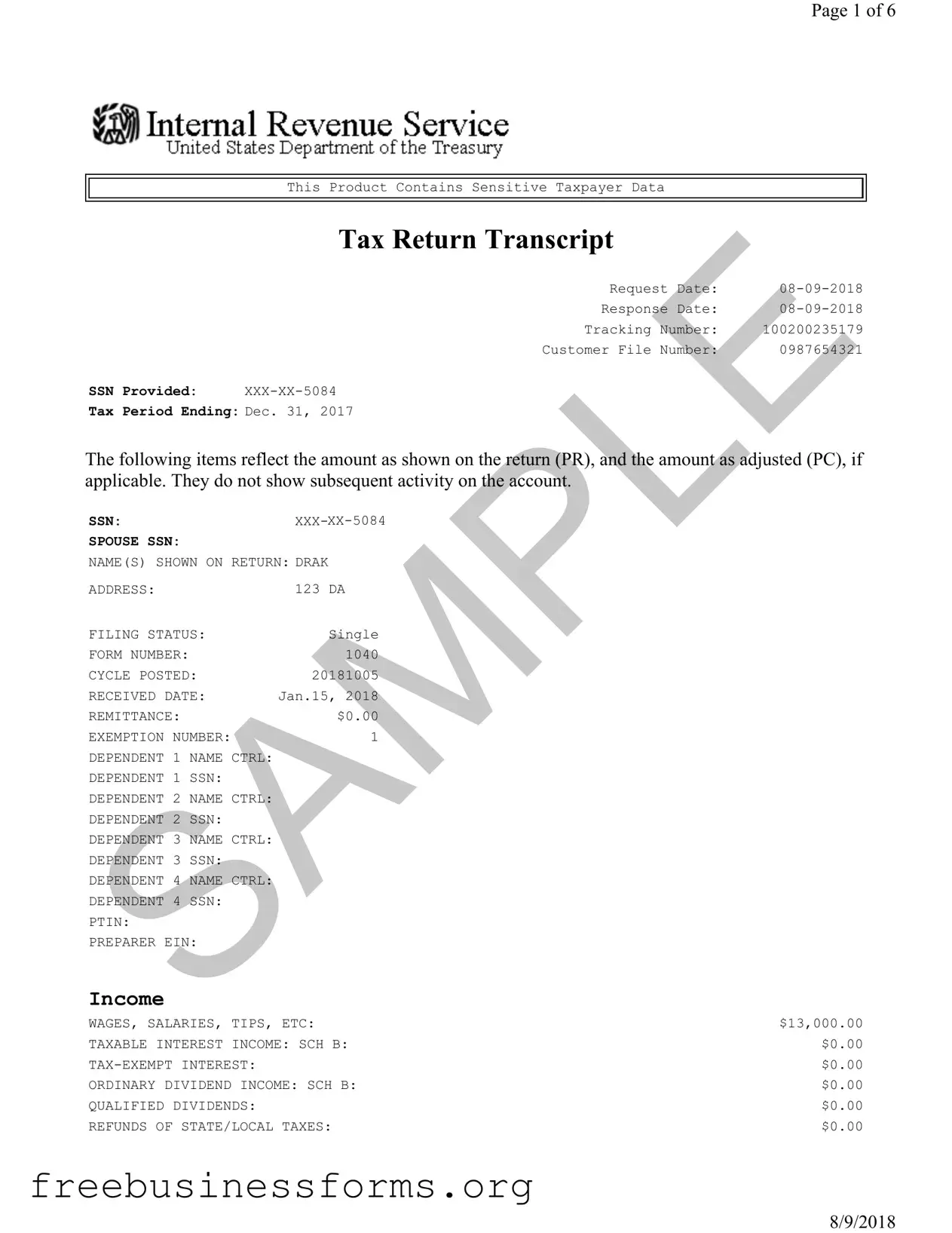

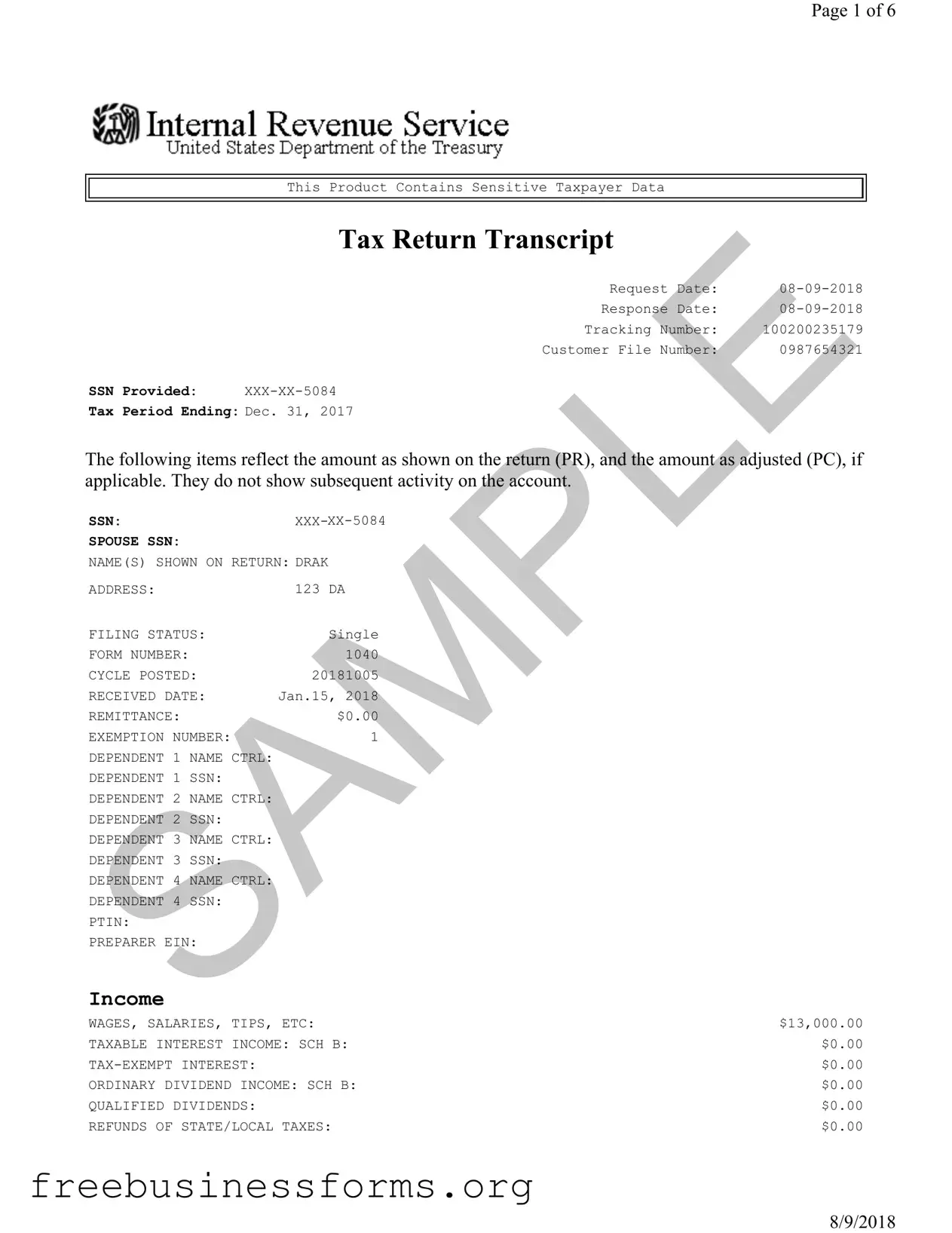

Official Sample Tax Return Transcript Form in PDF

The Sample Tax Return Transcript is a document that provides a summary of your tax return information as reported to the IRS. It includes key details such as income, adjustments, and tax liabilities, allowing individuals to verify their tax history. Understanding this form can help you navigate your tax obligations and ensure accuracy in your financial records.

Open Form Here

Official Sample Tax Return Transcript Form in PDF

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Sample Tax Return Transcript online quickly — edit, save, download.