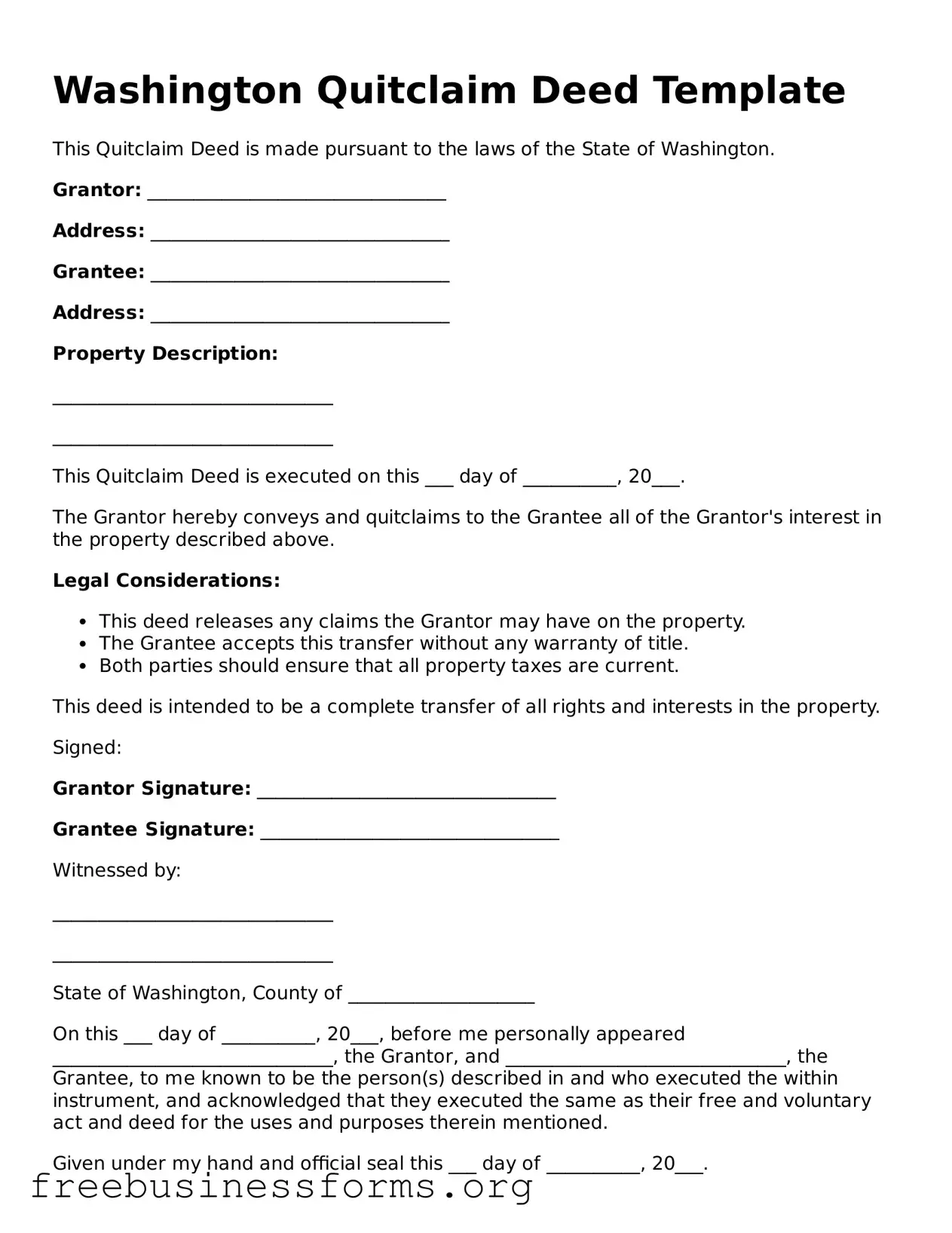

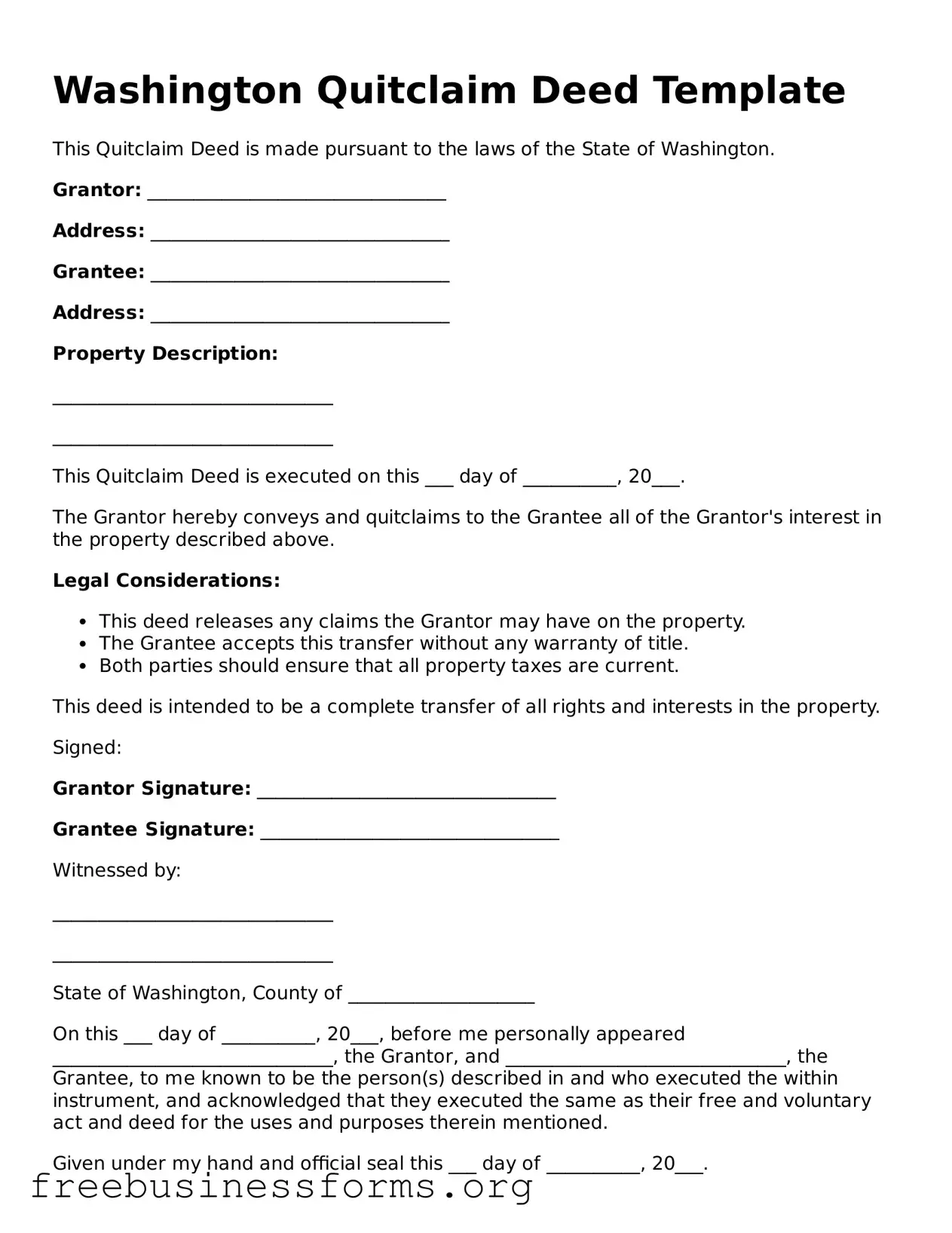

Blank Quitclaim Deed Template for Washington

A Washington Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without making any promises about the property's title. This form is often utilized when the parties know each other well, such as family members or friends, and trust that the transfer will be smooth. Understanding the Quitclaim Deed is essential for anyone involved in property transactions in Washington State.

Open Form Here

Blank Quitclaim Deed Template for Washington

Open Form Here

Open Form Here

or

↓ PDF File

Quickly complete this form online

Complete your Quitclaim Deed online quickly — edit, save, download.