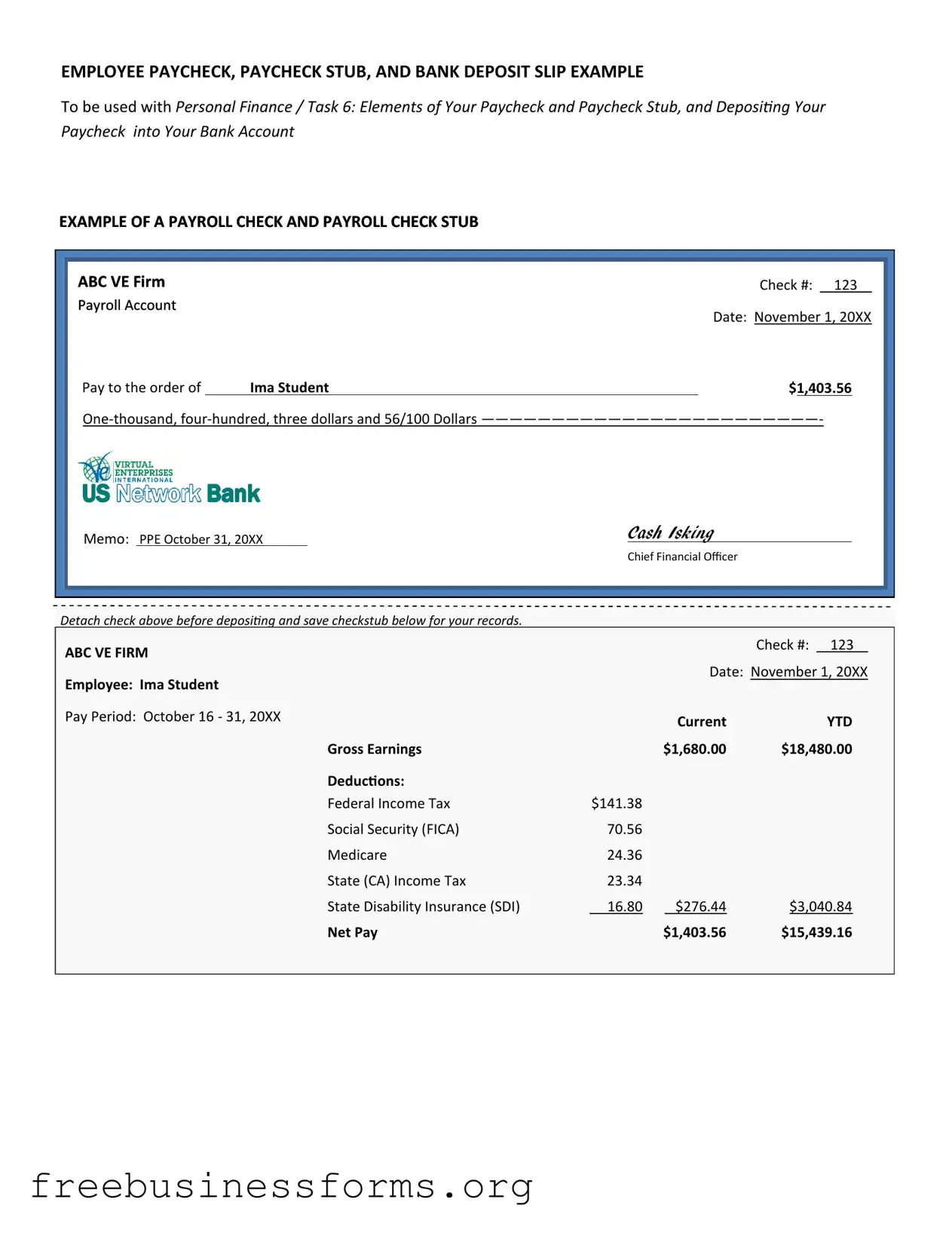

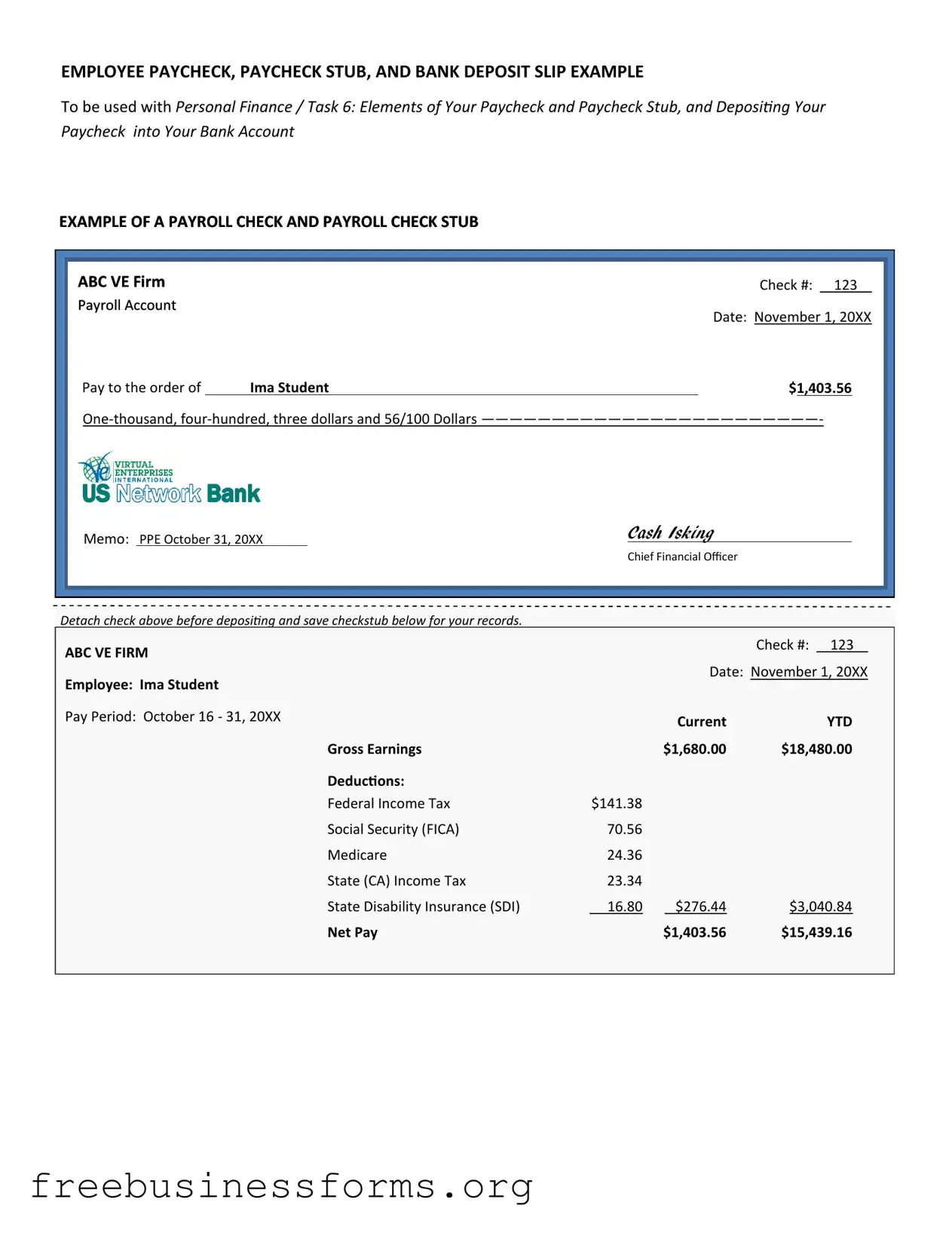

Official Payroll Check Form in PDF

The Payroll Check form is a document used by employers to pay their employees for work performed during a specific pay period. This form typically includes essential details such as the employee's name, the amount being paid, and deductions for taxes or benefits. Understanding how to properly fill out and manage this form is crucial for both employers and employees to ensure accurate and timely compensation.

Open Form Here

Official Payroll Check Form in PDF

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Payroll Check online quickly — edit, save, download.