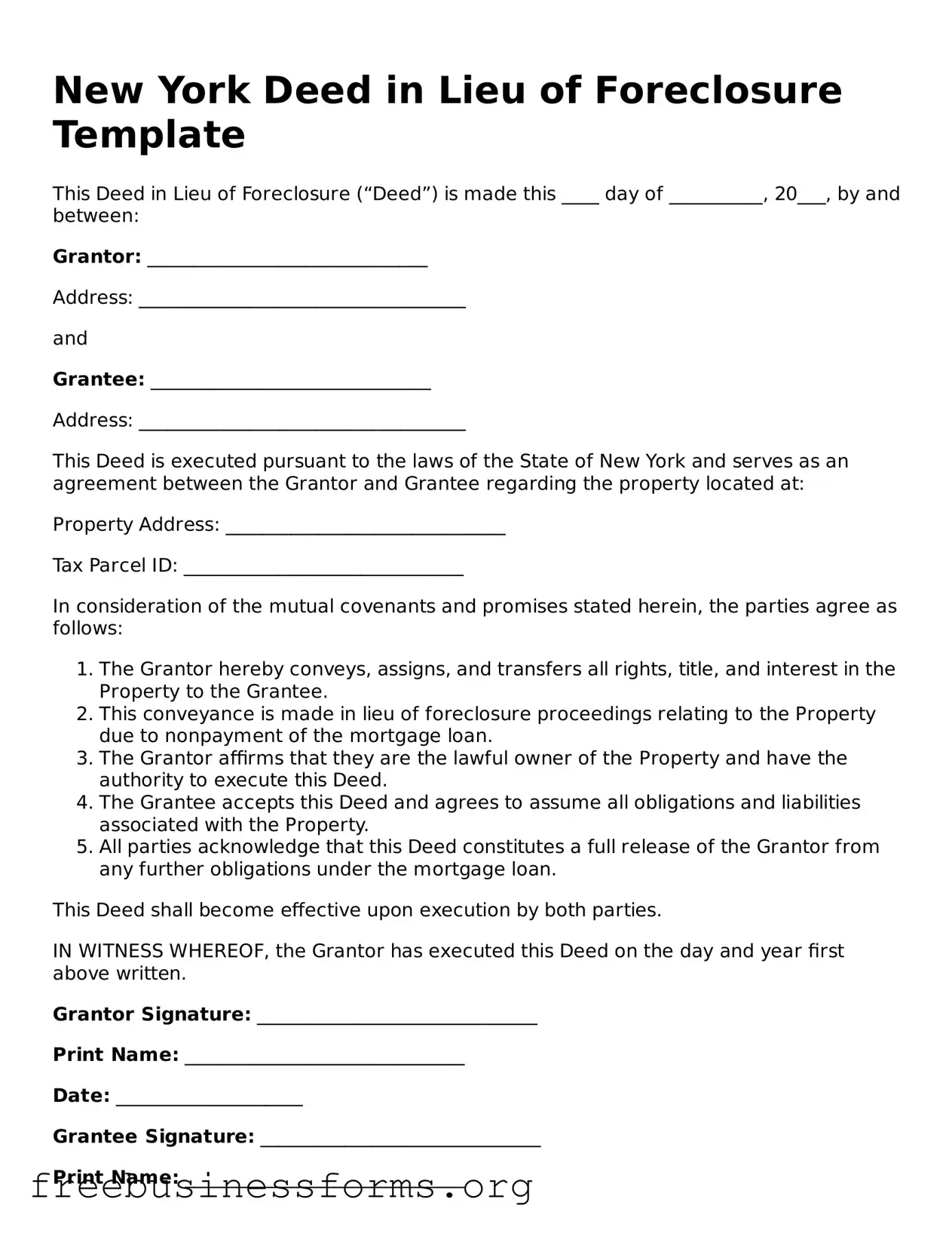

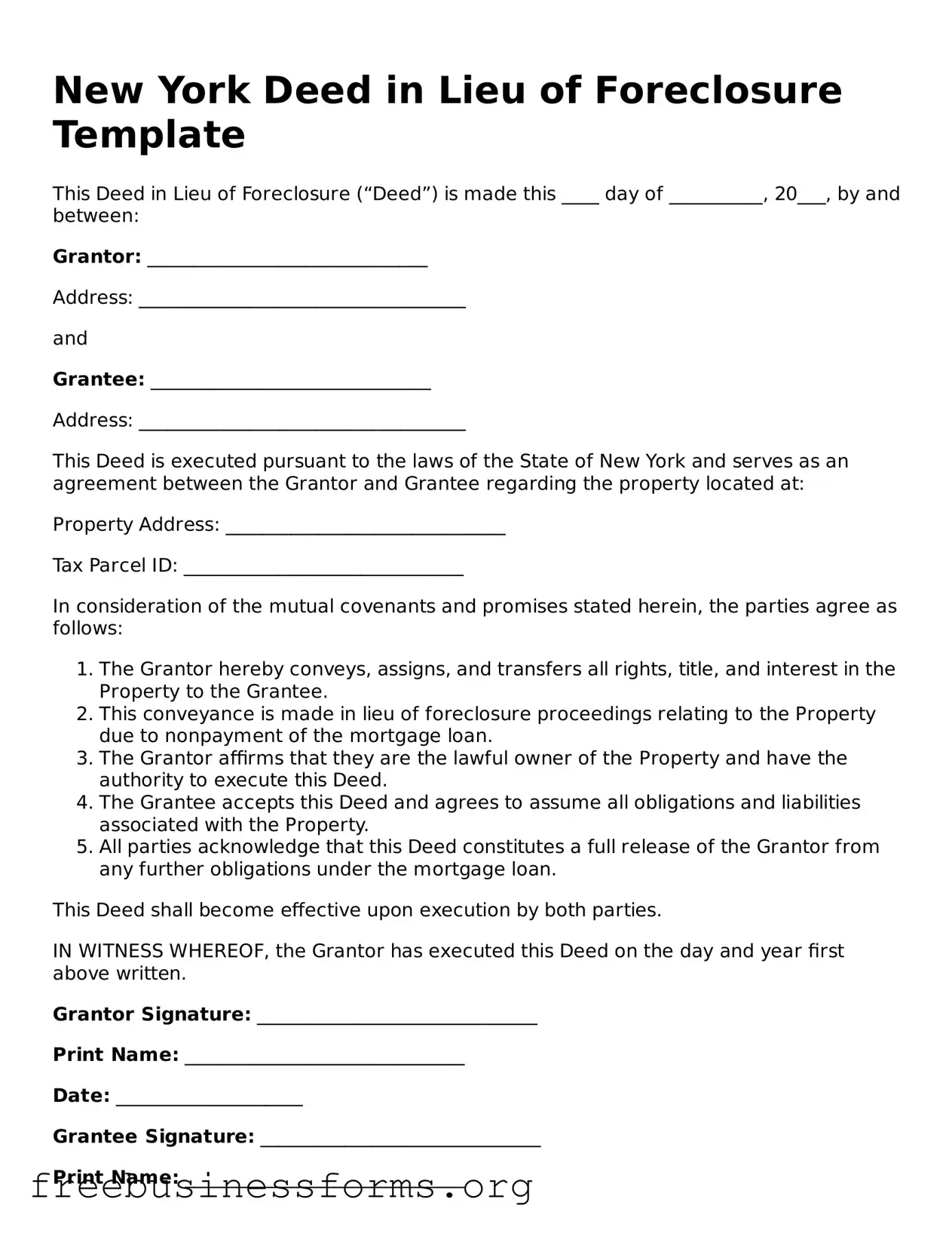

Blank Deed in Lieu of Foreclosure Template for New York

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer the title of their property to the lender in exchange for the cancellation of their mortgage debt. This process can provide a more efficient and less stressful alternative to foreclosure proceedings. Understanding the implications and procedures associated with this form is essential for homeowners facing financial difficulties.

Open Form Here

Blank Deed in Lieu of Foreclosure Template for New York

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Deed in Lieu of Foreclosure online quickly — edit, save, download.