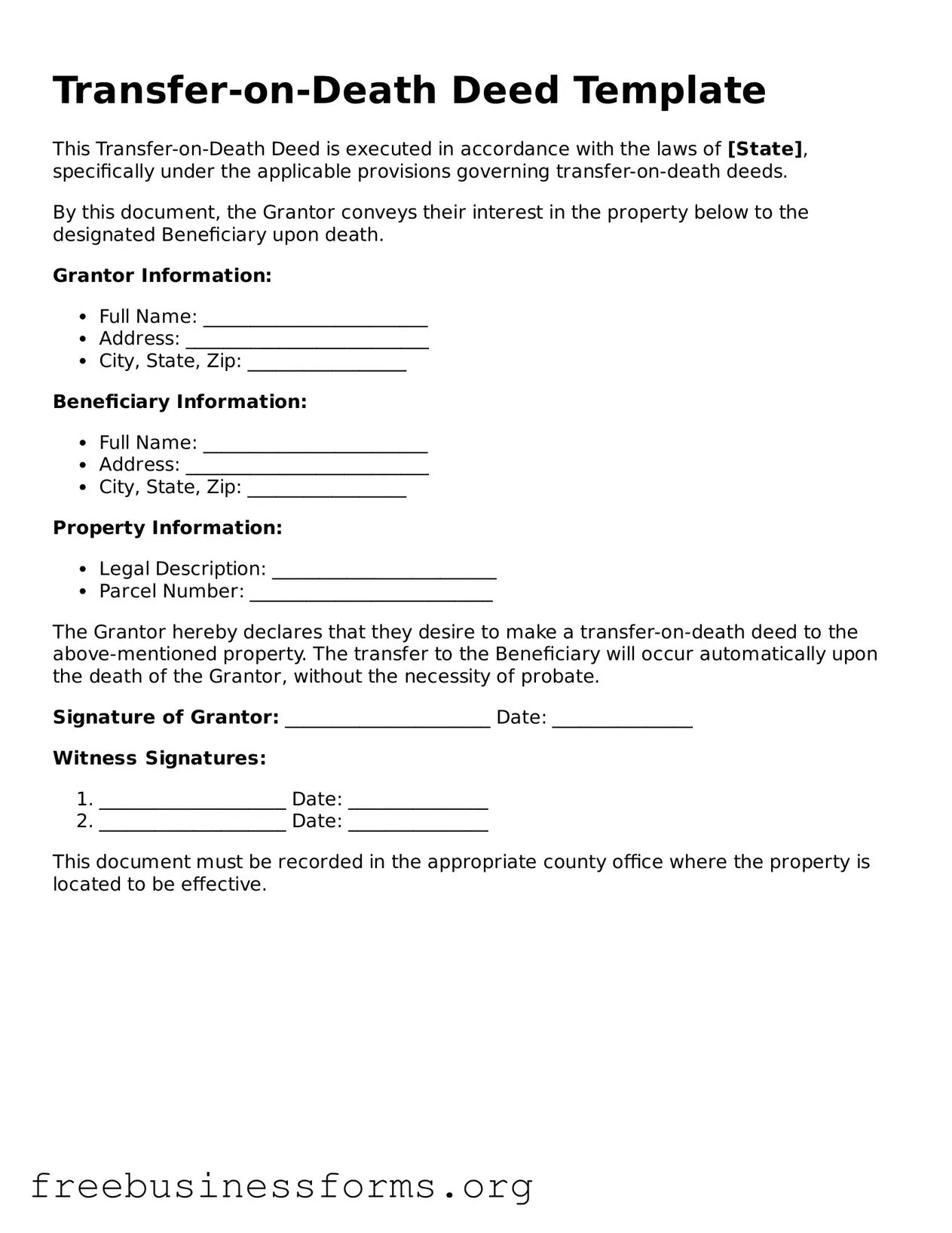

Official Transfer-on-Death Deed Form

The Transfer-on-Death Deed form is a legal document that allows individuals to designate beneficiaries who will receive their real property upon their death, bypassing the probate process. This deed serves as a straightforward way to transfer ownership without the complexities often associated with estate planning. By utilizing this form, property owners can ensure their assets are transferred directly to their chosen heirs, streamlining the process and reducing potential disputes.

Open Form Here

Official Transfer-on-Death Deed Form

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Transfer-on-Death Deed online quickly — edit, save, download.