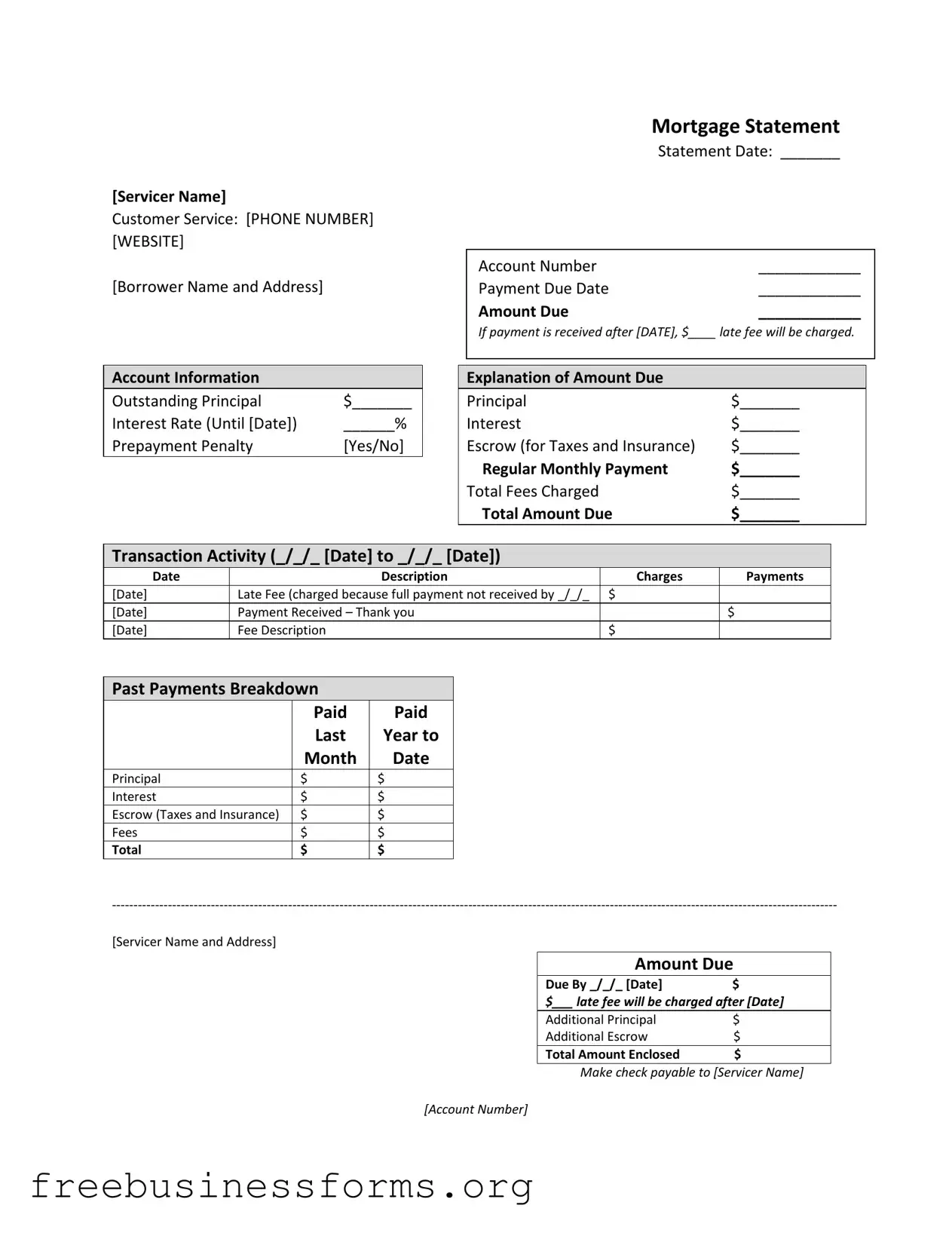

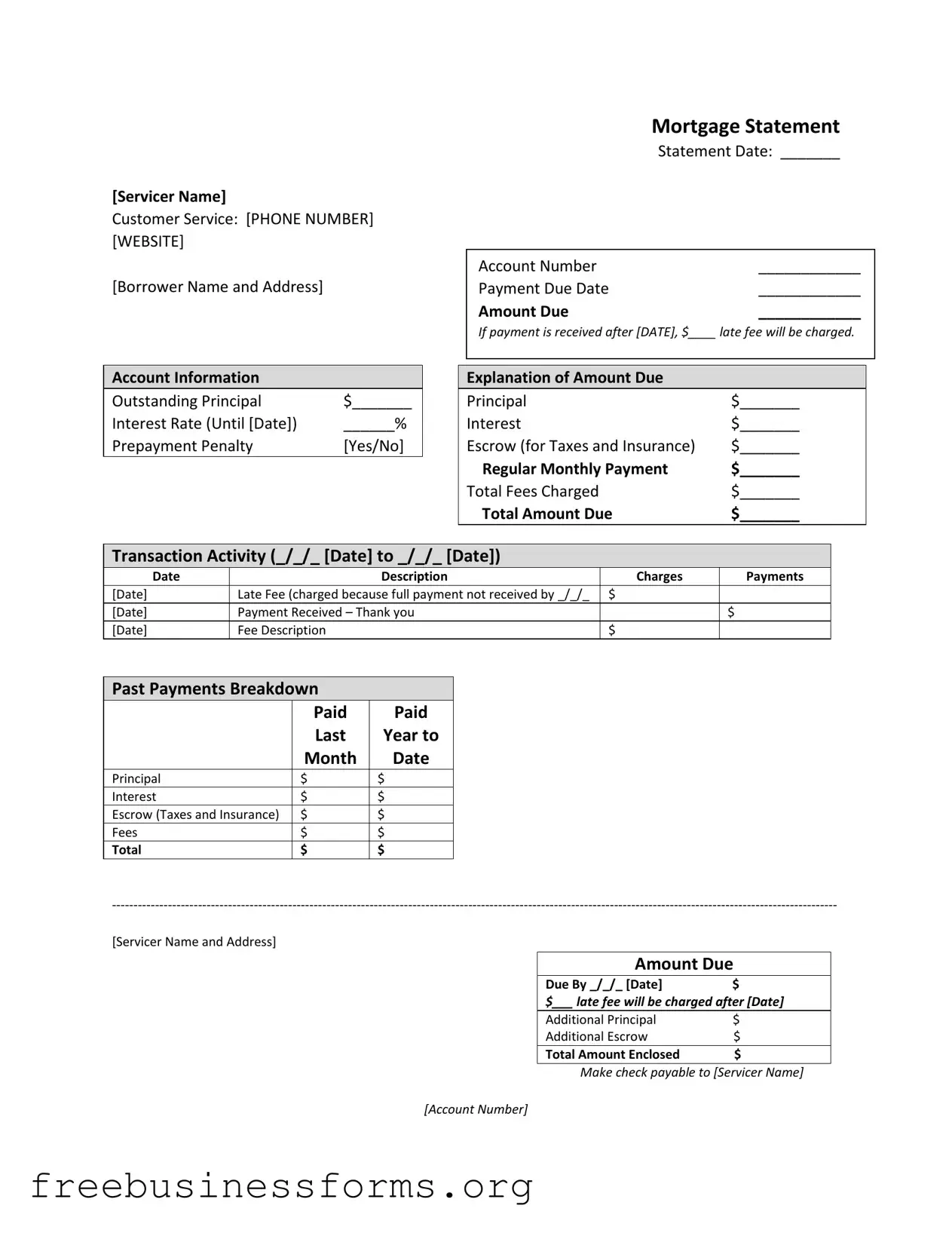

Official Mortgage Statement Form in PDF

The Mortgage Statement form is a crucial document that provides homeowners with a detailed overview of their mortgage account. It outlines important information such as the amount due, payment history, and any fees incurred. Understanding this form can help borrowers stay on top of their payments and avoid potential pitfalls like late fees or foreclosure.

Open Form Here

Official Mortgage Statement Form in PDF

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Mortgage Statement online quickly — edit, save, download.