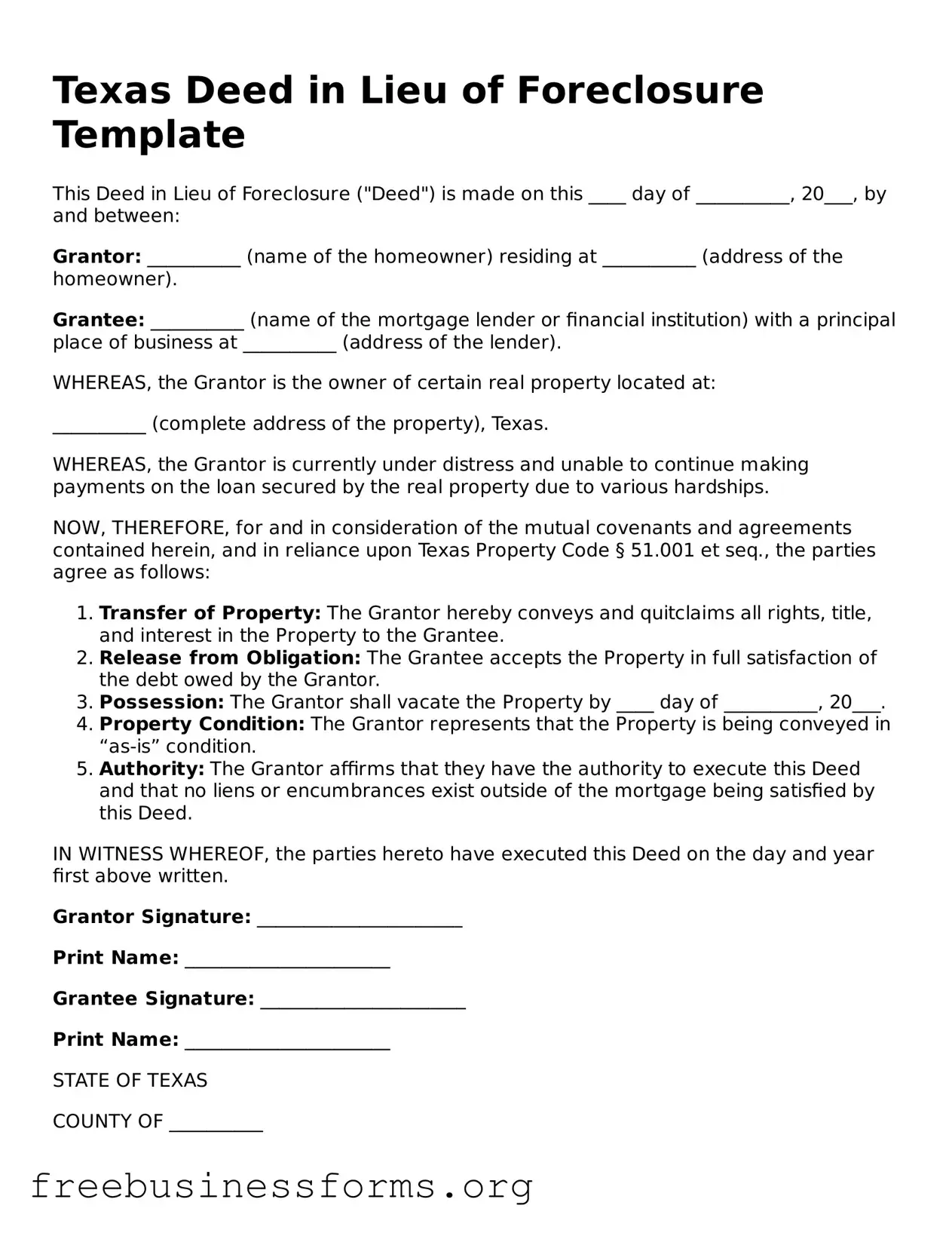

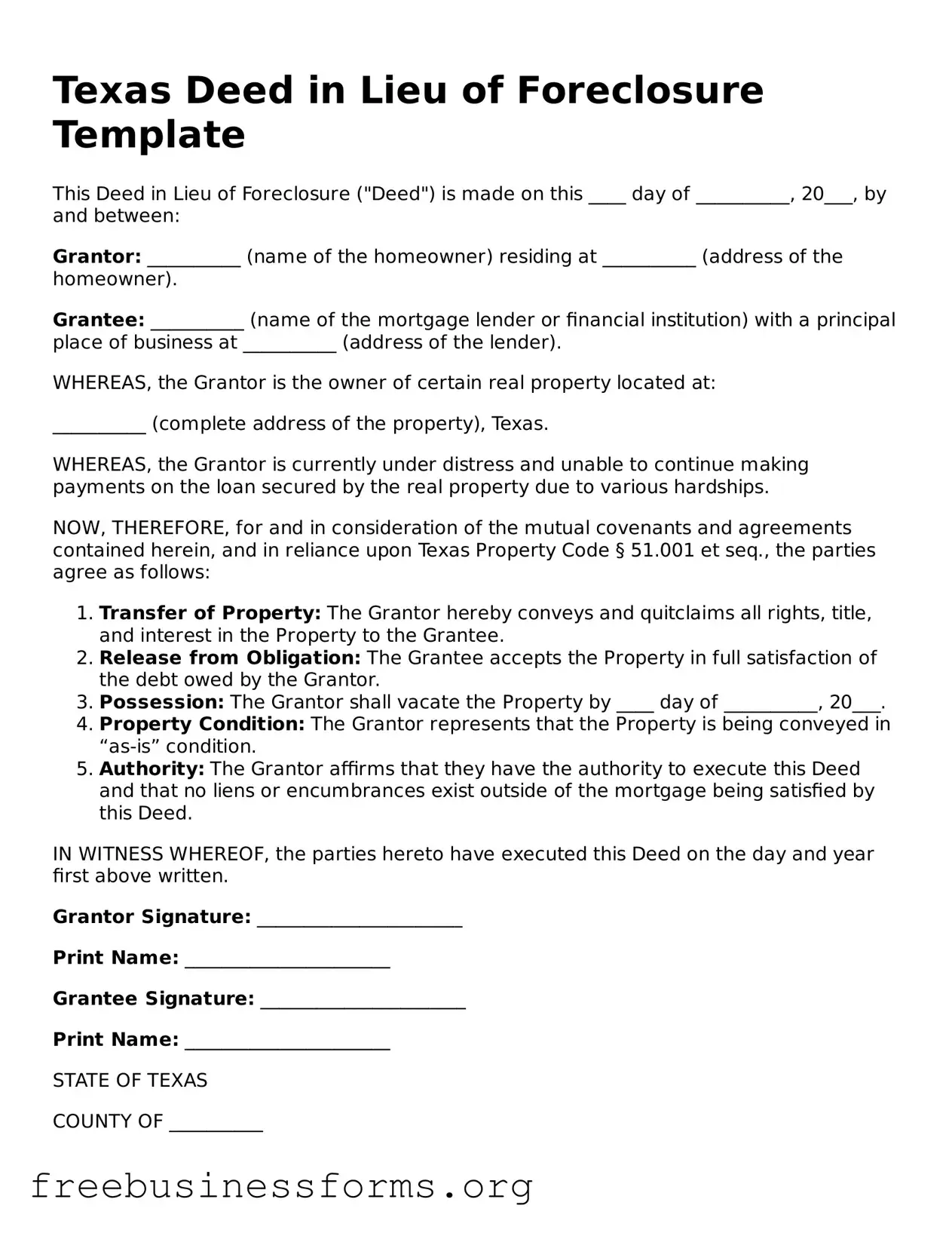

Blank Deed in Lieu of Foreclosure Template for Texas

A Texas Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer their property to the lender to avoid the foreclosure process. This option can provide a smoother exit for homeowners facing financial difficulties while helping lenders recover their investment more efficiently. Understanding the implications and requirements of this form is essential for anyone considering this route.

Open Form Here

Blank Deed in Lieu of Foreclosure Template for Texas

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Deed in Lieu of Foreclosure online quickly — edit, save, download.