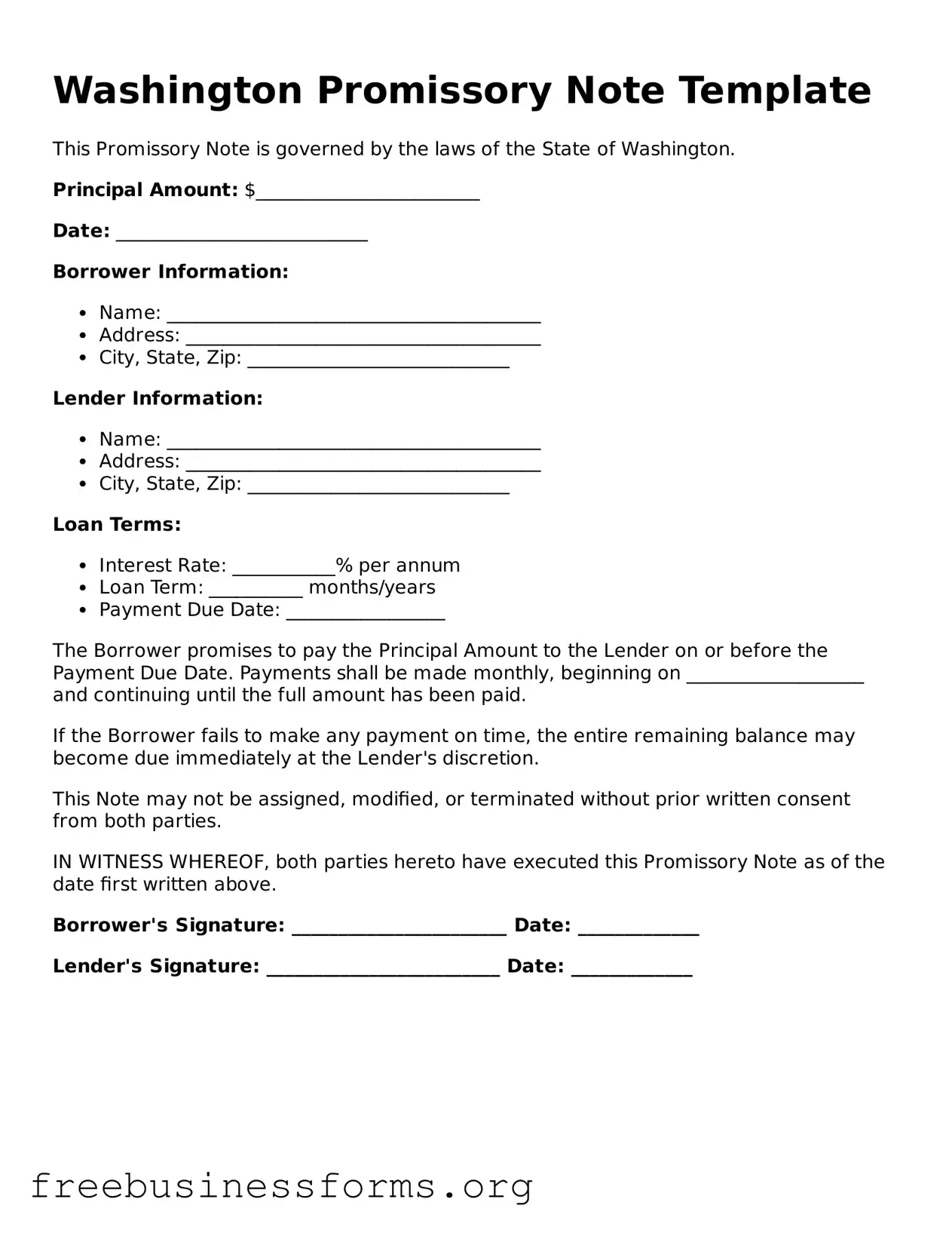

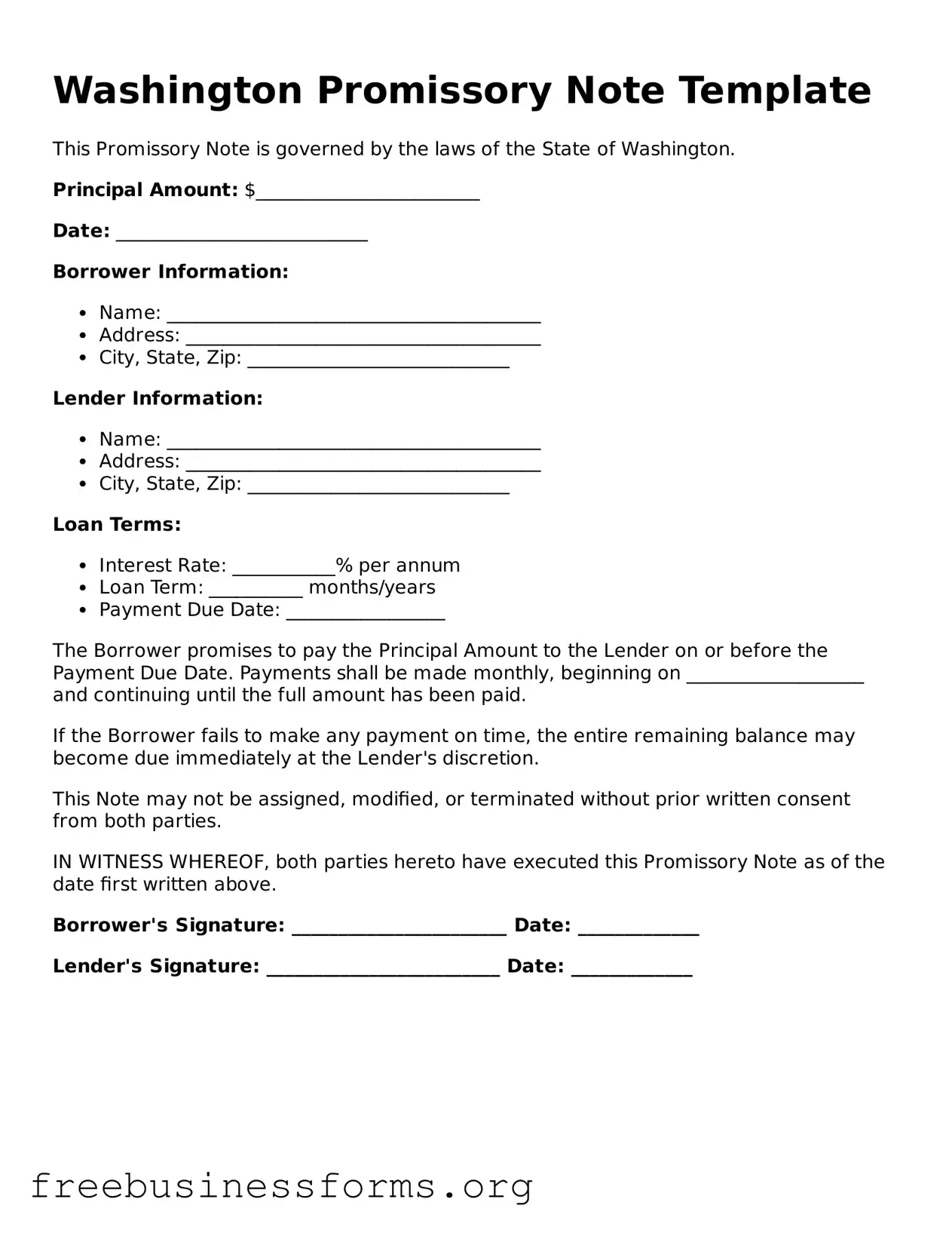

Blank Promissory Note Template for Washington

A Washington Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. This form serves as a crucial tool for both parties, ensuring clarity and protection in financial transactions. Understanding its components can help individuals navigate their lending agreements more effectively.

Open Form Here

Blank Promissory Note Template for Washington

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Promissory Note online quickly — edit, save, download.