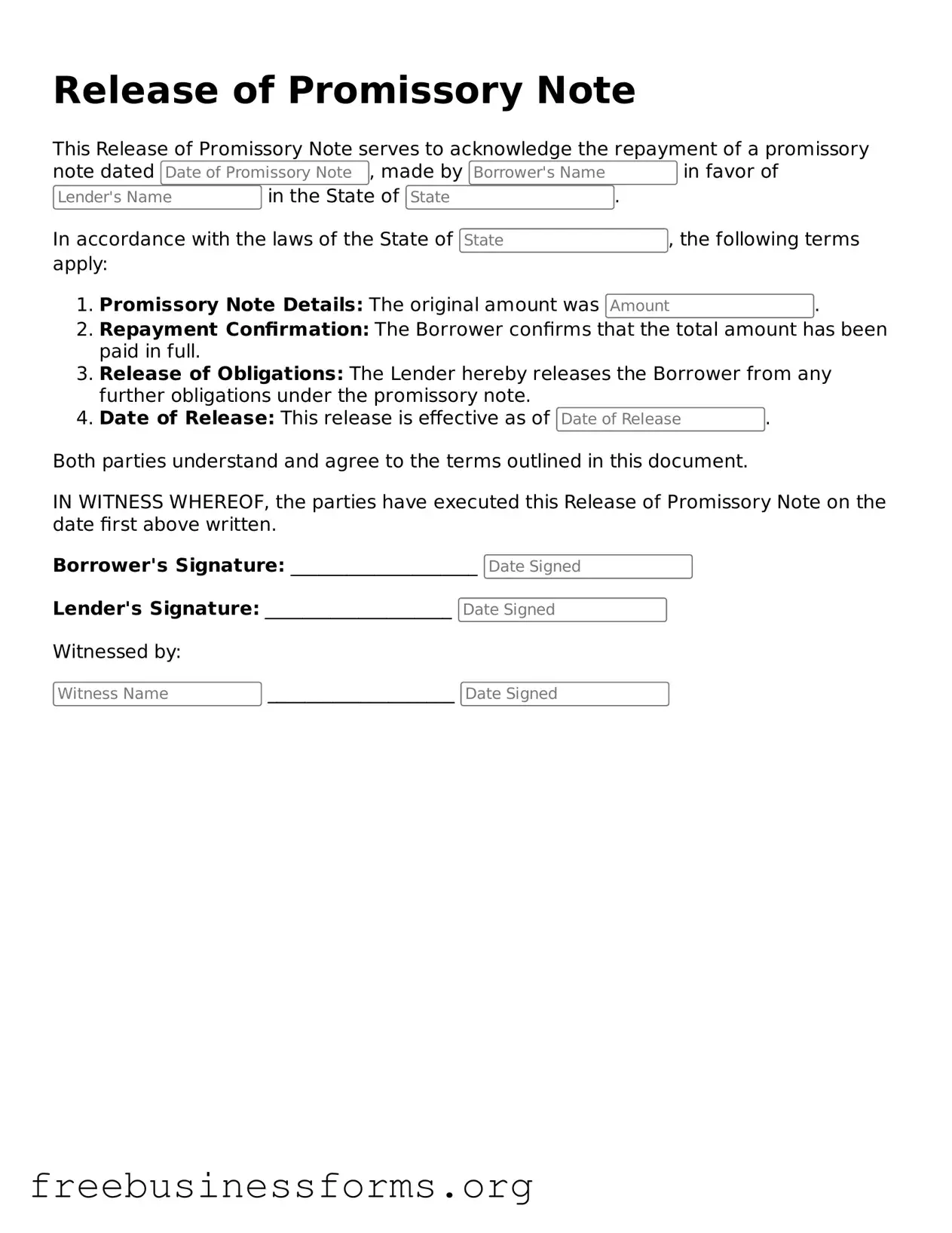

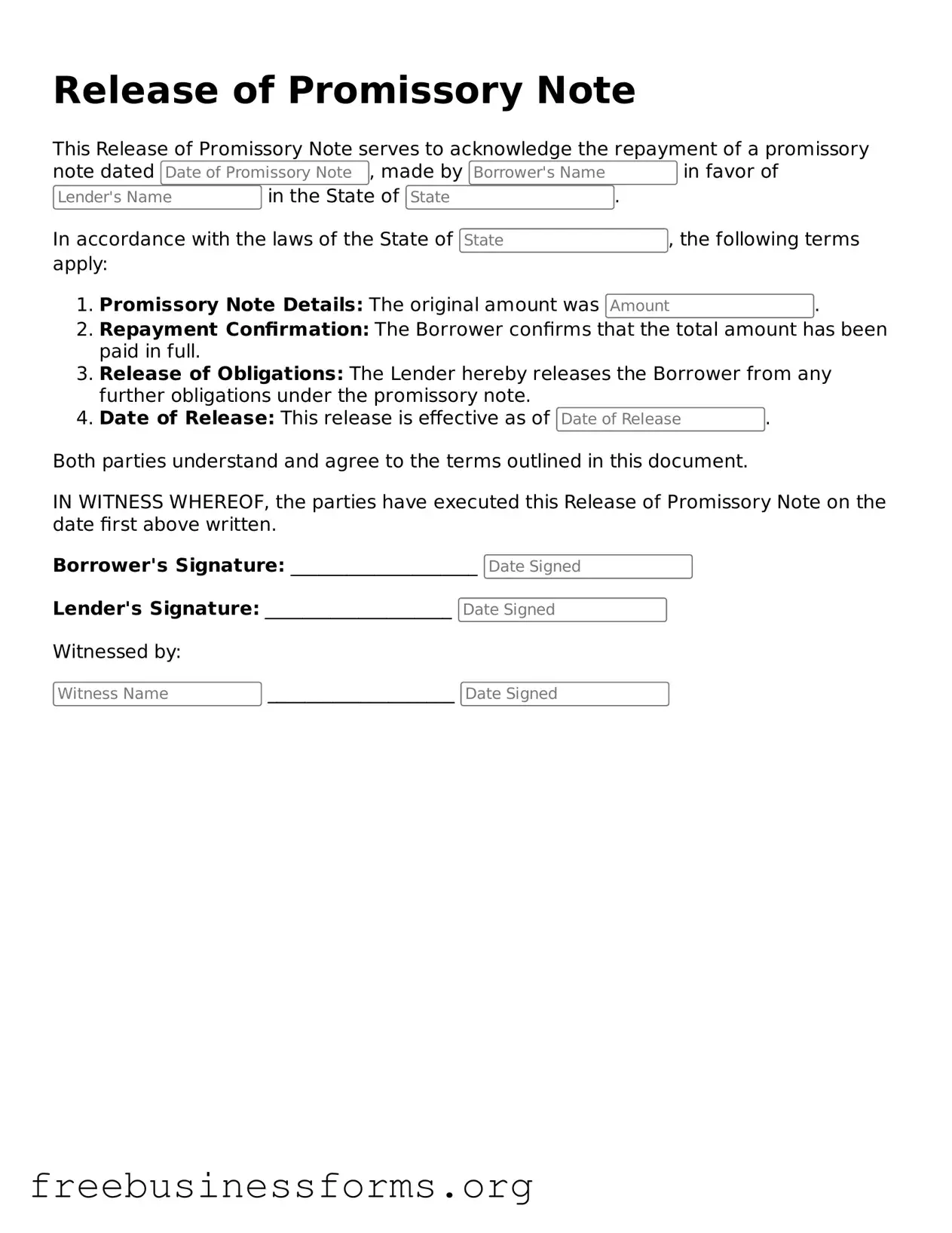

Official Release of Promissory Note Form

A Release of Promissory Note form is a crucial document that signifies the cancellation of a promissory note, indicating that the borrower has fulfilled their repayment obligations. This form not only protects the interests of both parties but also serves as a formal acknowledgment that the debt has been settled. Understanding its significance can help individuals navigate the complexities of financial agreements with confidence.

Open Form Here

Official Release of Promissory Note Form

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Release of Promissory Note online quickly — edit, save, download.