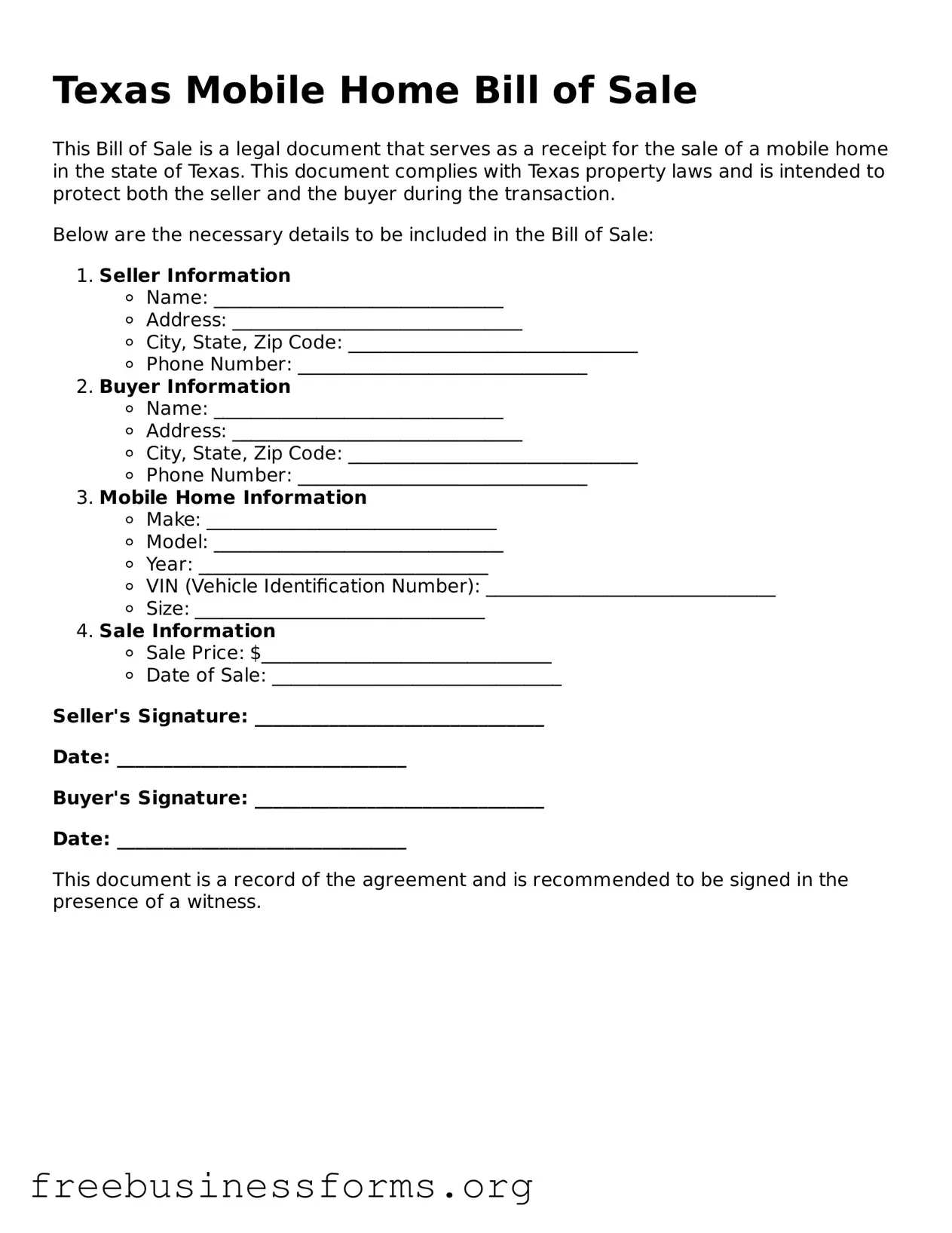

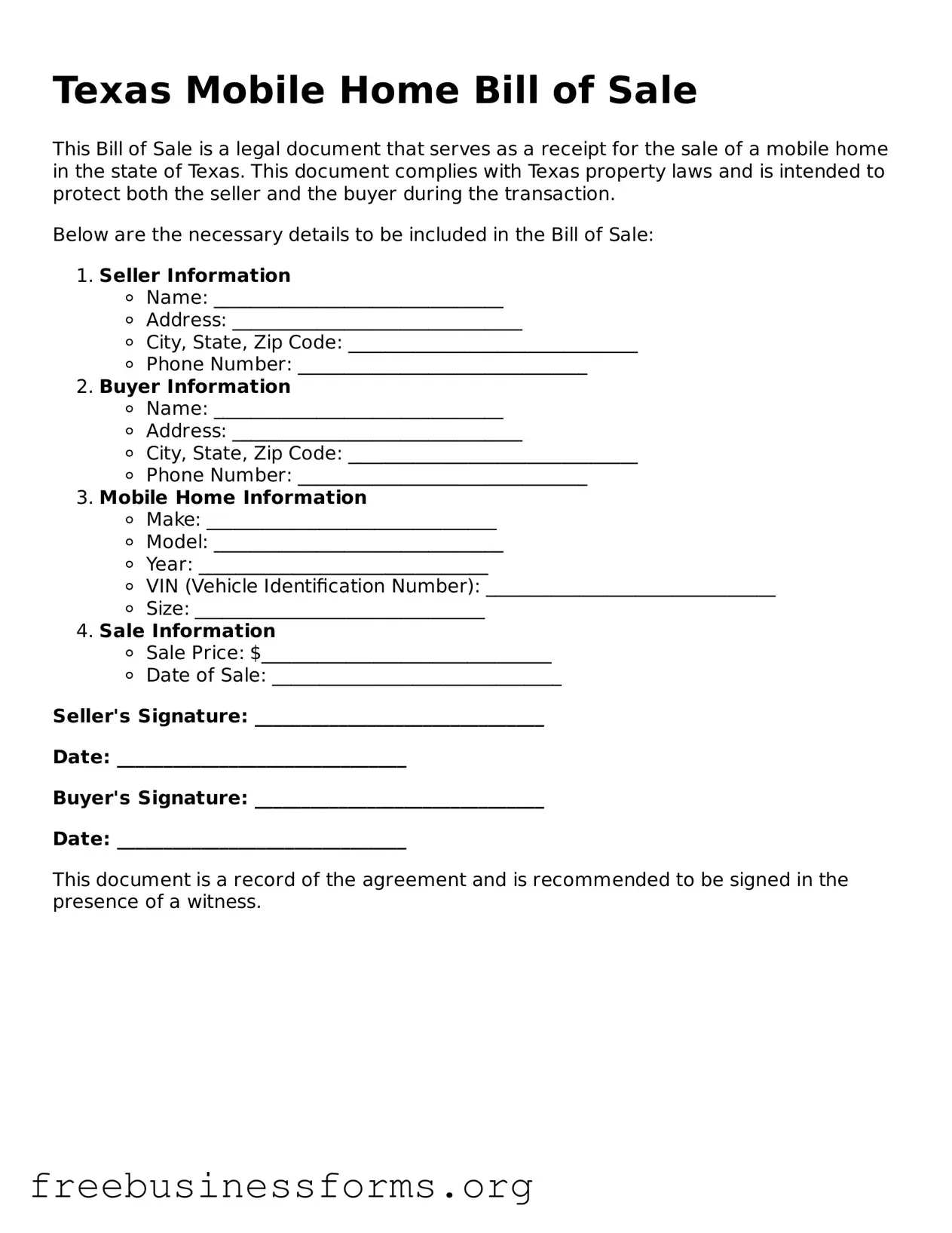

Blank Mobile Home Bill of Sale Template for Texas

The Texas Mobile Home Bill of Sale form is a legal document used to transfer ownership of a mobile home from one party to another. This form outlines essential details such as the buyer and seller's information, the mobile home's description, and the sale price. Proper completion of this form is crucial for ensuring a smooth transaction and for establishing legal ownership.

Open Form Here

Blank Mobile Home Bill of Sale Template for Texas

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Mobile Home Bill of Sale online quickly — edit, save, download.