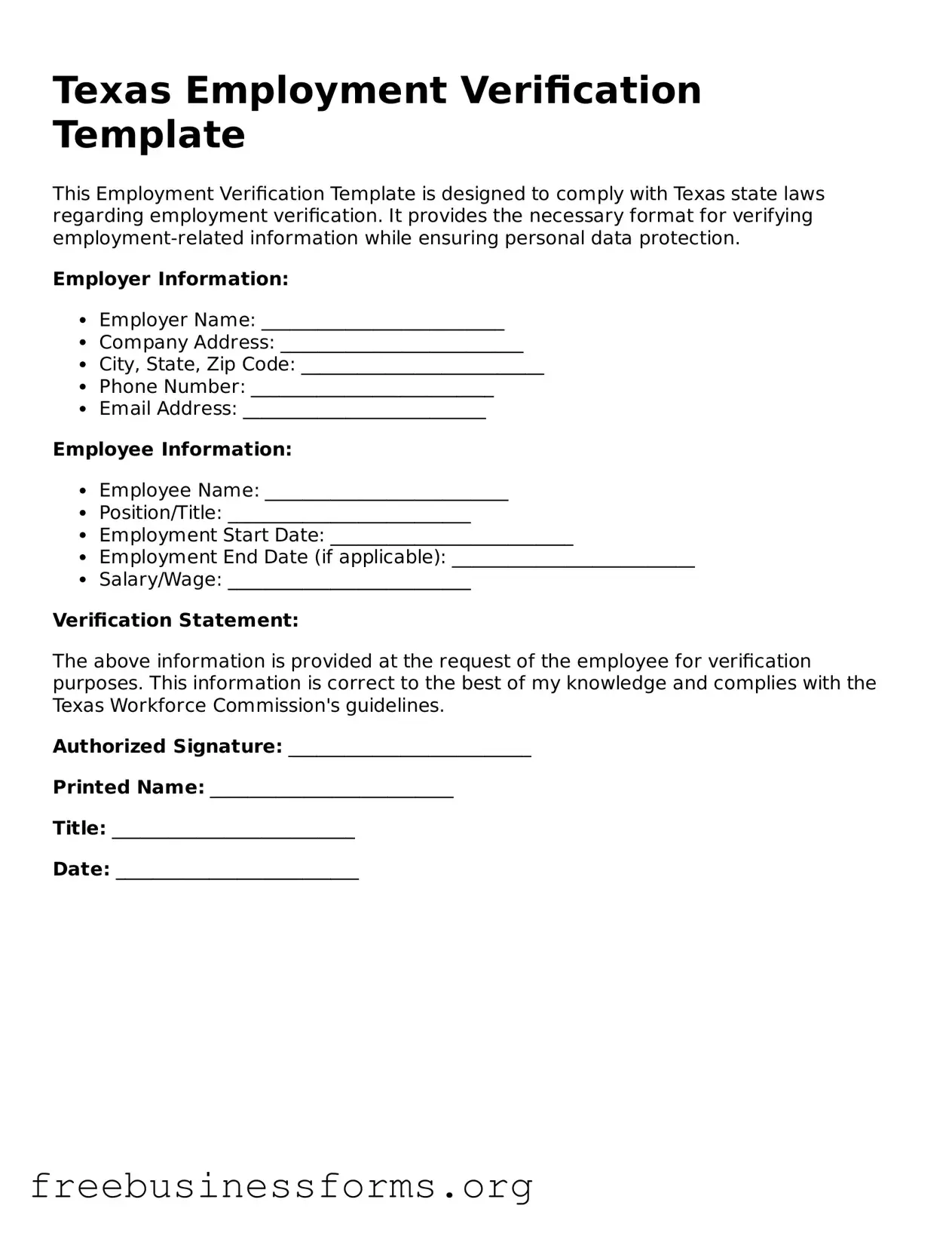

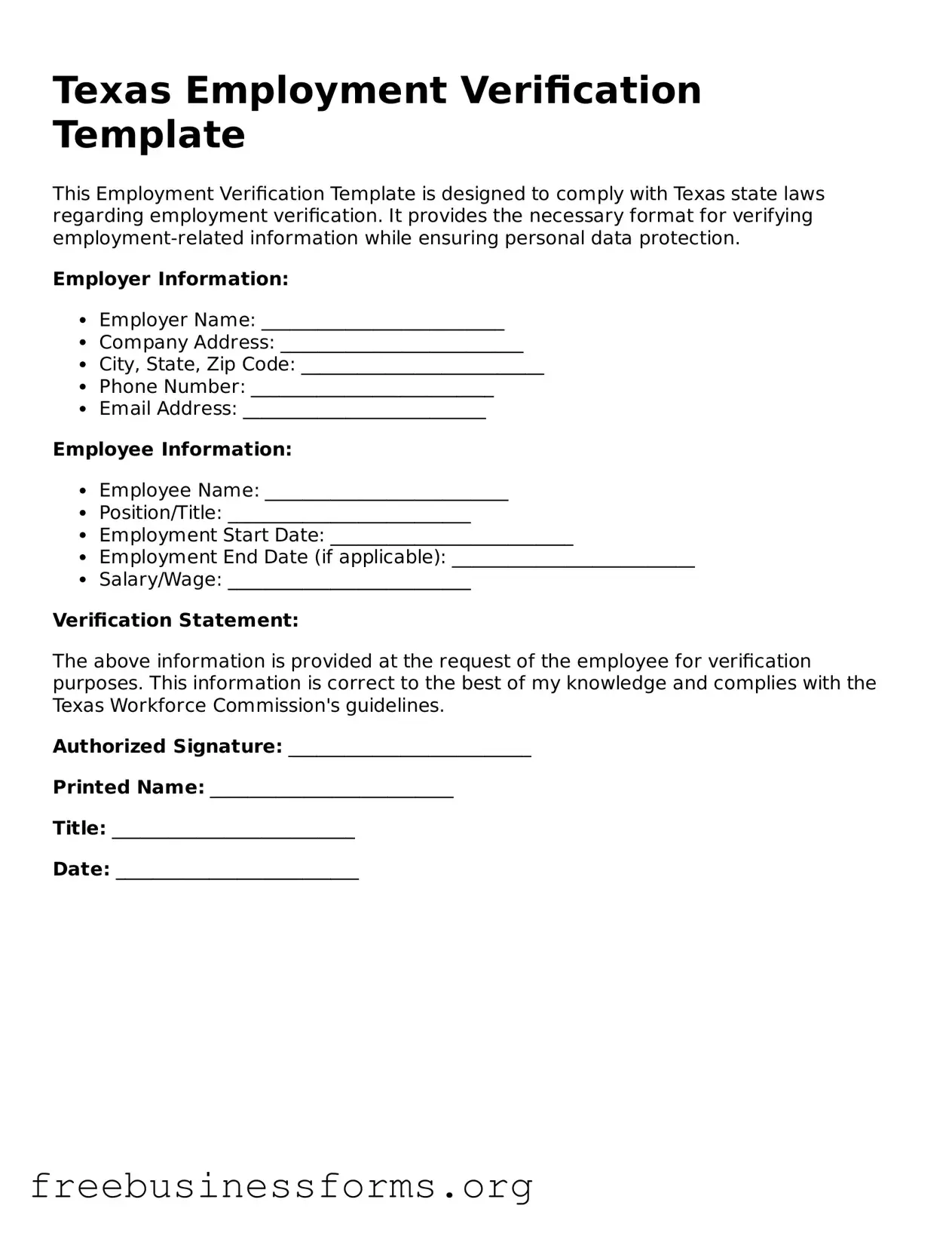

Blank Employment Verification Template for Texas

The Texas Employment Verification form is a document used by employers to confirm an employee's work history and employment status. This form plays a crucial role in various situations, such as loan applications or background checks. Understanding its purpose and proper usage can help both employers and employees navigate employment verification processes more effectively.

Open Form Here

Blank Employment Verification Template for Texas

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Employment Verification online quickly — edit, save, download.