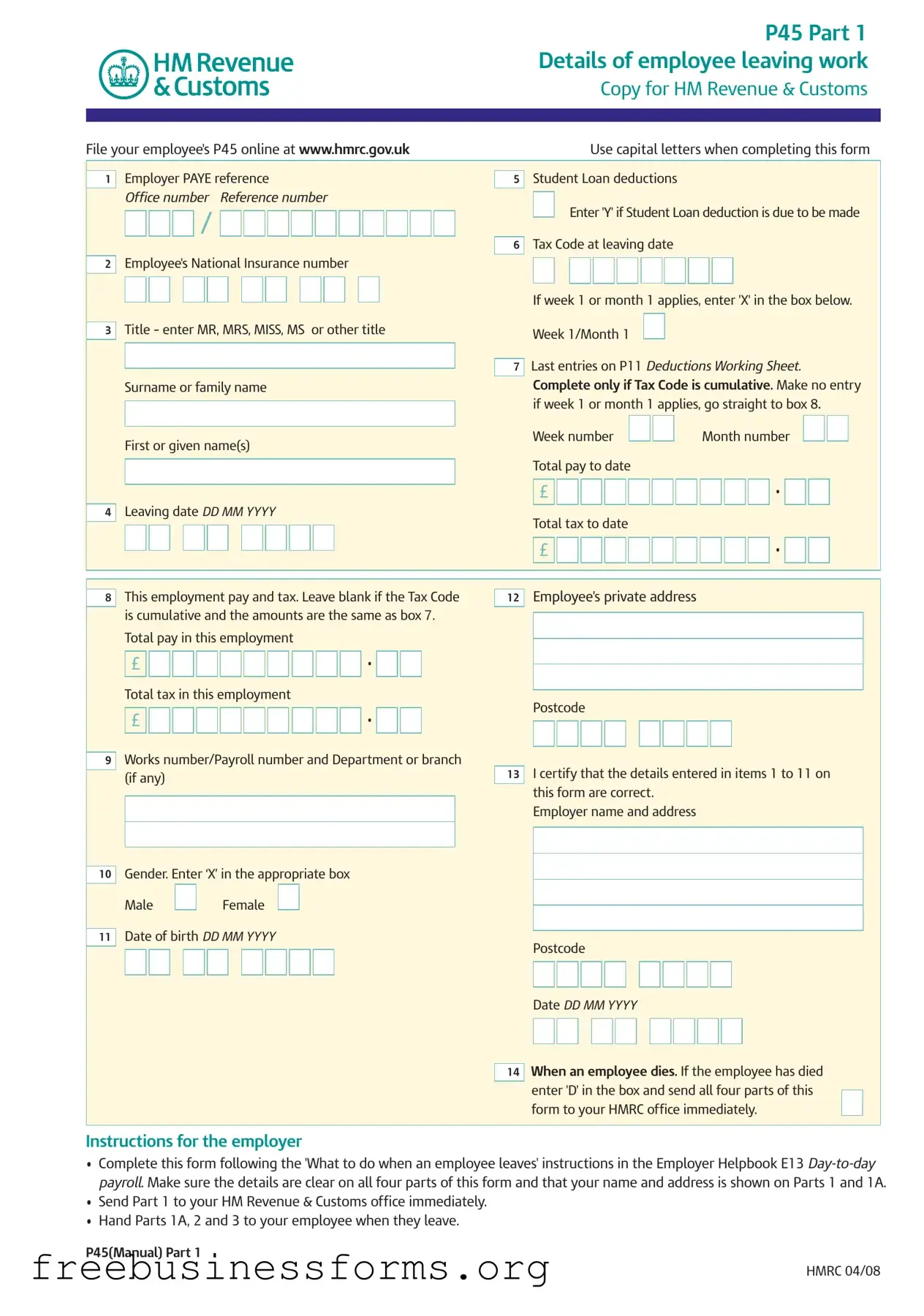

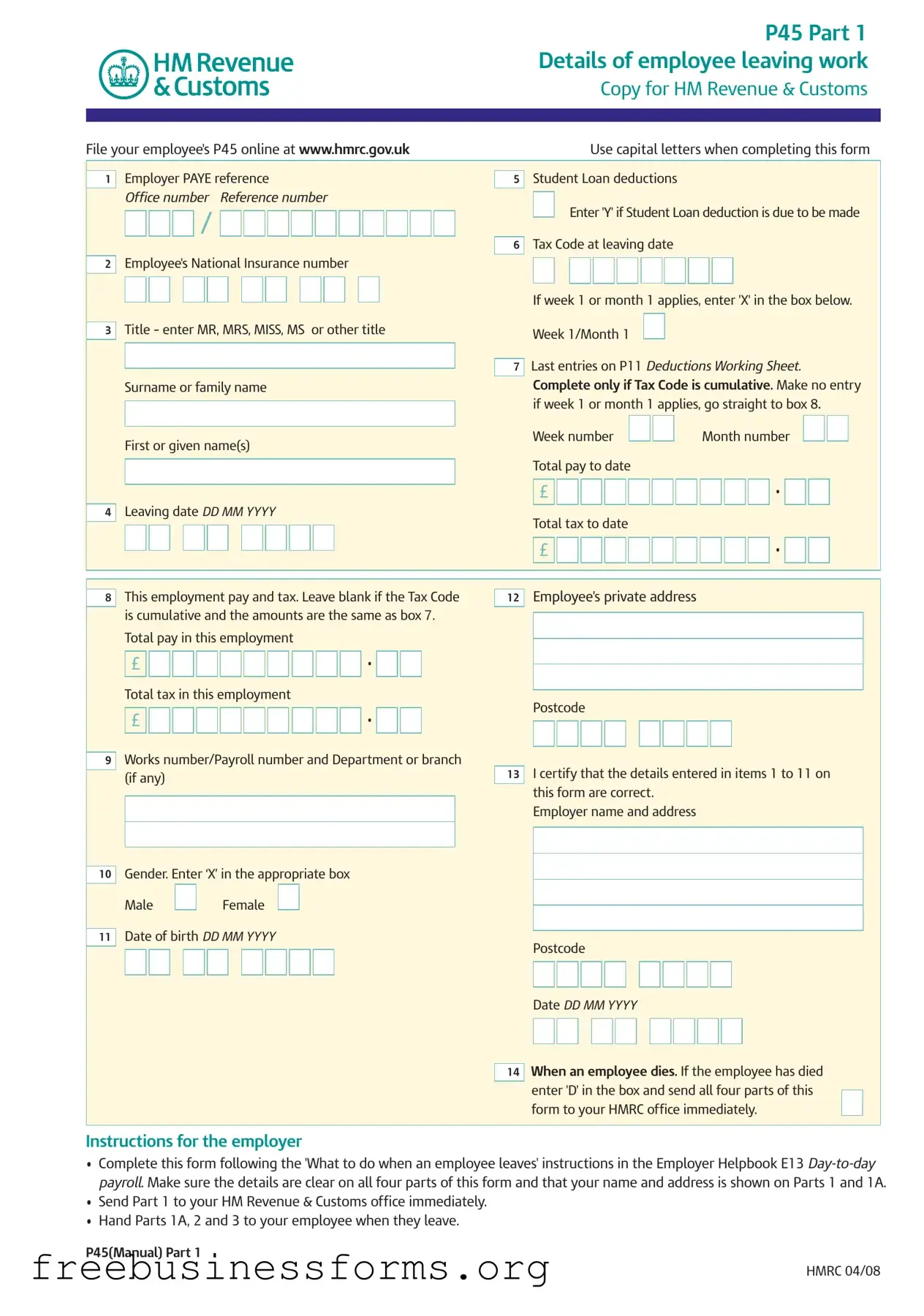

Official P 45 It Form in PDF

The P45 It form is an important document used in the UK to record the details of an employee who is leaving a job. It helps both the employer and the employee manage tax and pay records effectively. Understanding how to fill out and use this form can make the transition to new employment smoother.

Open Form Here

Official P 45 It Form in PDF

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your P 45 It online quickly — edit, save, download.

/

/

•

•

•

•

/

/

•

•