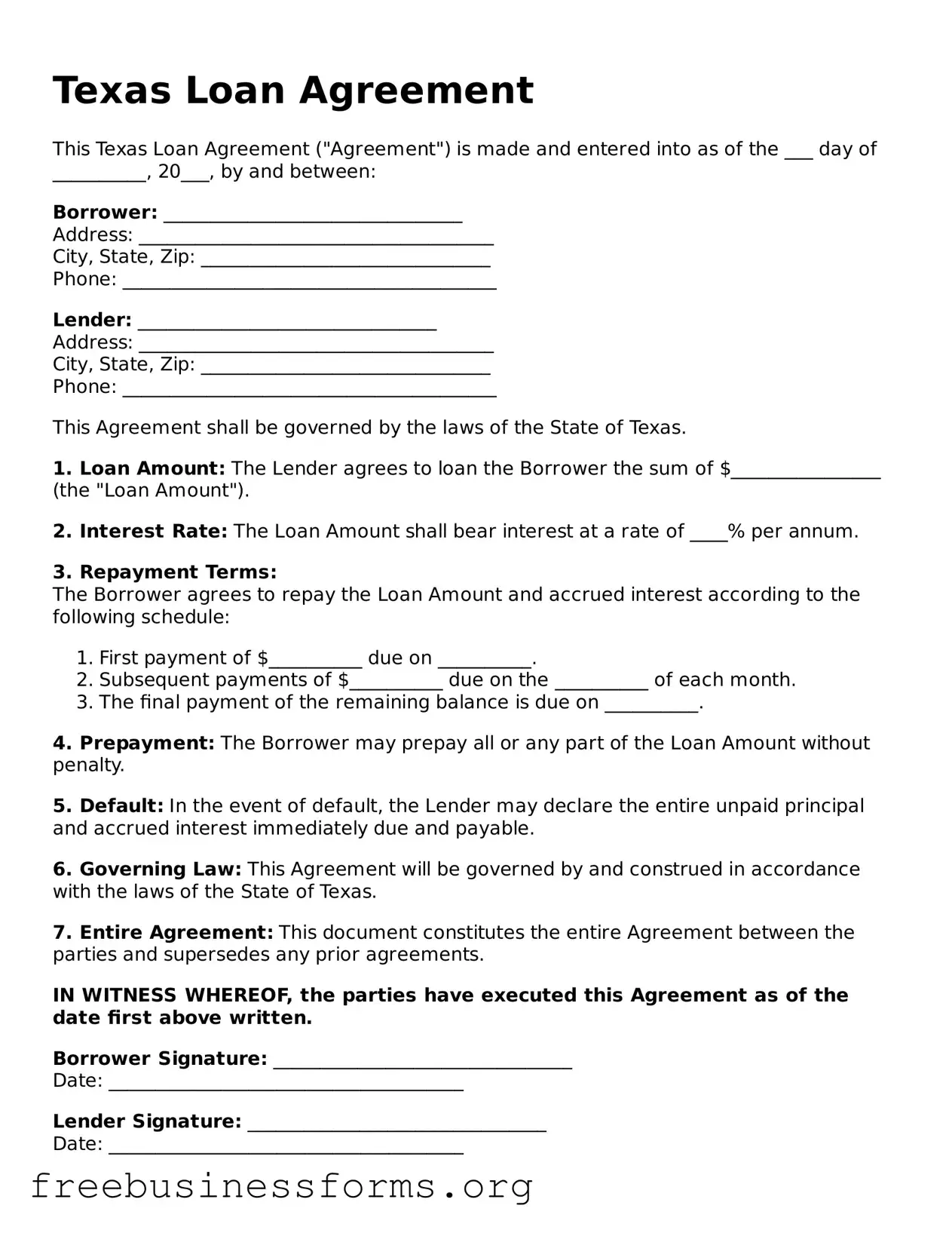

Blank Loan Agreement Template for Texas

A Texas Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a borrower and a lender. This form serves to protect both parties by clearly defining the repayment schedule, interest rates, and other key elements of the loan. Understanding this document is crucial for anyone looking to secure a loan in Texas.

