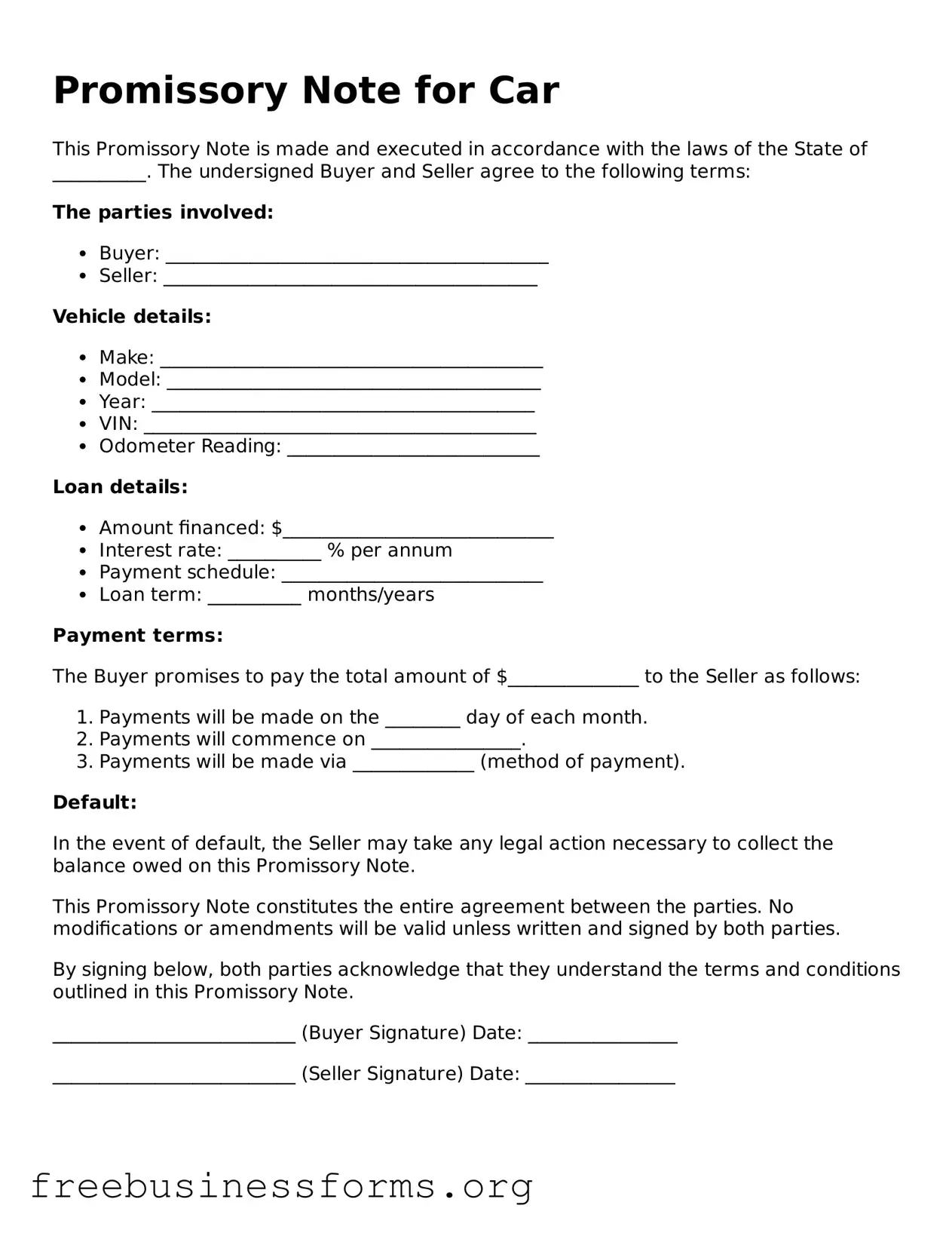

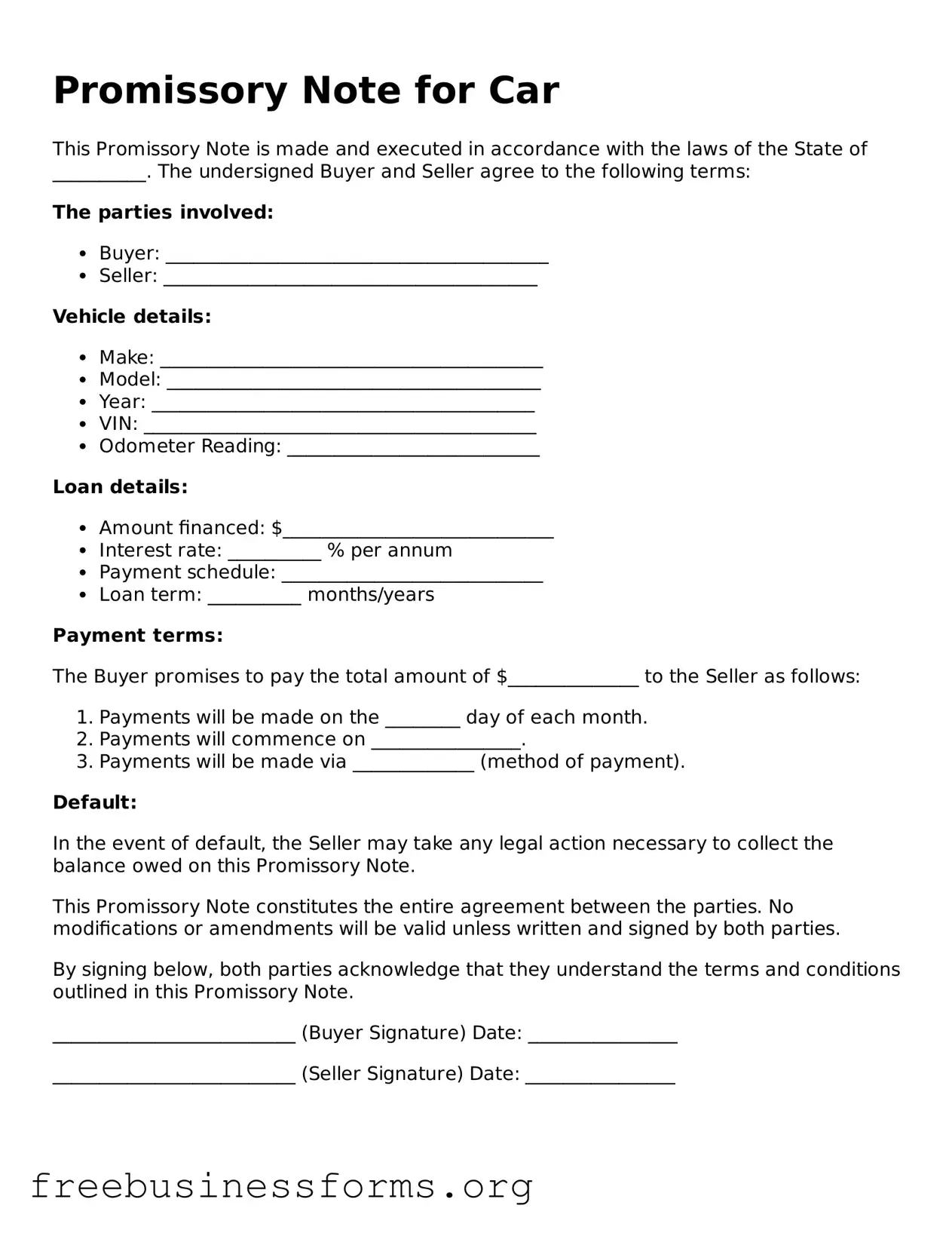

Official Promissory Note for a Car Form

A Promissory Note for a Car is a legal document that outlines a borrower's promise to repay a loan used to purchase a vehicle. This form includes essential details such as the loan amount, interest rate, repayment schedule, and consequences of default. Understanding this document is crucial for both buyers and sellers to ensure a smooth transaction.

Open Form Here

Official Promissory Note for a Car Form

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Promissory Note for a Car online quickly — edit, save, download.