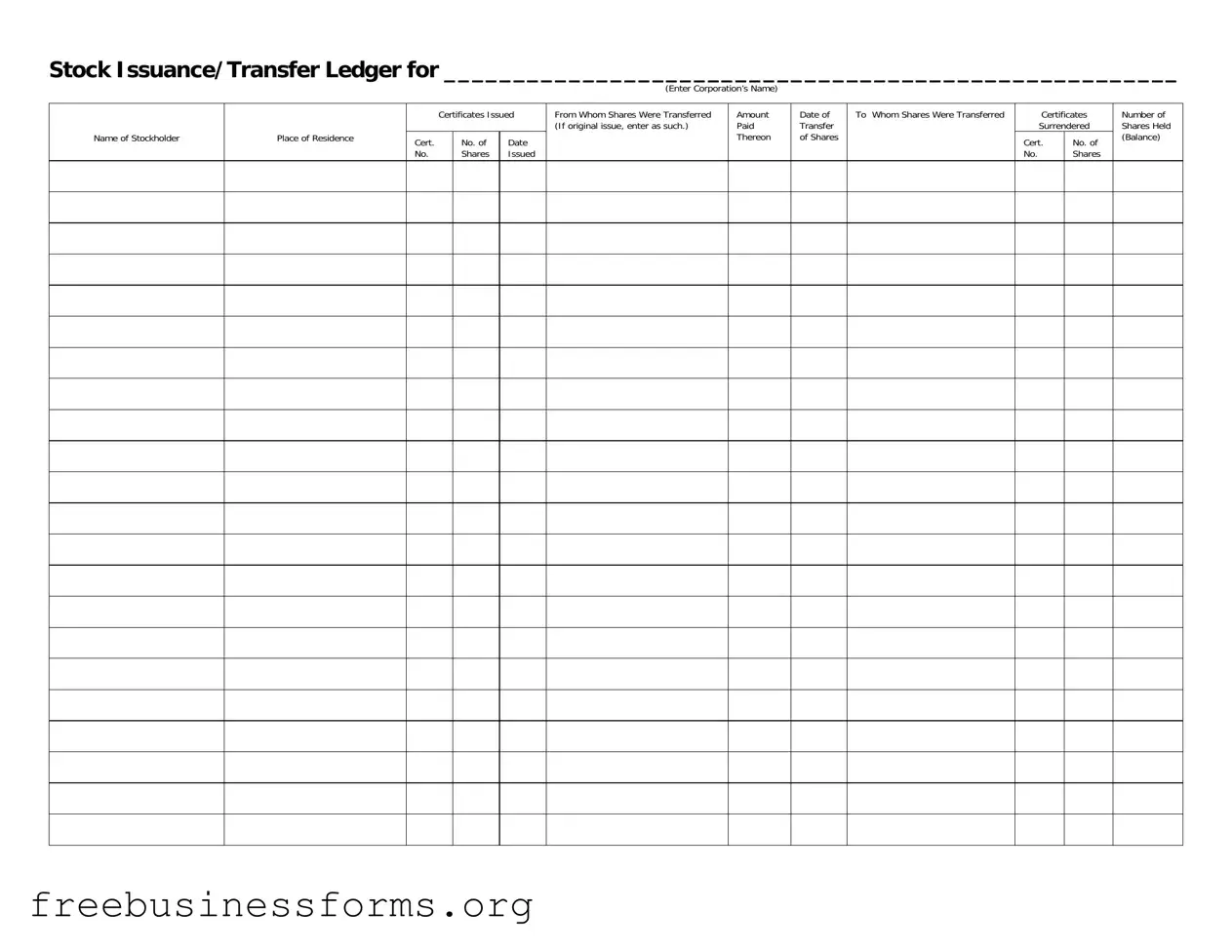

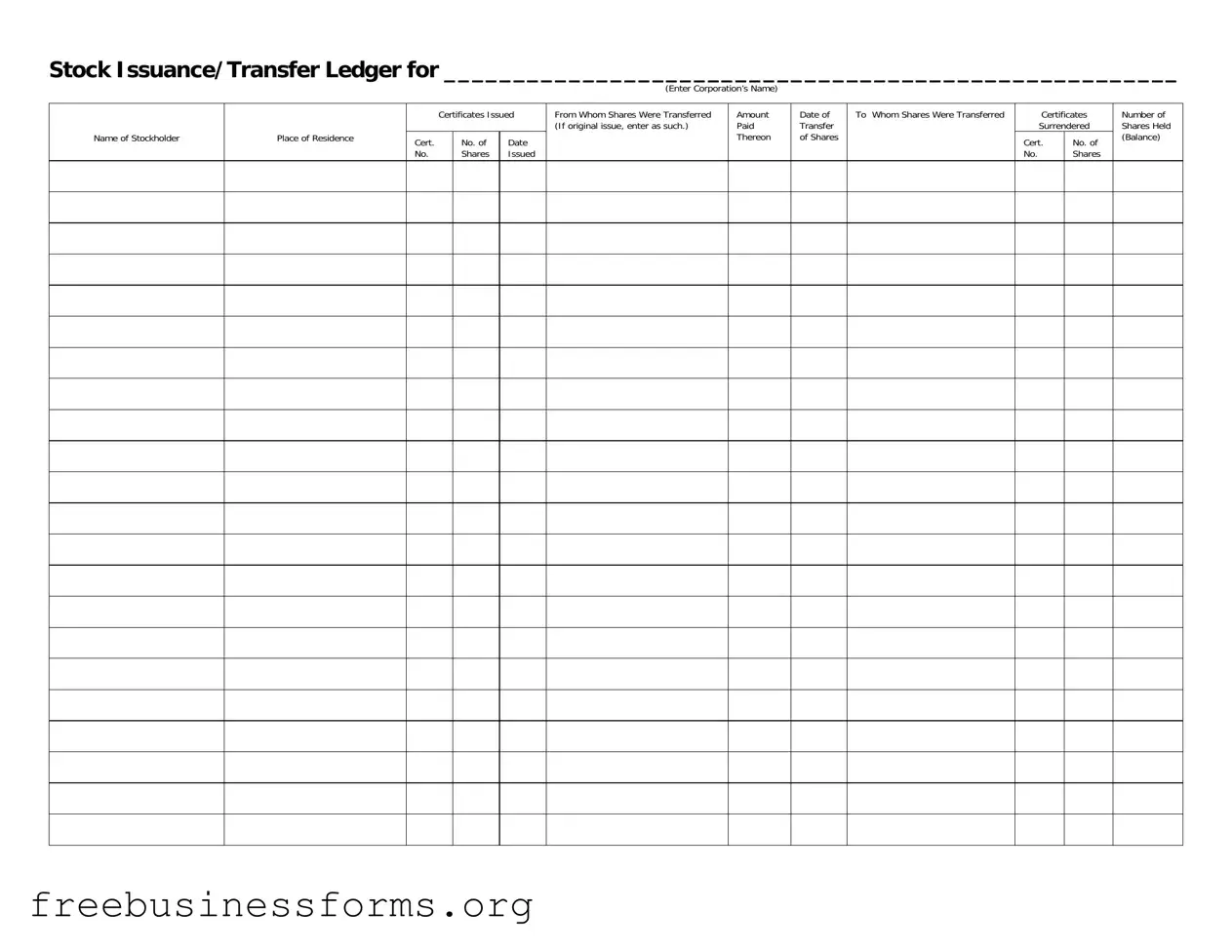

Official Stock Transfer Ledger Form in PDF

The Stock Transfer Ledger form is a crucial document used to record the issuance and transfer of stock within a corporation. This form captures essential details such as the stockholder's name, the number of shares issued, and the dates of transfer. Properly maintaining this ledger helps ensure accurate tracking of ownership and compliance with legal requirements.

Open Form Here

Official Stock Transfer Ledger Form in PDF

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Stock Transfer Ledger online quickly — edit, save, download.