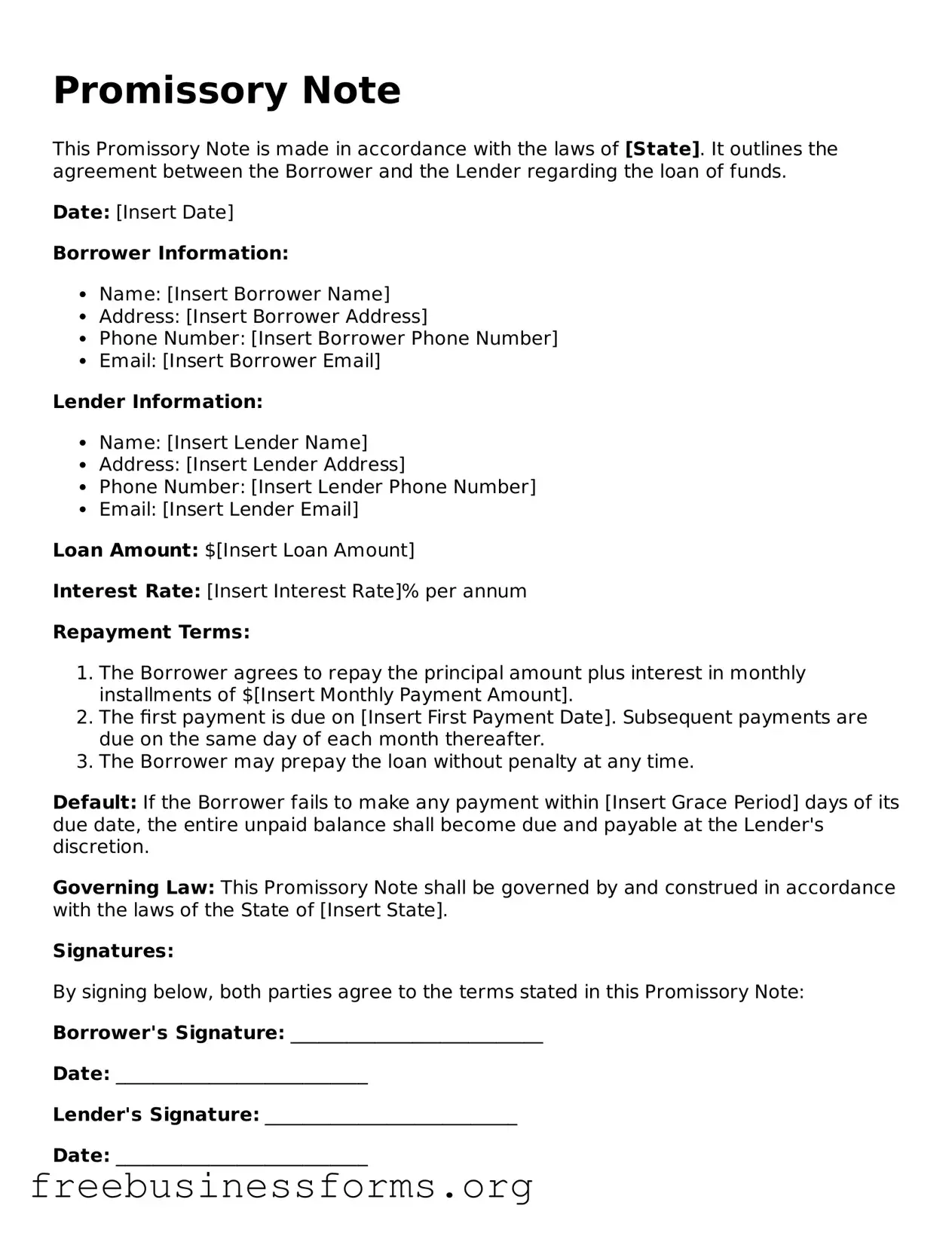

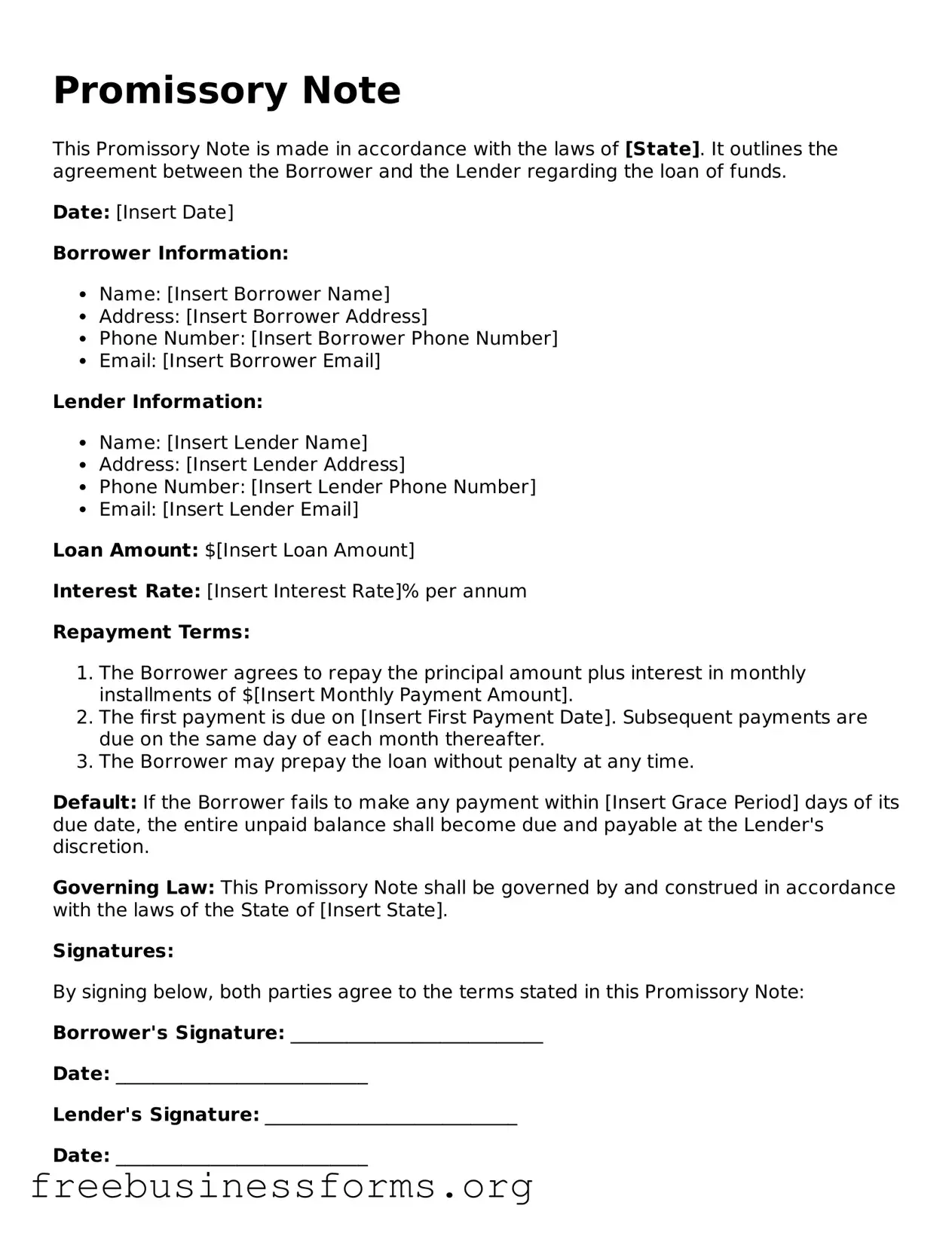

Official Promissory Note Form

A Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a future date or on demand. This financial instrument outlines the terms of the loan, including interest rates and repayment schedules. Understanding the components of a Promissory Note is essential for both lenders and borrowers to ensure clear expectations and legal protection.

Open Form Here

Official Promissory Note Form

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Promissory Note online quickly — edit, save, download.