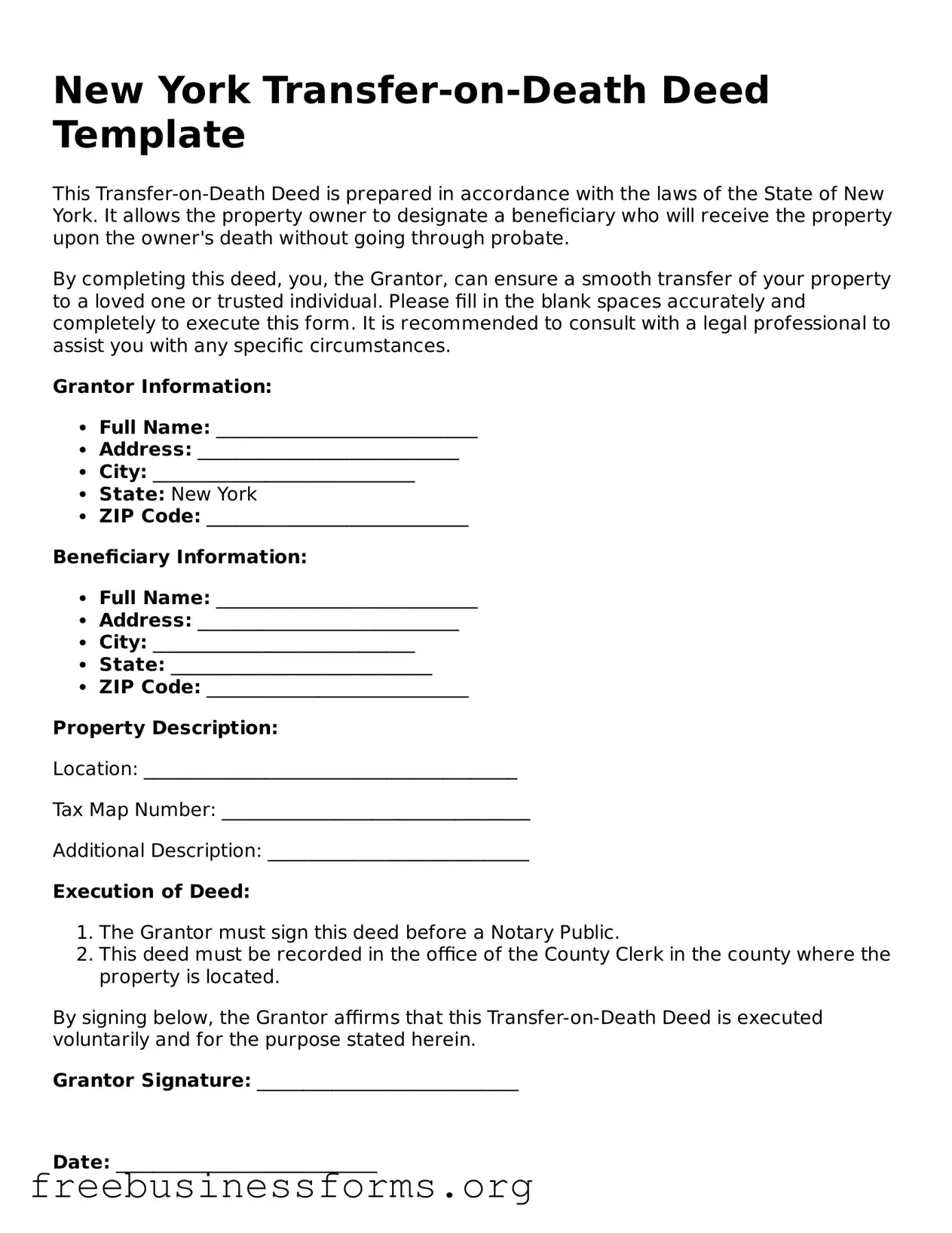

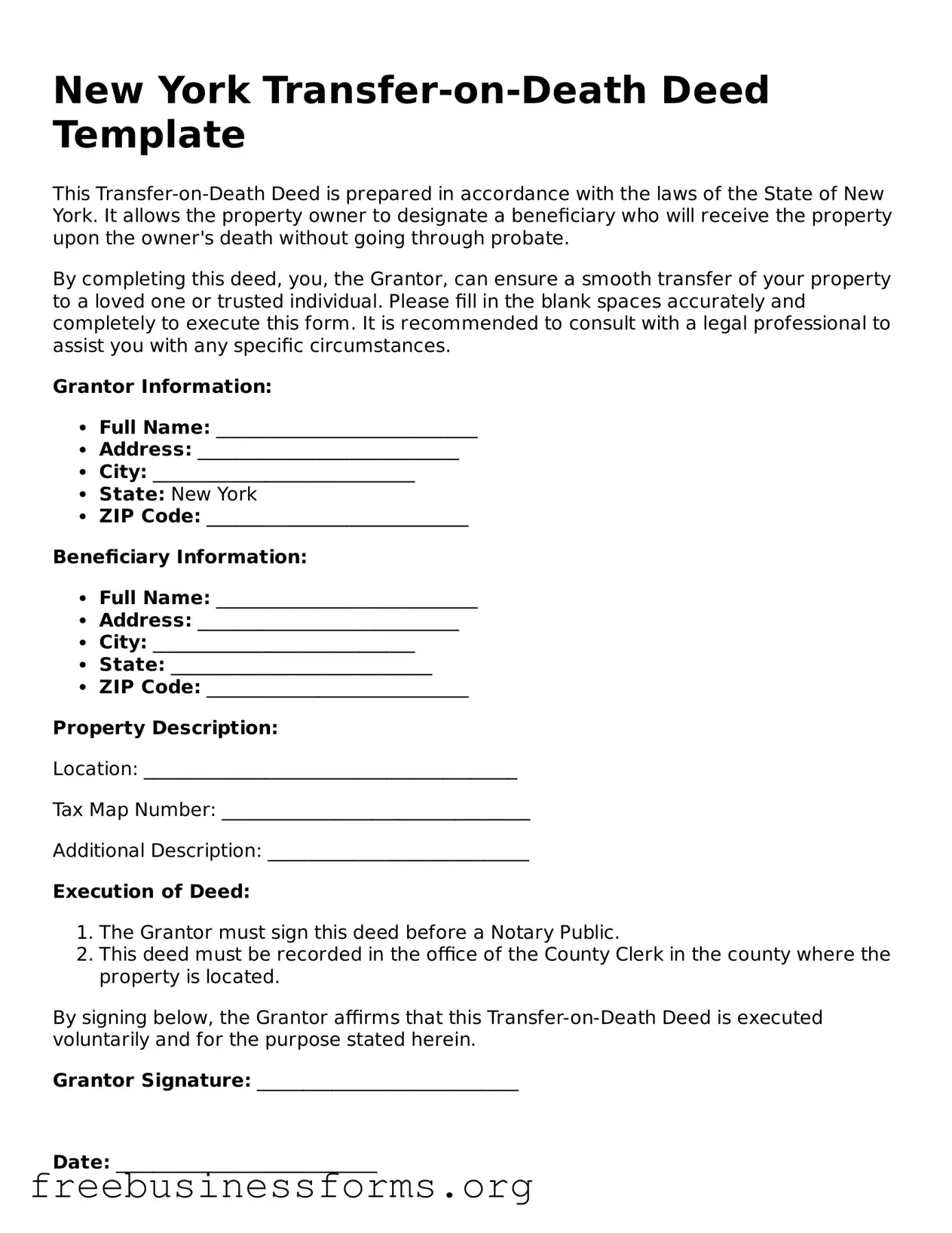

Blank Transfer-on-Death Deed Template for New York

The Transfer-on-Death Deed form is a legal document that allows individuals to transfer real estate to a beneficiary upon their death, without the need for probate. This form provides a straightforward way to ensure that property passes directly to loved ones, simplifying the estate planning process. Understanding how to properly use this deed can help individuals make informed decisions about their property and beneficiaries.

Open Form Here

Blank Transfer-on-Death Deed Template for New York

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Transfer-on-Death Deed online quickly — edit, save, download.