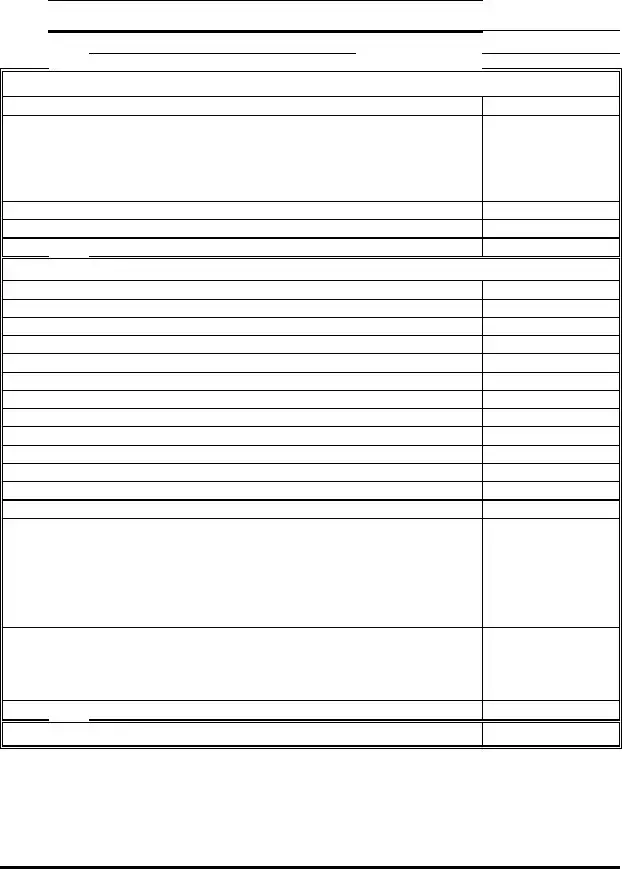

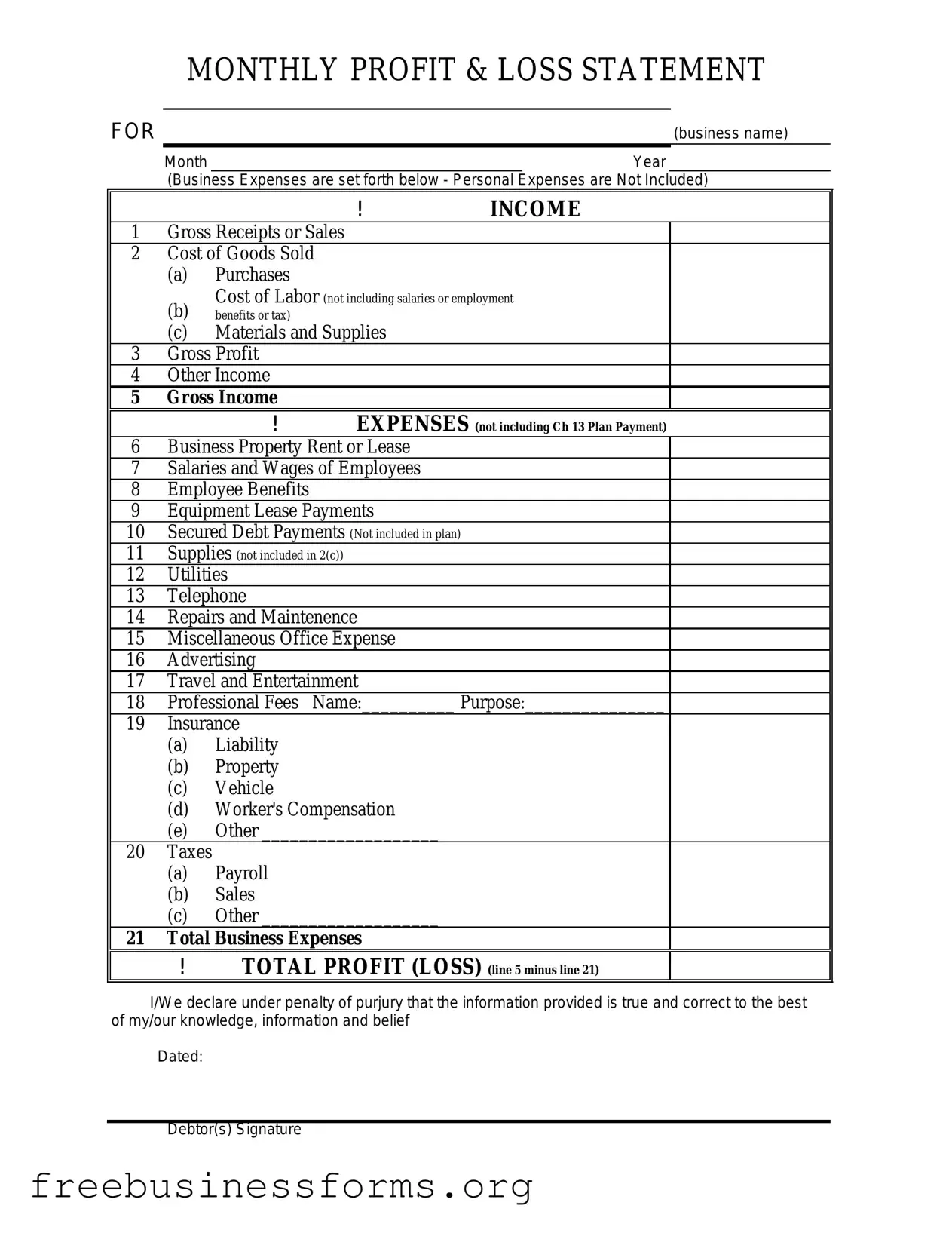

Official Profit And Loss Form in PDF

The Profit and Loss form, often referred to as an income statement, is a financial document that summarizes a company's revenues and expenses over a specific period. This essential tool provides insight into the profitability of a business, allowing stakeholders to assess financial performance and make informed decisions. Understanding the components of this form is crucial for anyone involved in financial management or analysis.

Open Form Here

Official Profit And Loss Form in PDF

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Profit And Loss online quickly — edit, save, download.