Open Form Here

Blank Loan Agreement Template for Texas

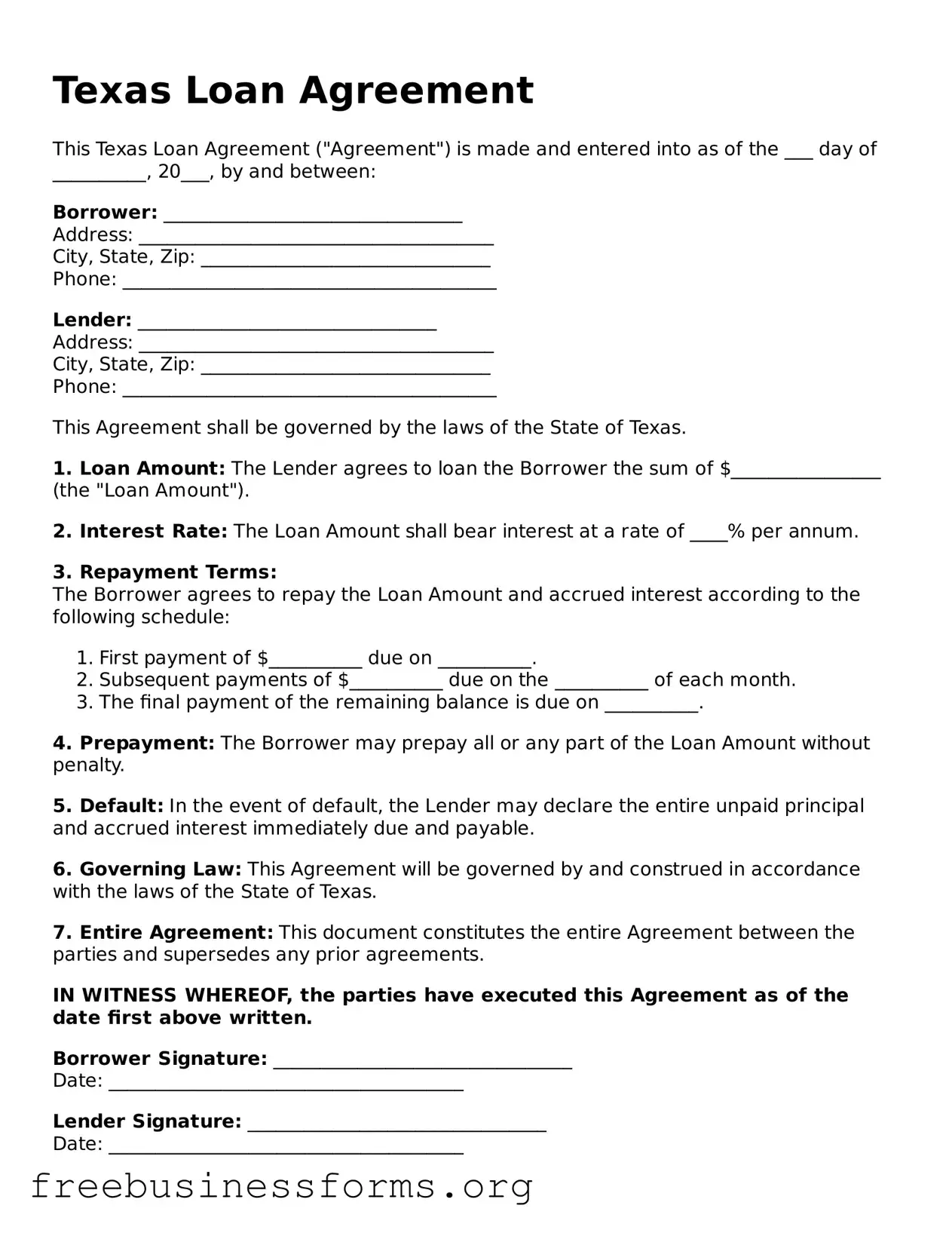

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Loan Agreement online quickly — edit, save, download.