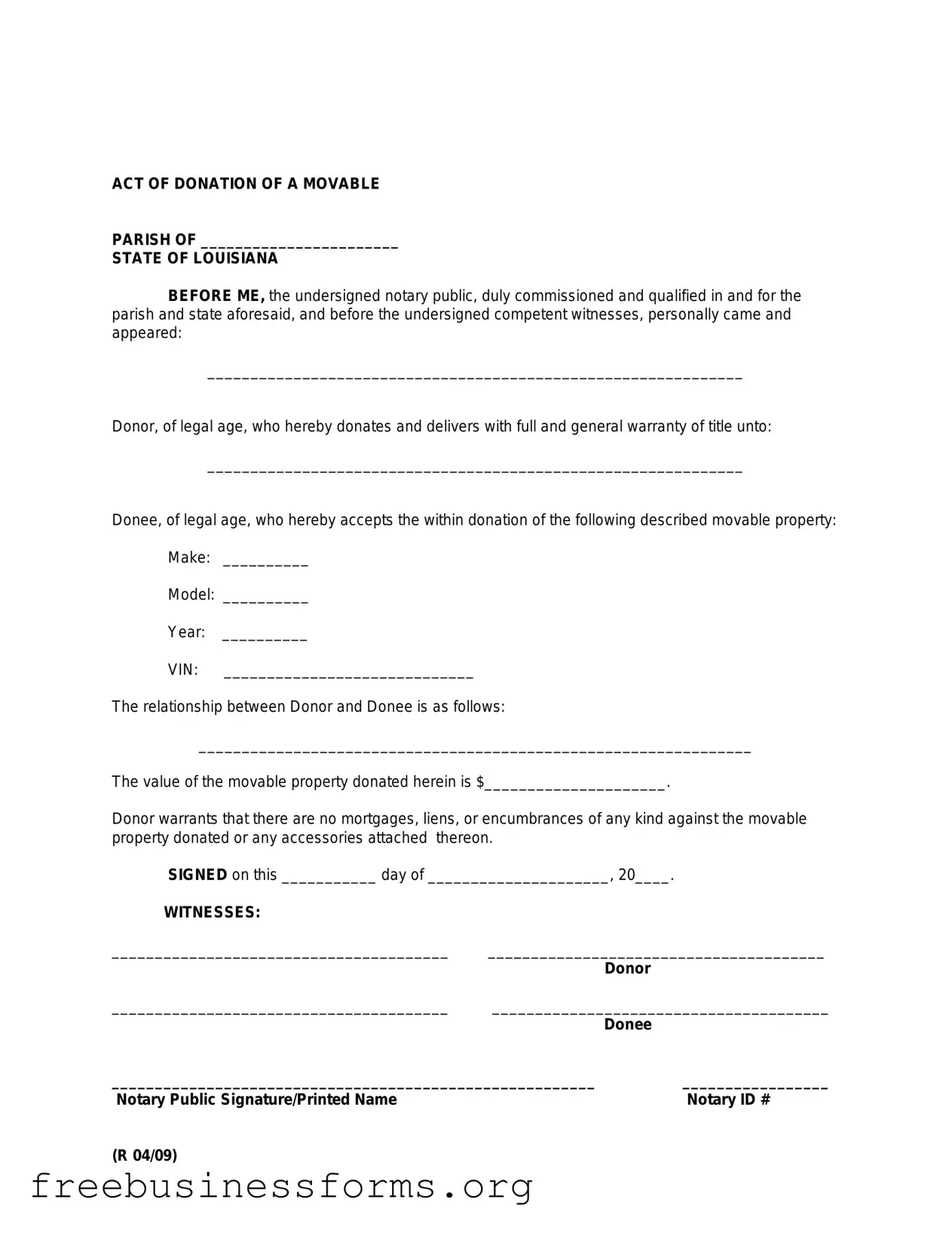

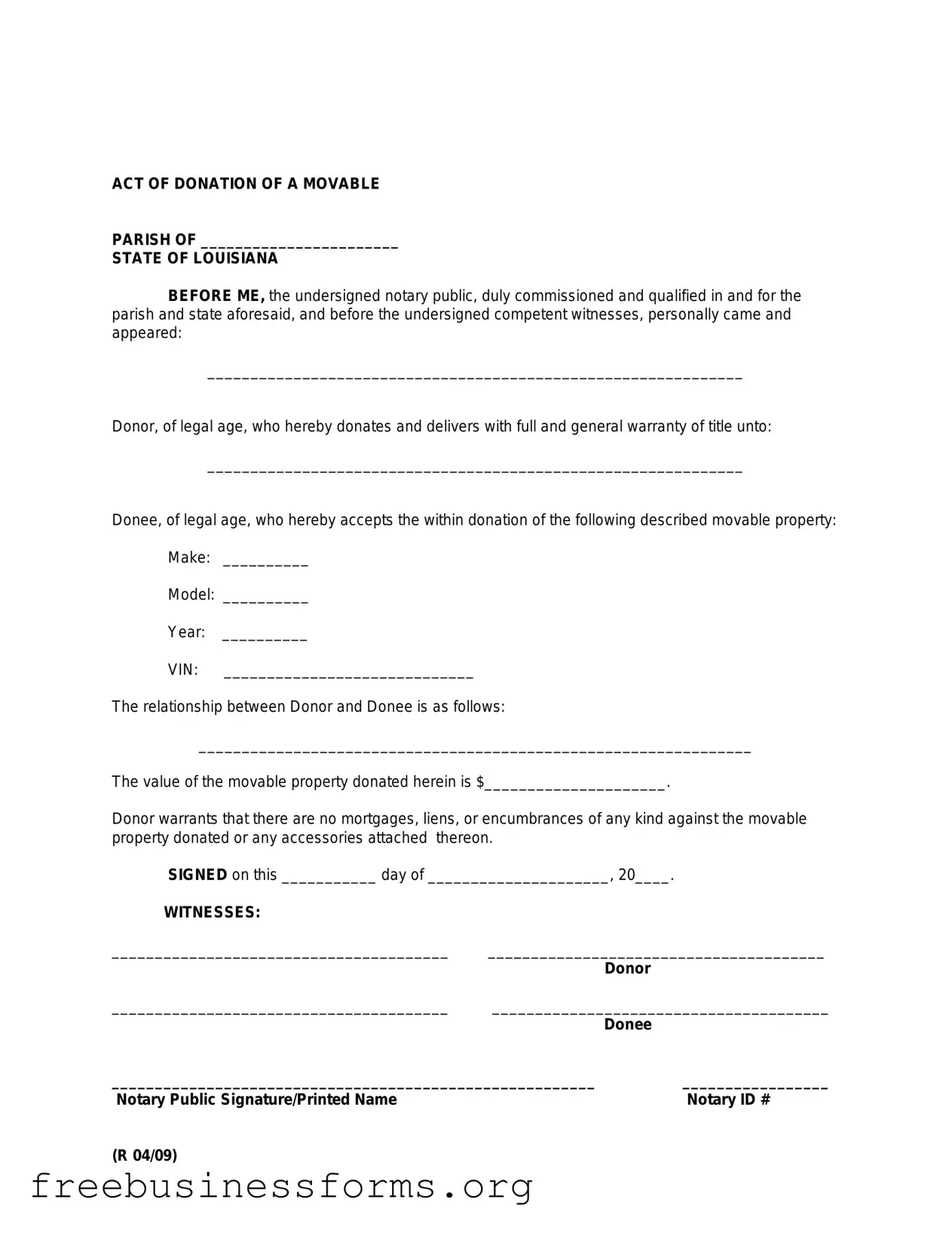

Official Louisiana act of donation Form in PDF

The Louisiana Act of Donation Form is a legal document that allows individuals to voluntarily transfer ownership of property or assets to another person without expecting anything in return. This form is an important tool for estate planning and can help simplify the transfer of wealth while minimizing potential disputes among heirs. Understanding how to properly utilize this form can empower individuals to make informed decisions about their assets.

Open Form Here

Official Louisiana act of donation Form in PDF

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Louisiana act of donation online quickly — edit, save, download.